The recovery in the labour market has continued to impress post the re-opening in October. The Australian economy added +64.8k jobs in December on top of the 366k jobs created in November. The seasonally adjusted unemployment rate fell to 4.2% from 4.6%, its lowest level since pre the Global Financial Crisis, August 2008.

Headline consumer prices for the December quarter rose by 1.3%, higher than the 1% expected by economists taking the annual inflation rate to 3.5%. The trimmed mean or core inflation (the RBA’s preferred inflation gauge) rose by 1%, taking the annual rate to 2.6%. Notably, the annual rate of core inflation is now above the mid-point of the RBA’s target 2-3% band for the first time since mid-2014.

The RBA has repeatedly stressed that wages growth around 3% will be necessary to sustain inflation within that band. Wage inflation is currently at ~2.2%yoy, which will see a lot of focus on the next wage inflation print on February 23rd.

What will the RBA do next week?

The RBA will likely end its $350 billion quantitative easing (QE) bond buying program next week and bring forward its rate hike guidance towards the first half of 2023. This is in contrast to the interest rate market currently pricing rates lift off in April and a further three rate hikes by December 2022.

What does it mean for the AUDUSD?

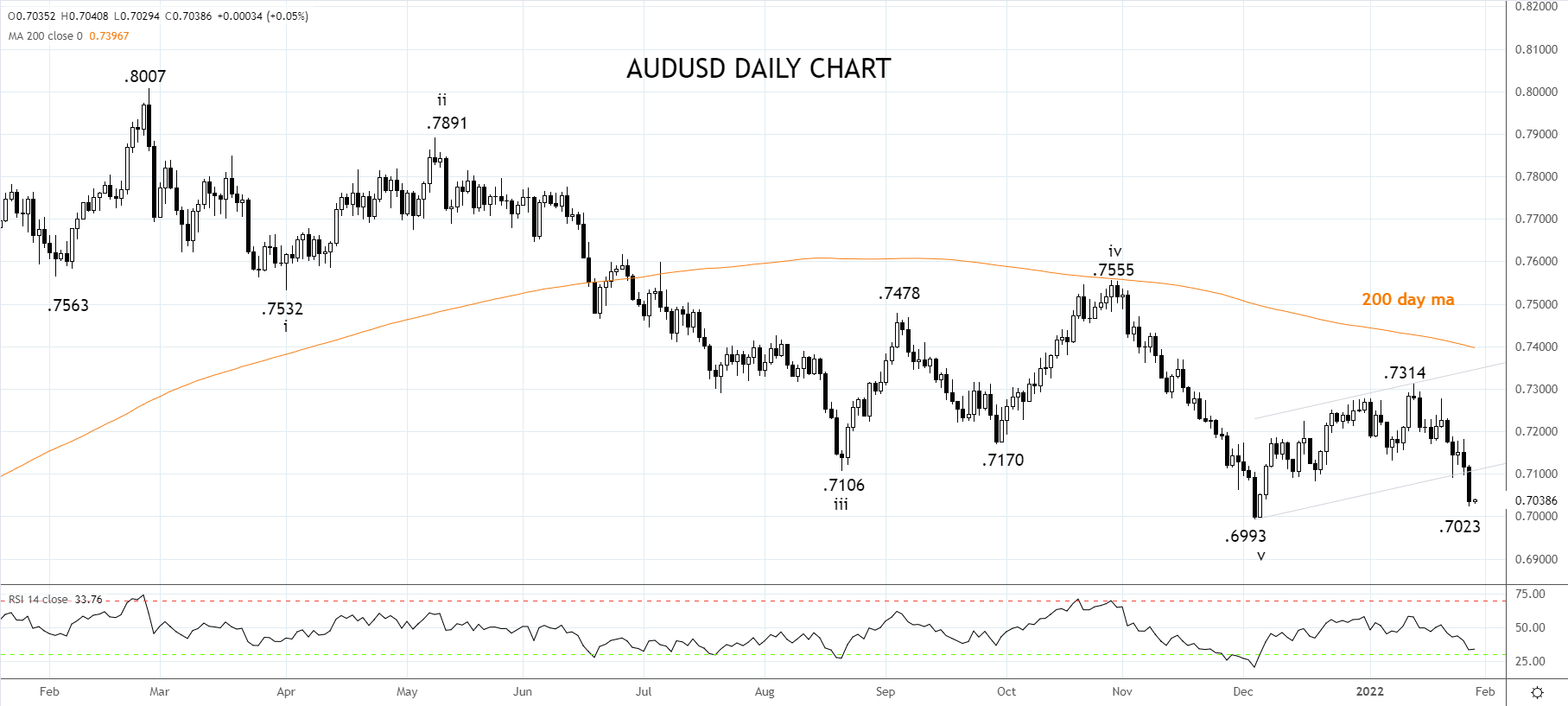

The AUDUSD has sagged under the weight of the stronger U.S. dollar post the hawkish FOMC meeting yesterday, and is eyeing strong horizontal support near .7000c.

Should the AUDUSD see a sustained break below .7000/.6990c, it would then see the AUDUSD move initially towards the June 2016 low at .6826, before .6675.

Source Tradingview. The figures stated areas of January 28th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade