Key themes:

Here we will look at the key themes that we expect to be the key influences on the market this quarter and what they could mean for asset prices.

1) Inflation

Inflation rose to multi-decade or even record highs in Q3. With commodity prices falling and consumer spending falling, signs are appearing that inflation is starting to peak. In the US, inflation hit 9.1% and has cooled slightly to 8.3%. In Europe, inflation sits at a record high; in the UK, consumer prices dipped from 10.1% to 9.9%. This quarter we expect to see inflation slowly cool but not by enough to spark a dovish pivot from the Federal Reserve.

The drivers of inflation -monetary and fiscal stimulus from the pandemic era, supply chain disruptions, labour shortages, and rising commodity prices are, in most cases reversing or improving, helping inflation lower. But the cooling process is expected to be slow.

2) Central Banks

Central banks across the globe, except the BoJ, rolled up their sleeves and hiked rates more aggressively across the third quarter of the year as inflation rose to multi-decade or record highs.

The Federal Reserve pulled two 75 basis point hikes out of the hat, the SNB put an end to negative rates, and even the ECB jumped on the 75 is the new 25 bandwagon.

Central bank action is expected to remain hawkish across the final quarter. With inflation in the US still hotter than expected, the Fed is expected to hike rates by 75 basis points in November and at least 50 basis points in December, if not more. Unless there is a sudden and sustained drop in inflation, the US central bank is not expected to take its foot off the hiking gas until 2023. The ECB is also expected to raise by a further 75 basis points in October and the BoE a possible 100 basis points in light of the Chancellor's mini budget.

3) Recession fears

Given that there is a lag time between a rate hike and its impact being felt in the economy, there is a danger that central banks could overtighten. Fed officials have said that it is preferable that the Fed tightens by too much rather than too little. In other words, inflation is a greater risk to the economy.

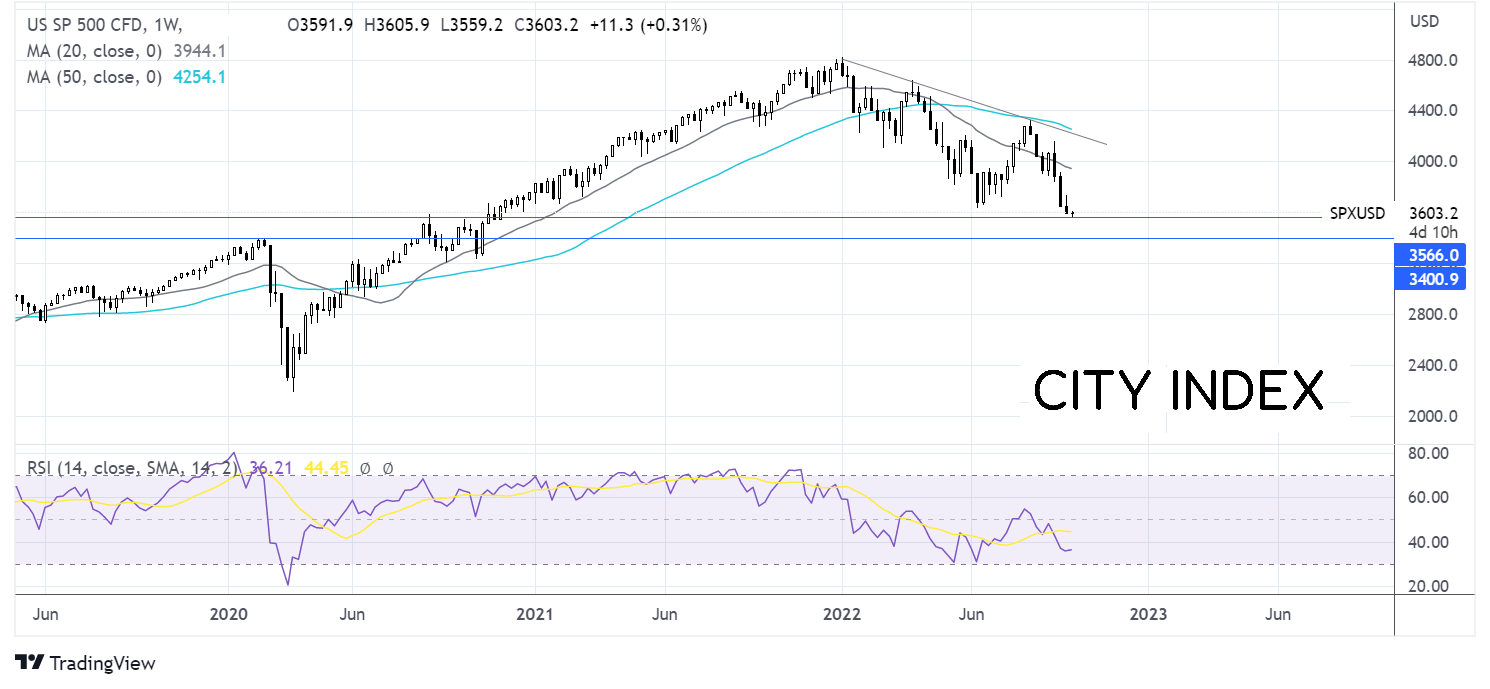

Economic slowdown and recession fears are rising and are expected to keep risk appetite in check across the coming quarter. Jerome Powell warned that there is no painless way to bring inflation lower. This could well mean more challenging times ahead for stocks. The S&P 500 fell over 4% across the third quarter, dropping 13% in the past two months, wiping out 9% gains in July. The index trades at a 2 year low with more weakness looking likely. Until the Fed looks towards a dovish pivot equities are likely to remain pressurised.

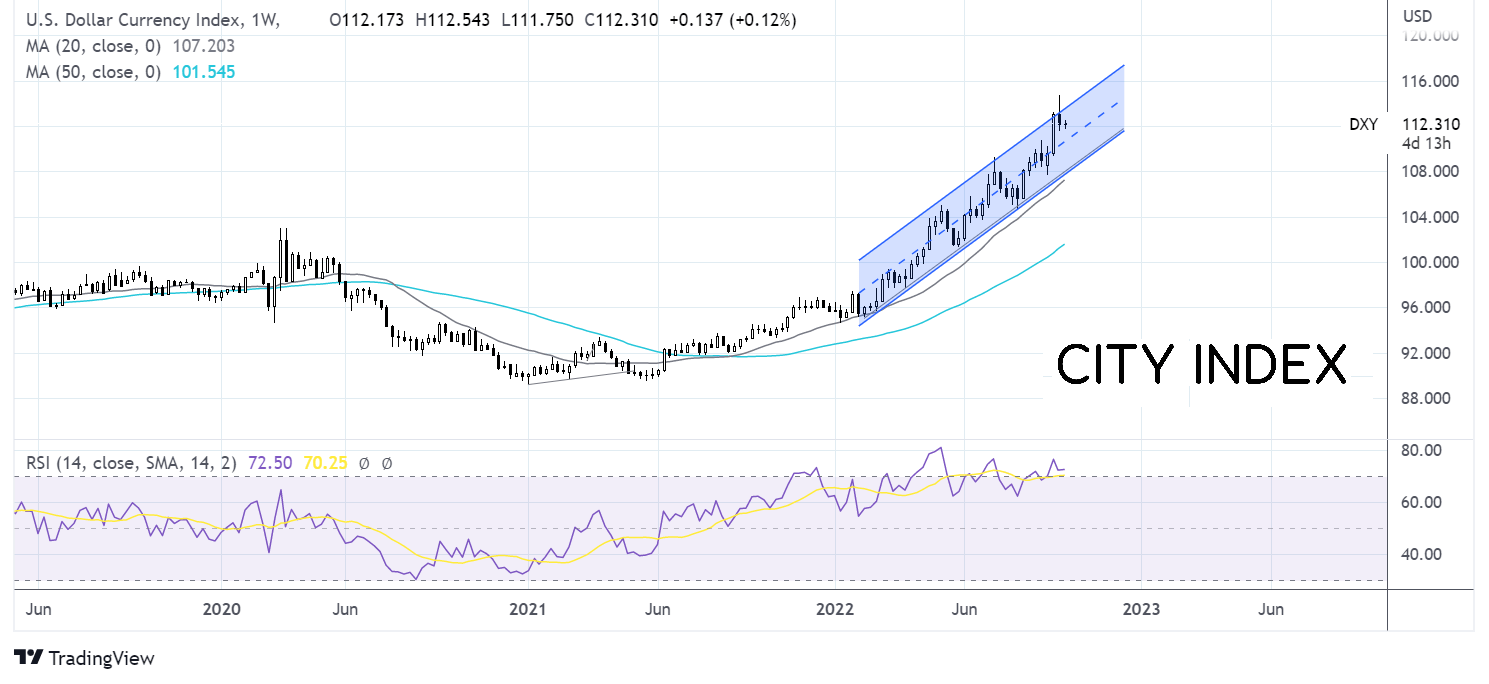

4) Dollar strength

USD dollar strength has been a key theme in recent weeks; the USD index has risen to a 2-decade high and shows few signs of slowing. The greenback has been boosted by hawkish Fed bets, and safe haven flows as recession fears grow. Furthermore, the lack of an alternative has also driven the USD higher. With the ongoing crisis in Europe and the UK and the dovish BoJ, alongside slowing growth in China hurting commodity currencies, there is little in the way of an alternative. We expect this to continue to play out across Q4. It is not until the Fed starts to slow rate hikes considerably that the USD will ease, which will likely be well into Q1 if not Q2 next year.

Perhaps the one thing to watch here is central bank intervention from global central banks and currency wars in reverse – rather than a race to the bottom, a central bank tug of war to strengthen currencies and avoid imported inflation. We’ve already seen the BoJ step in to support the yen and the BoE step back into the bond market. Could we see this spread to other central banks?

5) Energy crisis

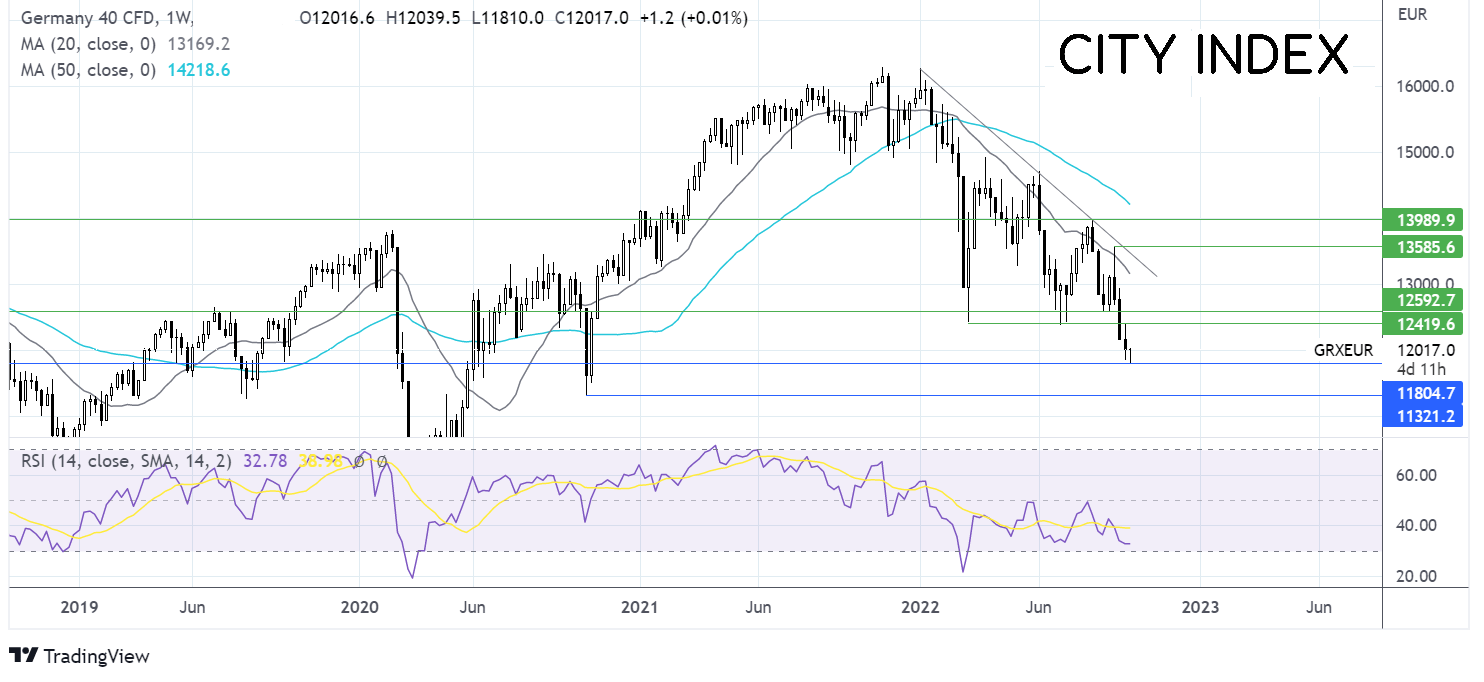

The energy crisis in Europe is escalating as we head towards the winter months. Russia continues to slow natural gas supplies to Europe, raising the likelihood of gas rationing, rising energy costs, and recession, particularly in Germany, which has been very dependent on cheap Russian gas.

These fears have hurt demand for the DAX, which trades at a two-year low and could continue falling as economic data paints an increasingly concerning picture. The energy crisis is expected to worsen over the coming months, meaning that the outlook for the German economy is bleak and the DAX is likely to remain weak, with few signs for optimism.

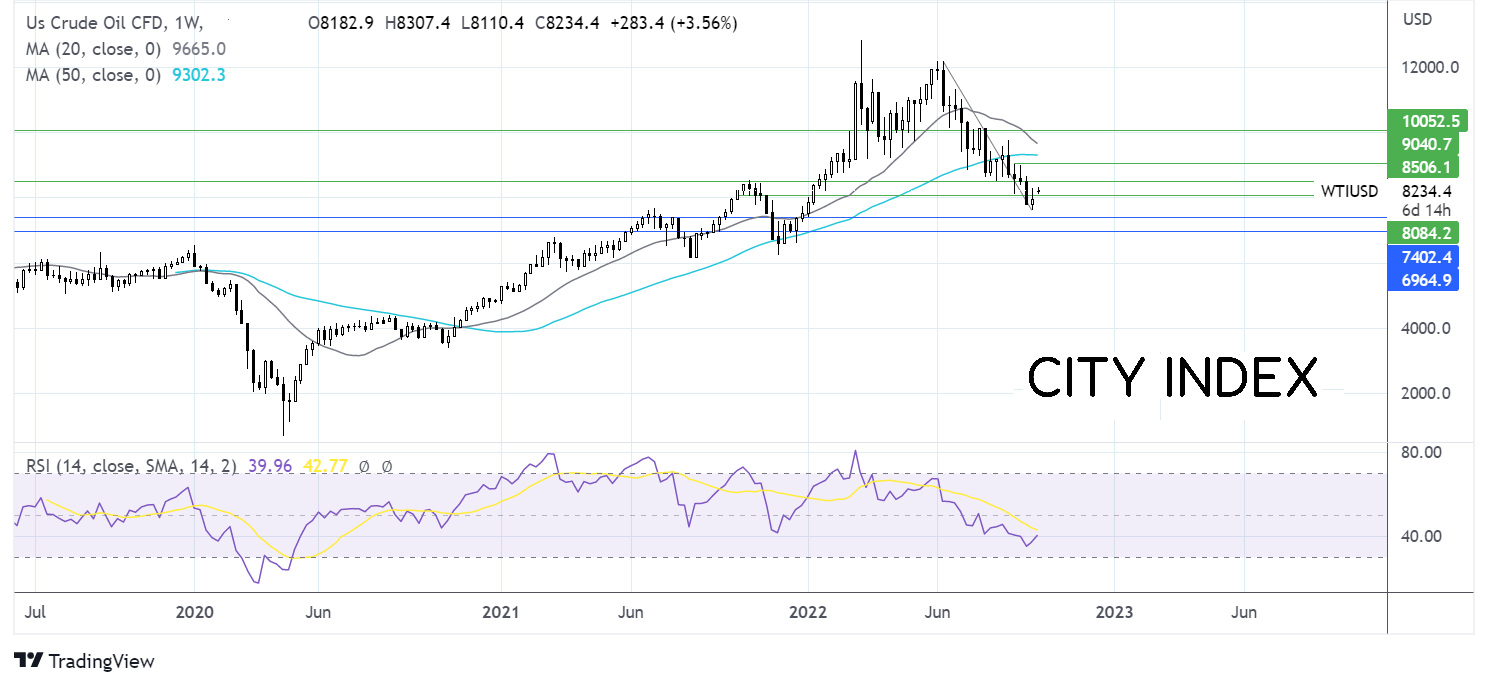

6) Oil

Oil prices have tumbled across Q3, dropping around 40% over the past four months. Demand concerns have dominated, despite supply remaining tight given the fallout from the Russian-Ukraine war, as central banks hiked rates fears of slowing global growth and recession hit the demand outlook.

This is not expected to change in the coming quarter. In fact, with central banks hiking further, mean recession fears are likely to intensify. China’s strict zero COVID policy means that further lockdowns in the world’s largest oil importer are also likely to hit the demand outlook. The IEA now expects oil demand to fall for the first time since 1990. Goldman Sachs has also cut their oil price outlook.

USD strength has been a drag on oil prices across Q3, and with the USD strength expected to stay across Q4, the negative impact brought by a strong dollar is expected to keep weighing on oil.

On the supply side, OPEC+ cut output by a token amount last month. However, they have hinted that they will cut oil output further if necessary, which could support oil prices and stem the selloff.

Heading towards the end of the year, the Russian oil supply is likely to fall, and oil prices could start to rise when the EU oil embargo kicks in, alongside the end of the SPR release.