Summary of the RBNZ statement, Feb 2024

- Core inflation and most measures of inflation expectations have declined

- Risks to the inflation outlook have become more balanced

- RBNZ have limited ability to tolerate upside surprises

- Heightened geopolitical and climate conditions remain a risk for inflation (such as the recent rise of shipping costs)

- The Committee remains alert to cost pressures and will act if necessary

- The Committee remains confident that the current level of the OCR is restricting demand

- The OCR needs to remain at a restrictive level for a sustained period of time

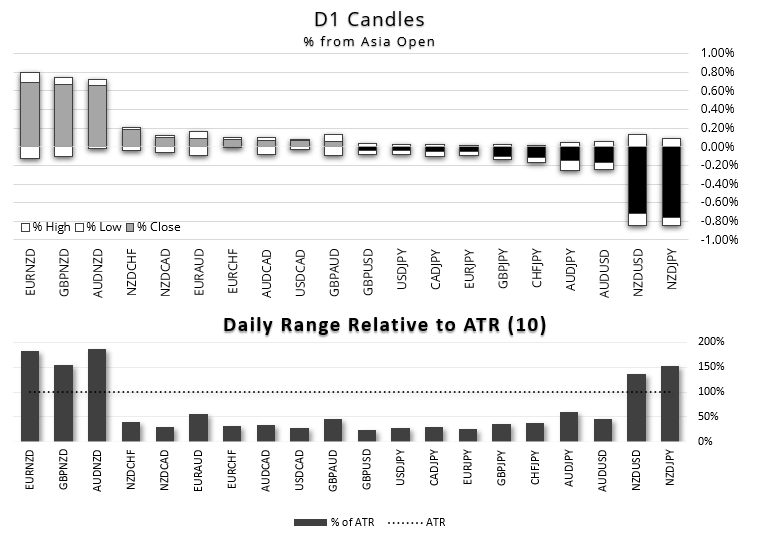

The RBNZ held rates at 5.5% to send the New Zealand dollar broadly lower. There had been speculation of a hike at this meeting when ANZ revised two potential hikes a few weeks back. Bets for a hike had been scaled back in recent days, but there was still clearly some expectation of a hawkish bias in the statement given the immediate reaction of the New Zealand dollar, which basically rolled off its perch at the announcement.

In fact, you could argue all that one needed to read was the statement title, which aptly stated that “Monetary Policy Remains Restrictive”. The statement itself was also notably less hawkish than November’s with the closing paragraph stating that “The Committee remains confident that the current level of the OCR is restricting demand”.

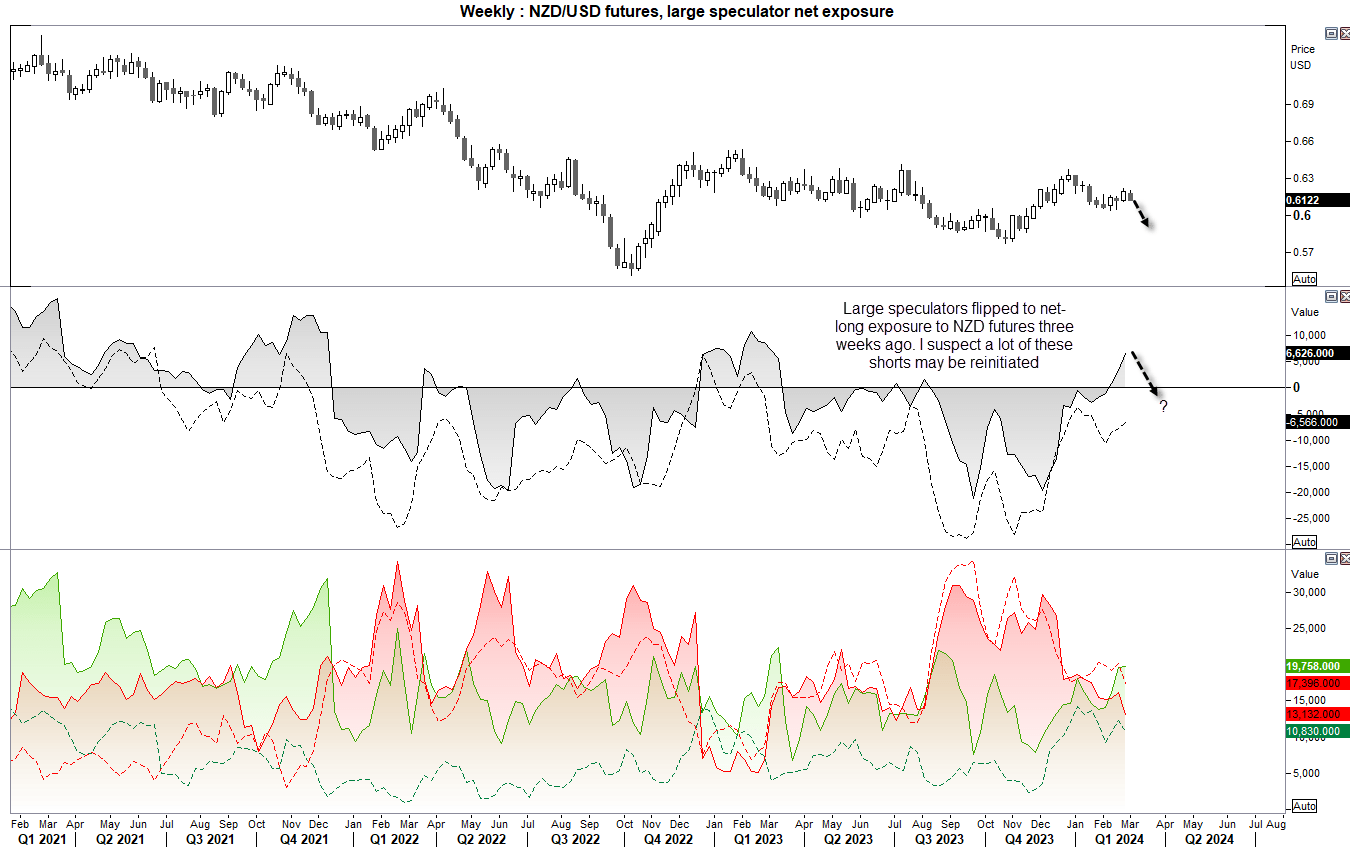

Looking through the updated forecasts reveals that their 2024 outlook for the OCR (overnight cash rate) has been trimmed to 5.6% from 5.7%. With a cash rate at 5.5%, the 10bp of wriggle room is simply there to remind us that they’ll hike if they need to but the bias is that they probably won’t. Either way, I suspect a lot of the short covering that sent the New Zealand dollar higher this year could now be reinitiated.

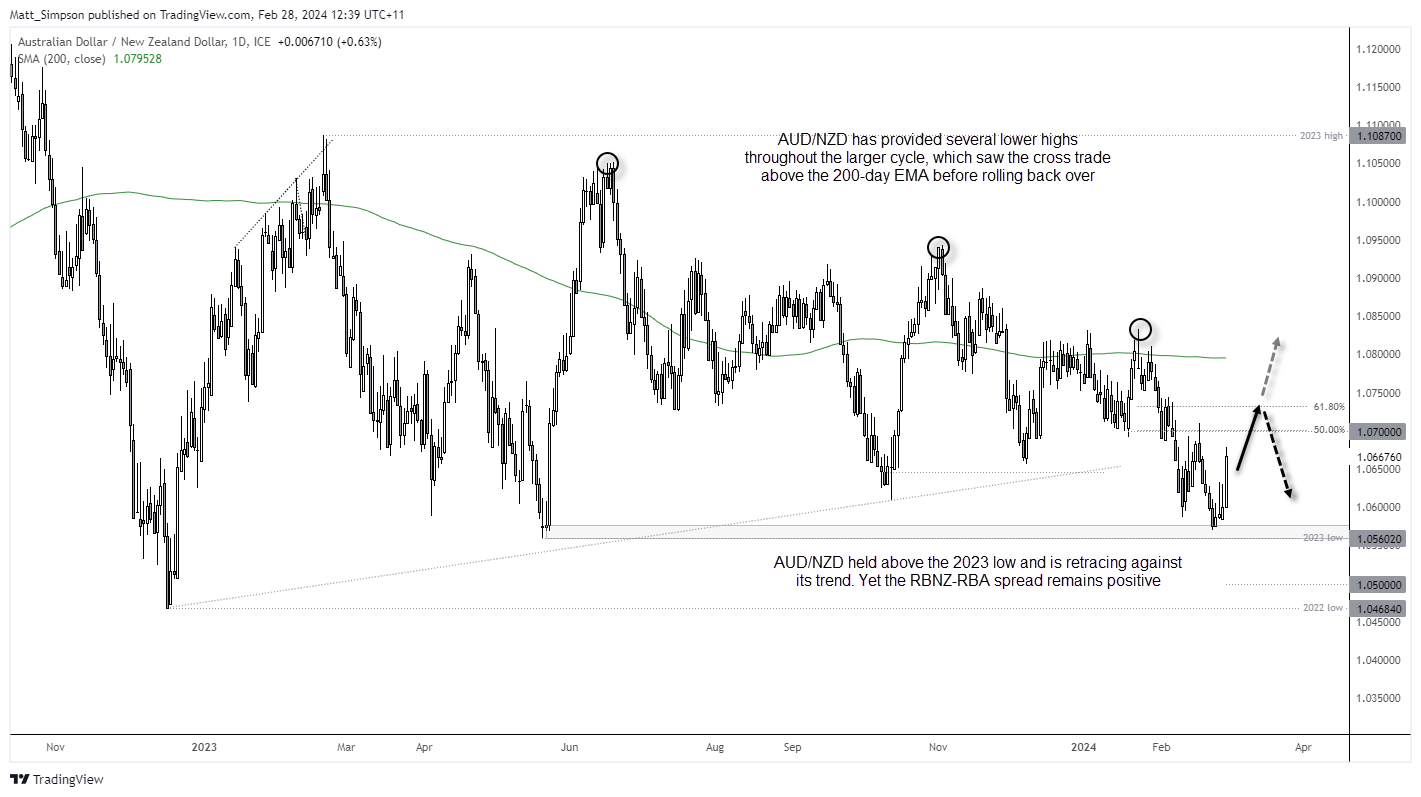

Just prior to the RBNZ meeting, Australia's inflation data provided another positive surprise, by not ticking higher as expected. The weighted mean at 3.4% y/y keeps the rate of inflation at a 2-year low. And whilst it remains above the RBA's 2-3% target range, it is close enough to expect the RBA to hold rates steady - regardless of the hawkish bias they decided to maintain at their recent meeting.

AUD/NZD technical analysis:

AUD/NZD is currently enjoying its best day of the year, and looks set to at least head for 1.07 or the 61.8% Fibonacci ratio. The RBNZ may have provided a dovish tile but their cash rate of 5.5% remains elevated relative to the RBA’s 4.35%, and neither bank are set to announce a dovish pivot any time soon. Ultimately this could cap gains on AUD/NZD, so the current rebound is assumed to be corrective.

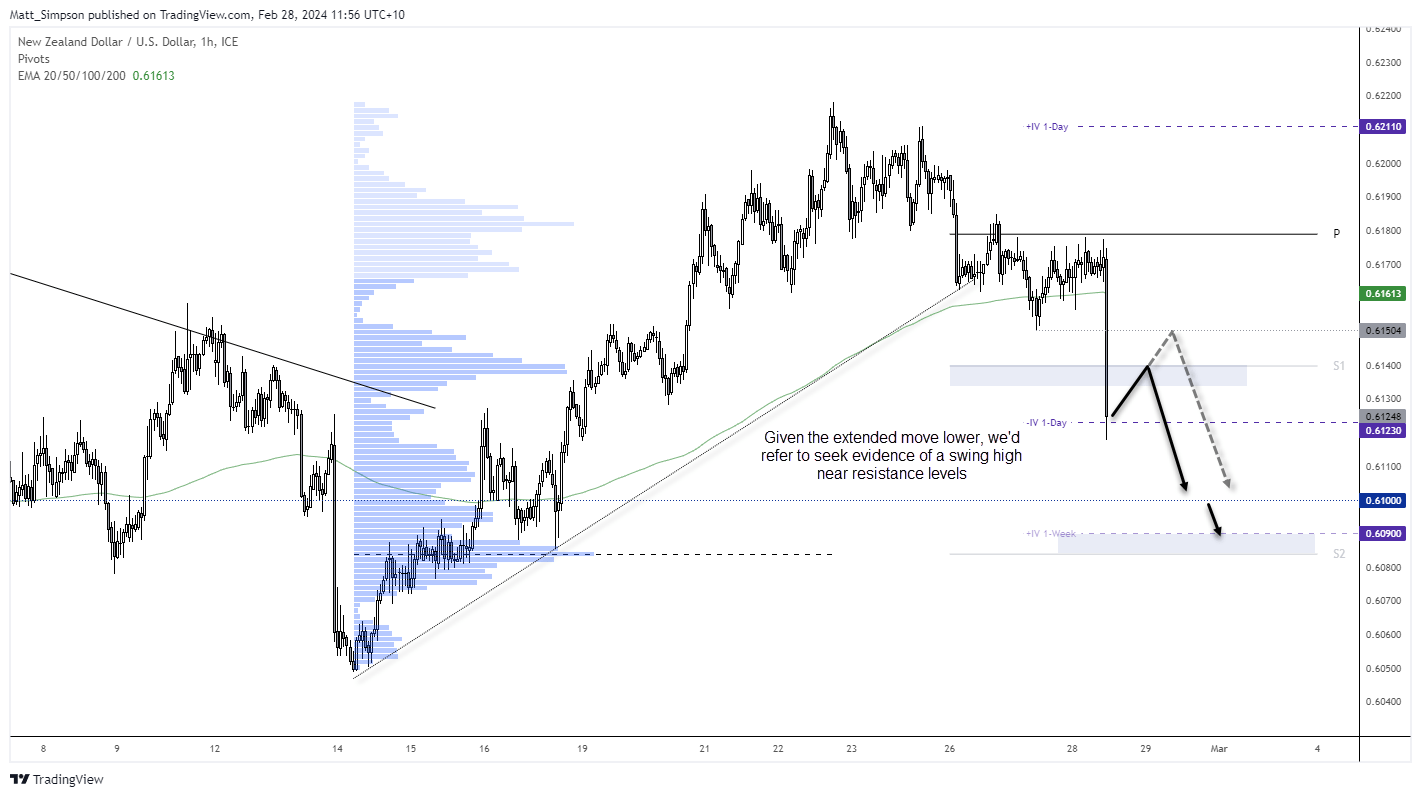

NZD/USD technical analysis:

The 1-hour chart shows that the RBNZ’s meeting quickly blew away my original bullish bias, based on the falling wedge pattern. Prices are currently residing around the lower 1-day implied volatility band measured prior to the meeting, and if it continues to fall over the coming days then the 6.090 level comes into focus based on the 1-week implied volatility band.

Given the magnitude of the move lower this past hour, and the fact that prices are no clinging to the lows – I suspect at least a minor bounce may be due. Tis runs the risk of further short covering and an unfriendly snapback before the next leg lower resumes.

0.610 and 0.609 are the next levels in focus for bears, but first we’re prefer to see prices retrace closer to the weekly S1 pivot before seeking evidence of a swing high.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade