US index futures have regained some of their poise after Thursday’s big plunge, which erased gains made earlier in the week. We have core PCE price index coming up today to help lift sentiment. But if the Fed’s preferred inflation gauge doesn’t show a similar drop as CPI, the markets will likely remain under pressure.

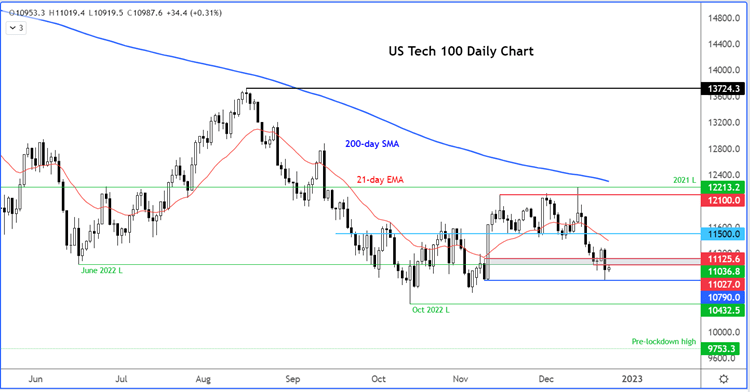

Before we discuss the macro factors further, let’s have a quick look at the chart of the Nasdaq 100 after the tech-heavy index broke further support levels on Thursday:

The broken support levels include the 11035 to 11125 range, which could now turn into resistance. The Nasdaq found support at 10790. But if this level gives way then there’s nothing further until the October low at 10432.

Unsurprisingly, this current macro environment is not one you would associate with excessive risk-taking and that’s how it has proved once again. The economic outlook is not going to change overnight, which means much of the issues we are facing right now could well be with us well into 2023. And after a big rebound starting in October, much of the positivity about the Fed pivoting to a less hawkish stance has now been priced in. So, I reckon that the risks are skewed to the downside for stocks in 2023.

While optimism about inflation peaking may keep the downside risks limited, that is all I can think of in terms of something that could provide support for stocks. However, you can argue that at least some of this peak-inflation narrative is already priced in after the markets surged higher from their October lows. Without seeing a strong economic recovery to help boost revenue and profit for corporates, the equity markets will likely struggle to go higher in early parts of 2023

Something else that has been providing support all these years had been central bank support in terms of QE and record low interest rates. This is not going to be there anymore, with inflation is still very high. Government stimulus will be limited, if any, after they already spend vast amounts to help during the pandemic and now with energy crunch in Europe.

Looking ahead

Friday

- The Fed’s preferred inflation gauge, the core PCE Price index comes in at 13:30 GMT. If it turns out to be much weaker than expected, this should underpin stocks – at least temporarily anyway. The index fell to 5.0% in October from 5.2% in the prior month, in line with market forecasts. This time, it is expected to fall to an annual rate of 4.7%, with a month-over-month reading expected to be +0.2 percent. But if inflation is hotter than expected then I would expect to see the markets plunge again.

- We will also have personal income and spending data, as well as new home sales and revised UoM sentiment data. The economic calendar is very light next week because of the holidays before things pick up again in the first week of January.

Last week of December

- The last week of 2022 will feature only a handful of data. Among those, will be US housing market data, with both the official HPI, as well as the S&P/CS Composite-20 HPI released at the same time on Tuesday, followed by pending home sales a day later. With borrowing costs soaring and consumers struggling, are we going to see more evidence of a downturn in the housing market? Vendors have been lowering their asking prices since the summer.

First week of January

- FOMC meeting minutes (Wednesday)

In the first week of the year, the first important macro data is likely to be the minutes of the FOMC’s December meeting. At that meeting, the FOMC reduced the pace of tightening to 50 basis points but appeared more hawkish than expected, in that policymakers projected a higher terminal interest rate and indicated that monetary policy will remain contractionary for longer. The minutes should reveal more details, which should set the tone for next few days at least.

- US Non-Farm Payrolls (Friday)

The first week of January could end with a bang, if US employment data shows a major surprise. The headline non-farm payrolls number has beaten expectations in each of the previous 8 months, with the prior months continually being revised higher. US jobs market remains hot, and while that’s the case, the Fed will be encouraged to keep its policy tight. If we get another set of stronger-than-expected numbers, then this could provide renewed support for the dollar.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade