Fed members were quick to respond and read from the same hawkish script, with little success early on as markets continued to call ‘bulldust’ on their rhetoric. That is, until a strong Nonfarm payrolls report shook things up, as it paved the way for further hikes. Yet it has taken over two weeks, a plethora more hawkish comments and strong data for markets to slowly wake up to the fact that a higher terminal rate is the more likely path for the Fed, and for us to forget about cuts this year. And that is the scenario we have backed throughout.

February data which has underscored the Fed’s hawkish stance include (but not limited to):

• Nonfarm payrolls 517k (185 expected, 186k previous)

• Unemployment 3.4% (3.6% expected, 3.5% previous, near historic lows)

• ISM services 55.2 (50.4 expected, 49.2 previous)

• CPI 6.4% y/y (6.2% expected, 6.5% previous)

• Retail sales 3% y/y (1.8% expected, -1.1% previous)

• Core retail sales 2.3% (0.8% expected, 0.4% previous)

• PPI 0.7% m/m (0.4% expected, -0.2% previous)

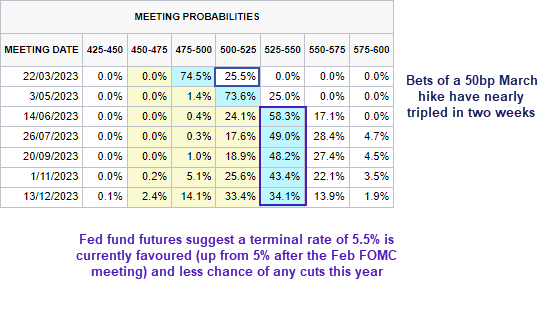

Fed fund futures now imply:

- 76% chance of a 25bp hike in March (down from over 90% two weeks ago)

- 25.5% chance of a 50bp hike in March (up from 9% two weeks ago, or 0% three weeks ago)

- A terminal rate of 5.5% in June (up from 5% terminal rate after the Fed’s last meeting)

- Less than a 35% of a 25bp cut in December (two cuts were being priced in after the Fed’s Fed meeting)

How markets are reacting:

It was a classic risk-off session as yet more strong data for the US hit traders screens. Bond yield are soaring higher with the 2-year hitting its highest level since July 2007 of 4.77%, and the 1-year remains at a premium of 5.03%. The dollar was higher overnight but I continue to suspect it remains oversold relative to its highs set last year, and Wall Street came under pressure as even equity markets took note.

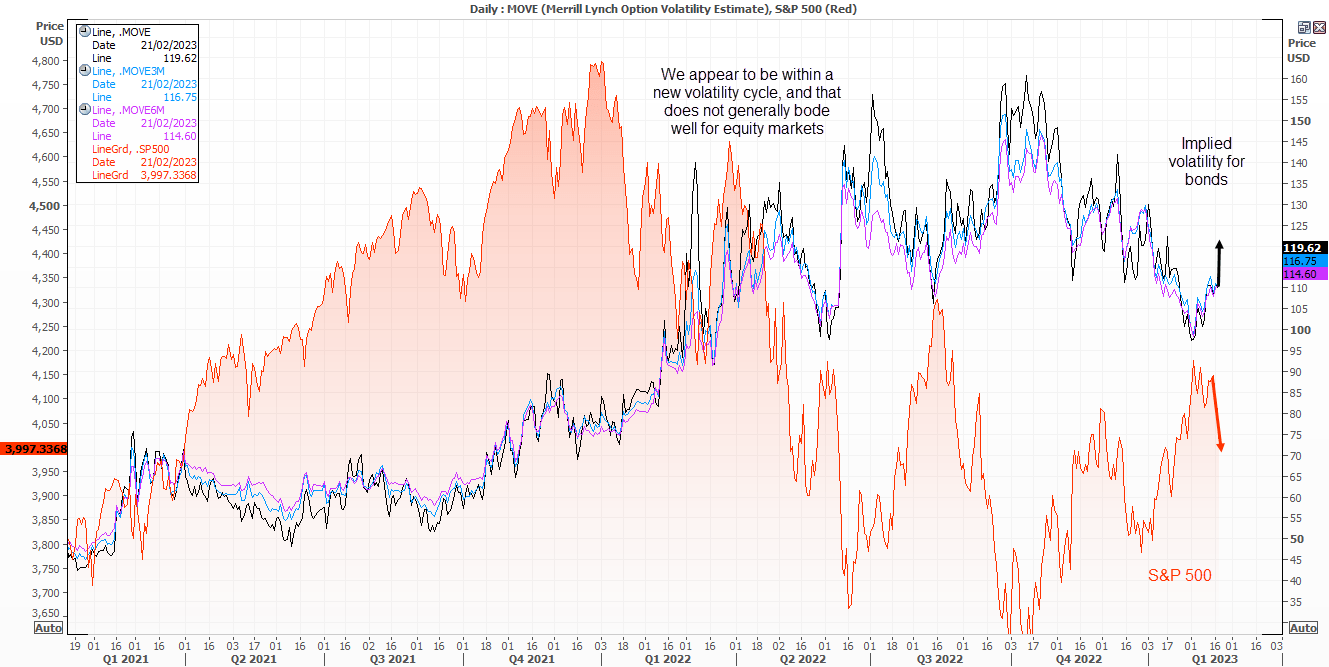

The MOVE index – which is implied volatility for bond markets – are turning notably higher. And they seem to be a better proxy of risk appetite for equities than the VIX of late, and share an inverted relationship with equities. It would appear we’ve entered a new volatility cycle ahead of today’s FOMC minutes, and markets are likely to be more sensitive to hawkish signs which have been there all along.

What are we looking for in the FOMC minutes?

For current market pricing to be sustained (or justified, for want of a better word) we’ll need to see a more finely balanced debate over a 50bp hike versus a 25bp in Feb or even March. Markets took it for granted that a 25bp was a given in February, so any uncertainty surrounding this assumption would knock confidence that another 25bp hike in March is a given. And that could send the US dollar and yields higher, and the stock market and gold lower.

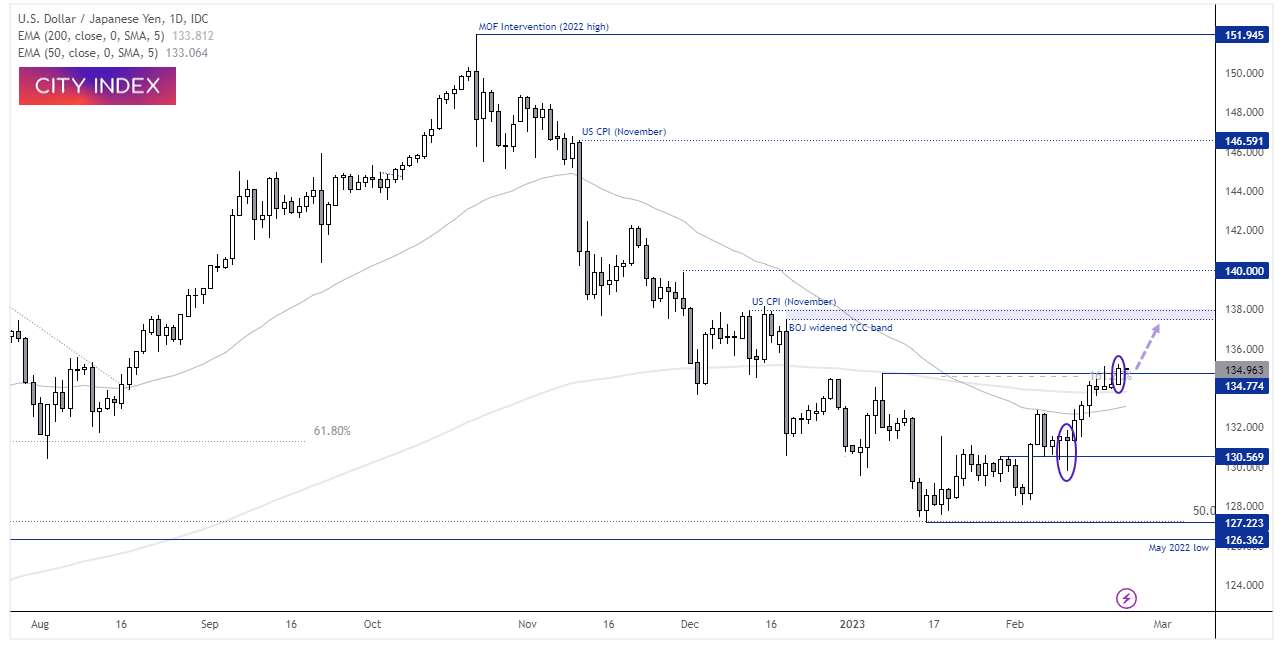

USD/JPY daily chart:

USD/JPY reached our upside target around the 200-day EMA / 161.8% Fibonacci projection outlined last Monday, following its false break of 130 and prominent bullish pinbar. Momentum is clearly pointing higher overall, and the recent repricing of Fed fund futures and rise in bond yields ahead of the FOMC minutes provides hope that its trend can continue (if the minutes are deemed to be hawkish, as we suspect). The high around 138 are the next major resistance level, near where another soft US CPI print and the BOJ widening their YCC band originally sent the pair lower.

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM