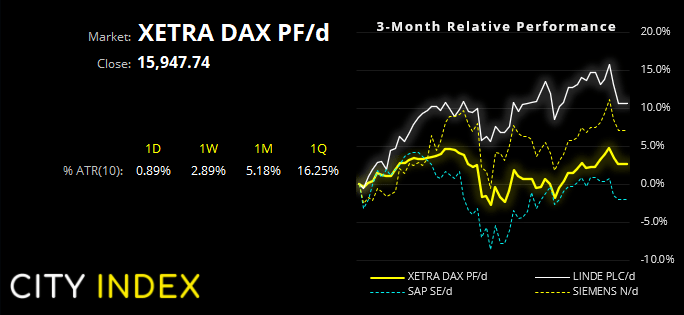

DAX 40: Top 5 stocks by market cap (euros, billions)

- Linde Plc: €151.7

- SAP: €149

- Siemens: €129.3

- Volkswagen: €118.7

- Airbus: €92.5

The DAX constituent list has recently been upgraded from 30 to 40 stocks. And whilst it is a market capitalisation index, there is a 10% limit for the weighting of any single stock within the index. We’ve taken a glance at the top five stocks which leans towards support for the index being found after its current correction.

Linde has been the worst hit as it fell to a 2-week low. Siemens is also on the ropes, yet it is holding above its monthly pivot and 150 handle. Volkswagen appears set to break above its 200-day eMA with a bull flag on the daily chart, and Airbus has printed a shallow pullback following a very strong rally above 120.

Seasonality for the DAX favours bulls (but only slightly)

Historically, the DAX has favoured a bullish close in January around 55% of the time over the past 29 years. Over this period, the DAX posted an average gain of 0.42%, of which its bullish months averaged a 4.5% return and bearish months averaged -4.6% return. Whilst it provides a slight edge for bulls it should be noted that April and December have produced far more impressive returns alongside a higher win rate of around 73% - 75%. We therefor only use this data lightly and urge caution, as typical levels of liquidity are yet to return to markets.

The DAX currently tracks DJI closer than the Nasdaq

Whilst global benchmarks tend to correlate closely over the longer-term the strength of their relationships oscillate over the near-term. It is therefore worth noting that the 20-day correlation between the Nasdaq 100 and DAX has fallen to around 0.2 (effectively not correlated) which is encouraging as the Nasdaq is an underperformer. However, the DAX currently shares a positive correlation coefficient with the Dow Jones of 0.9 (a strong positive correlation) and its pullback from its record high has been shallow, which is a sign of strength.

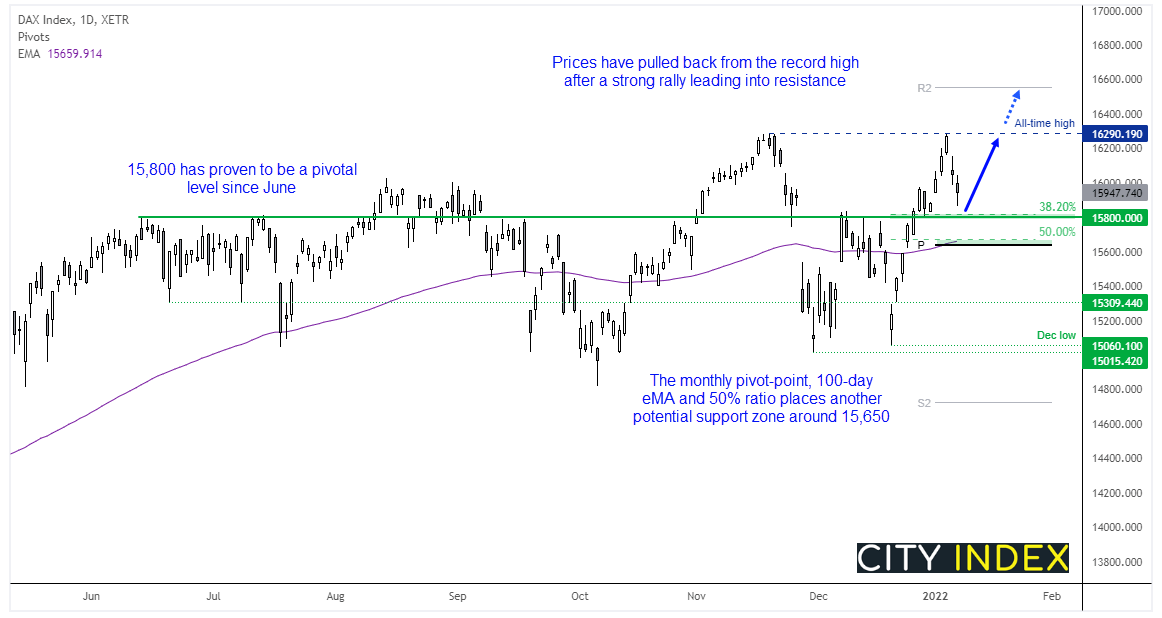

Seeking a corrective low ahead of a retest (and potential break) of its record high

We can see on the daily chart that the DAX failed to break back above its record high last week. According to the 7-day incidence index, coronavirus cases have risen each day (per 100k people) since the end of December. And with restrictions being reimplemented in Germany it leaves the potential for some further downside before bulls can fully regain control. However, the strength of the rally from December low should not be ignored as it outpaced the prior rally which set the record high in November. We are therefor seeking evidence of a corrective low to position ourselves for a long setup.

We look to enter long around or above 15,800, as this level has proven to be pivotal since June 2021. Traders could place a stop loss below 15,600 (round number) which is also beneath the 100-day eMA and 50% retracement level. The initial target is the record high at 16,290, a break above which would then bring 16,550 into focus near the monthly R2 pivot point. Should prices instead close below 15,800 we would then look for support to build above or around 15,800, then enter long with a fresh break back above 15,800.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade