Data-heavy week offers health check on the ‘higher for longer’ narrative

After the Fed delivered a hawkish bias at its September FOMC meeting, it’s now up to the economic data to justify that stance on the outlook for interest rates. If it can’t, it may be difficult to sustain the upward momentum in the US dollar and bonds. It means traders should be on alert to any releases that could move the dial on the ‘higher for longer’ narrative. Tuesday’s JOLTs survey looms as one this week, providing something of a lead indicator on demand for workers, payrolls growth and wages.

With the data rolling over hard from unprecedented levels, leaving growth in job openings roughly in line with the pre-pandemic trend, any signs of further loosening in the US labour market could spark an outsized move in the US dollar or US Treasuries given how much hawkish sentiment has been priced in, especially when you look at oversold markets such as gold or EUR/USD.

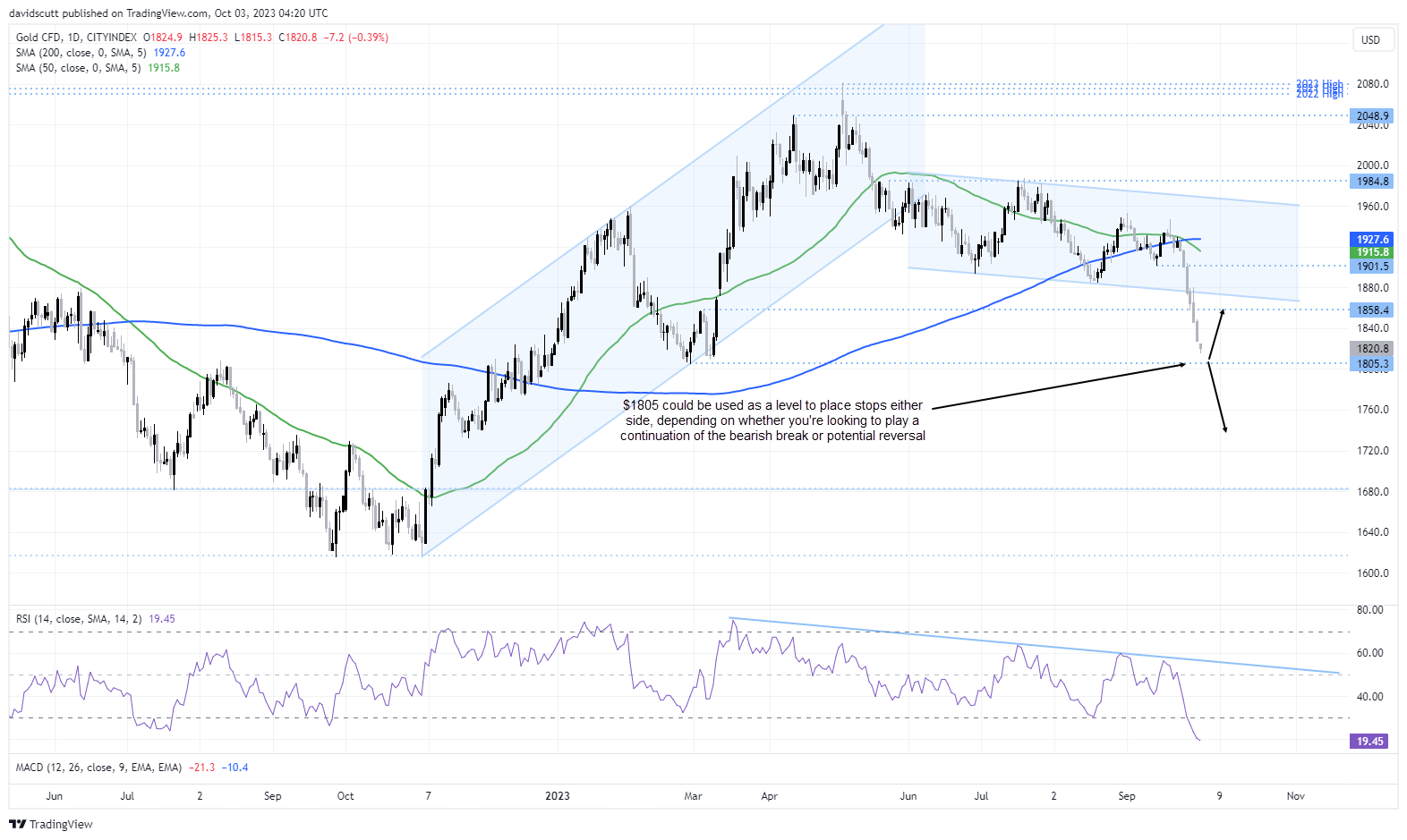

Gold the most oversold since August 2018

Gold is the most oversold it’s been since August 2018 on the daily, suggesting it’s not just soaring real bond yields and US dollar that’s tarnishing its performance. Given how erratic the bearish unwind has become, it points to possible forced liquidations, potentially to cover losses in other asset classes which have fared even worse in the current environment.

You can see how oversold bullion is looking on RSI, sitting below 20 after seven consecutive daily losses. It’s been slicing through supports left, right and centre, leaving it perilously close to taking out the year-to-date lows around $1805 set in February.

Buying now would be akin to catching a falling knife. But selling after such a pronounced decline is prone to reversal risks, providing a poor trade setup around these levels. But with not only the JOLTs survey but also ISM services PMI, ADP Employment and Non-farm payrolls arriving this week, we may soon get a health check on the higher for longer rates narrative, providing a potential fundamental catalyst that may confirm or question the prevailing theme.

$1805 is a level worth watching given its acted as support and resistance in the past. A downside break may add to selling momentum, especially with little visible support evident until you get down towards $1733. But should we see yield and USD soften on any data disappointment, the proximity to $1805 could provide an opportunity to establish longs with a stop below, targeting a move back towards $1858.

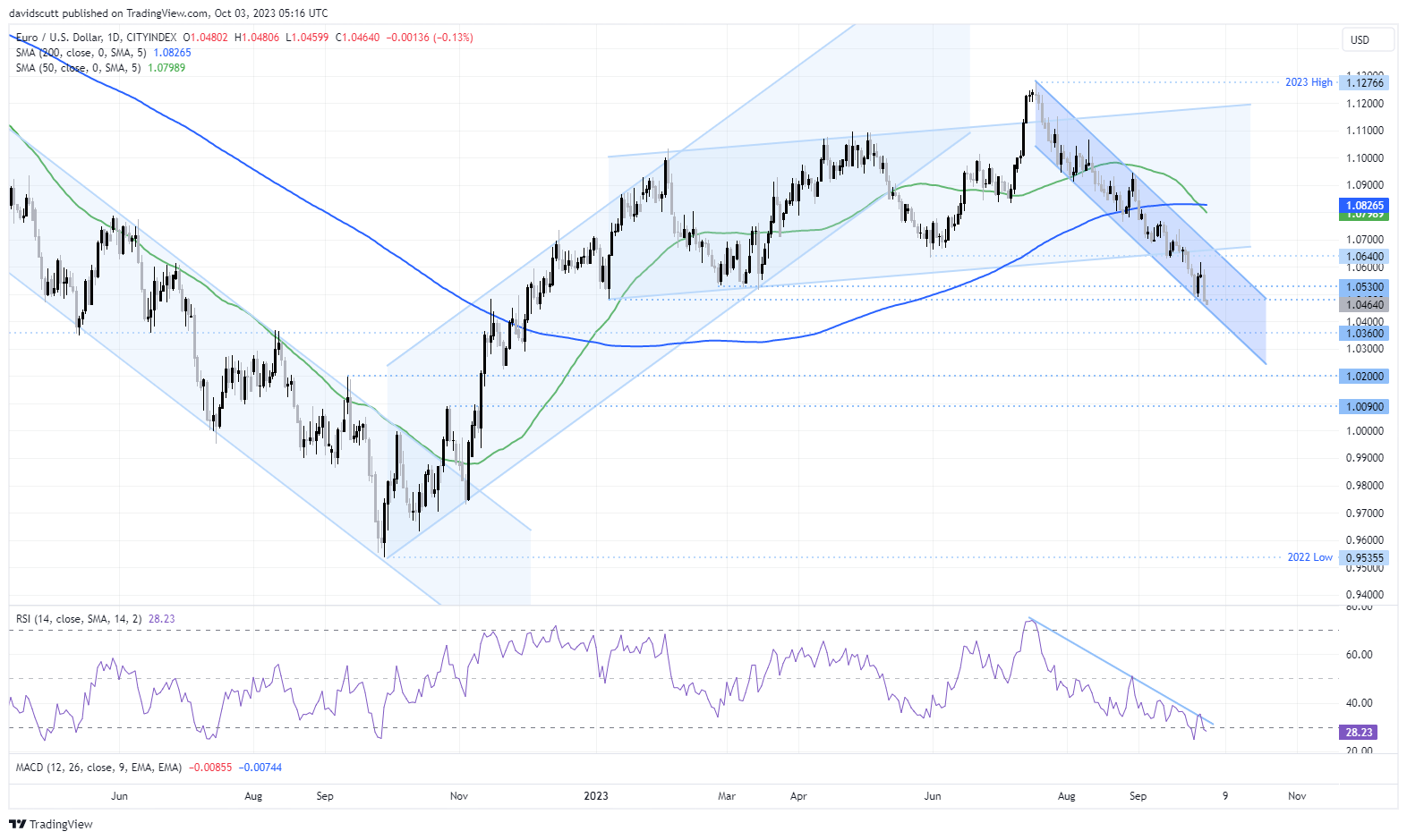

EUR/USD oversold after hitting 2023 lows

Turning to EUR/USD, its long-running downtrend is showing little sign of being threatened, falling to fresh 2023 lows on Monday after taking out stops located below 1.0480. But the pair is oversold on the daily and is sitting near channel support, making it another potential squeeze risk short-term.

On the upside, levels to watch include 1.0480, 1.053 and again at 1.0640. Anything higher would be unrealistic in the absence of a significant shift in the macro landscape. For those looking to play a continuation of the prevailing bearish trend, the break of 1.0480 means 1.0360 is the next logical downside target.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade