Gold and silver slumped sharply on Thursday and were struggling again ahead of the US jobs report at the time of writing on Friday. But it remained to be seen whether the selling would gather momentum as, after all, this is not the first time we have seen such a drop before dip buyers have stepped in to take the metal prices higher. Everything hinges on the direction of the dollar, which, despite its recovery yesterday, remains in a bearish trend until proven otherwise. All the attention is going to be on the US jobs report.

Read my colleague Matt Weller’s NFP preview article HERE

Initially, gold was up on Thursday, and silver was shining even more brightly as it broke to a new multi-month high above $24.50. But as investors digested the central bank bonanza, they decided to take profit ahead of the Us payrolls report, due to be published later today. Despite the fact the ECB and BoE both sounded more dovish than expected, gold traders were spooked by the turnaround in the dollar index as the EUR/USD and GBP/USD both slid. The day before, the Fed’s Chair Jerome Powell had fuelled dovish expectations, causing the dollar and yields to weaken across the board. But that move was unwound on Thursday at least for the dollar. Yields remained undermined and equity indices underpinned.

So, gold’s sell-off can be attributed almost entirely due to the dollar’s rebound on Thursday, as the message from the big central banks was similar i.e., that interest rate hikes are going to be paused soon. This means that gold can rebound equally strongly if we see a drop in the dollar today in response to the US non-farm payrolls report. However, if the dollar bulls like the data, then gold and silver should remain out of favour.

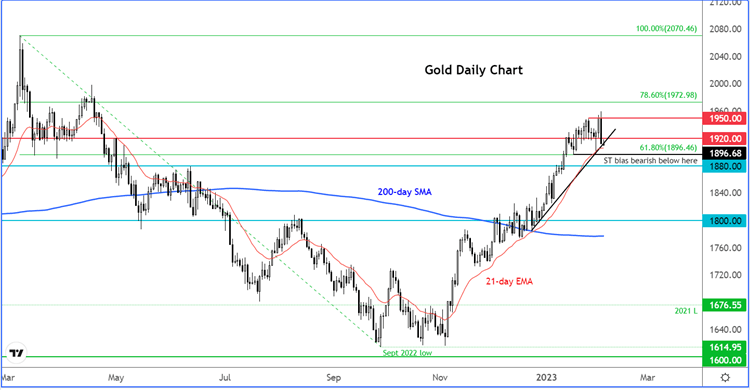

Gold’s big sell-off means it is now displaying a large bearish engulfing candle on its daily chart, which may discourage some technical traders from buying this dip. Others would probably look for short-term bullish signal to emerge here as the metal tests its bullish trend line, before stepping in to take advantage of the sale. The more macro-focused traders will probably wait until the jobs report is out of the way before deciding whether look for long or short opportunities.

Until gold creates a decisive move beneath its recent low at $1896, so that the structure of higher highs and higher lows breaks, I will give the benefit of the doubt to the bulls as they have been in control of price action for several months now.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade