Fed and Gold takeaways

- Today’s US CPI has likely sealed the deal for a “hawkish hold” from the Fed on Wednesday.

- Traders will nonetheless scrutinize the central bank’s economic projections and Chairman Powell’s press conference for hints about what July and the rest of H2 will bring.

- Gold is poised for a potential breakout after spending the last 4 weeks consolidating in a tight $50 range.

Fed analysis

Sometimes an appetizer is so good that it saps your appetite for the main course.

That’s exactly what may have happened to traders with today’s CPI report relative to tomorrow’s “main course” FOMC meeting. The May reading on consumer inflation came in right near expectations at 0.1% m/m and 4.0% y/y on the headline reading with core (ex-food and -energy) CPI printing at 0.4% m/m 5.3% y/y).

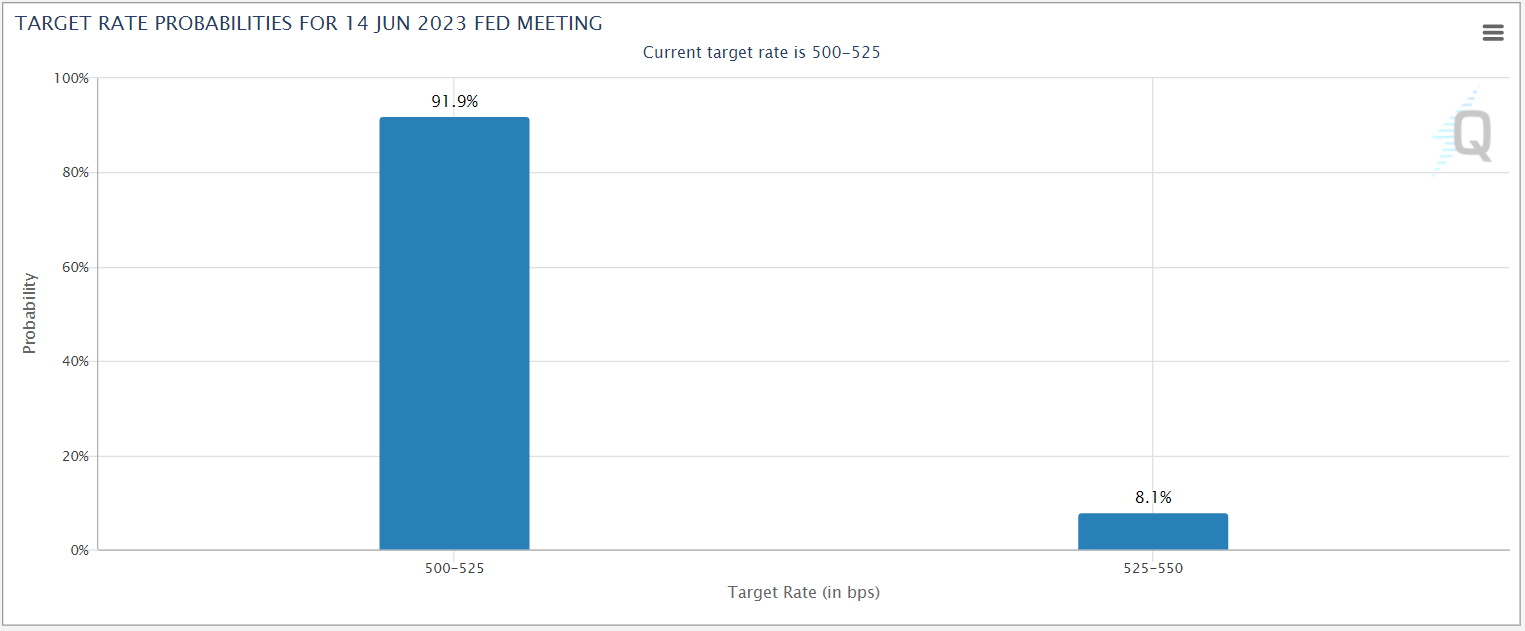

With no upside surprises to inflation, it looks likely that Jerome Powell and company will follow through on their recent comments favoring a “skip” in the interest rate hiking cycle tomorrow, while leaving the door open for a potential resumption of rate increases next month if the data dictates. Indeed, that’s exactly what Fed Funds futures traders are expecting, with just 8% implied odds of a rate hike this week (down from above 20% yesterday) and a roughly 2-in-3 probability of a(t least one) rate hike at the conclusion of the July meeting, per CME FedWatch:

Source: CME FedWatch

Outside of the (likely non-)decision on interest rates, the Fed will also release its standard monetary policy statement, quarterly Summary of Economic Projections (SEP), and Fed Chairman Powell’s press conference.

As ever, the key area of focus from the Fed’s SEP will be the “dot plot” of interest rate forecasts. Thus far, the Fed appears to be “winning” its battle against the market, with traders finally pricing out any rate hikes this year. If the median Fed member raises his/her forecast for year-end interest rates above 5.25%, it would likely be seen as a hawkish development that would benefit the US dollar and serve as a headwind for risk assets like the S&P 500.

As for the statement and press conference, traders will be keen to see if the (presumed) decision to hold interest rates steady is unanimous and how Chairman Powell characterizes the economy. Previously, Mr. Powell had noted that risks to the economic outlook were “balanced” (between a recession and too-high inflation), so expect him to receive more questions about how that outlook has evolved and what that may mean for monetary policy moving forward.

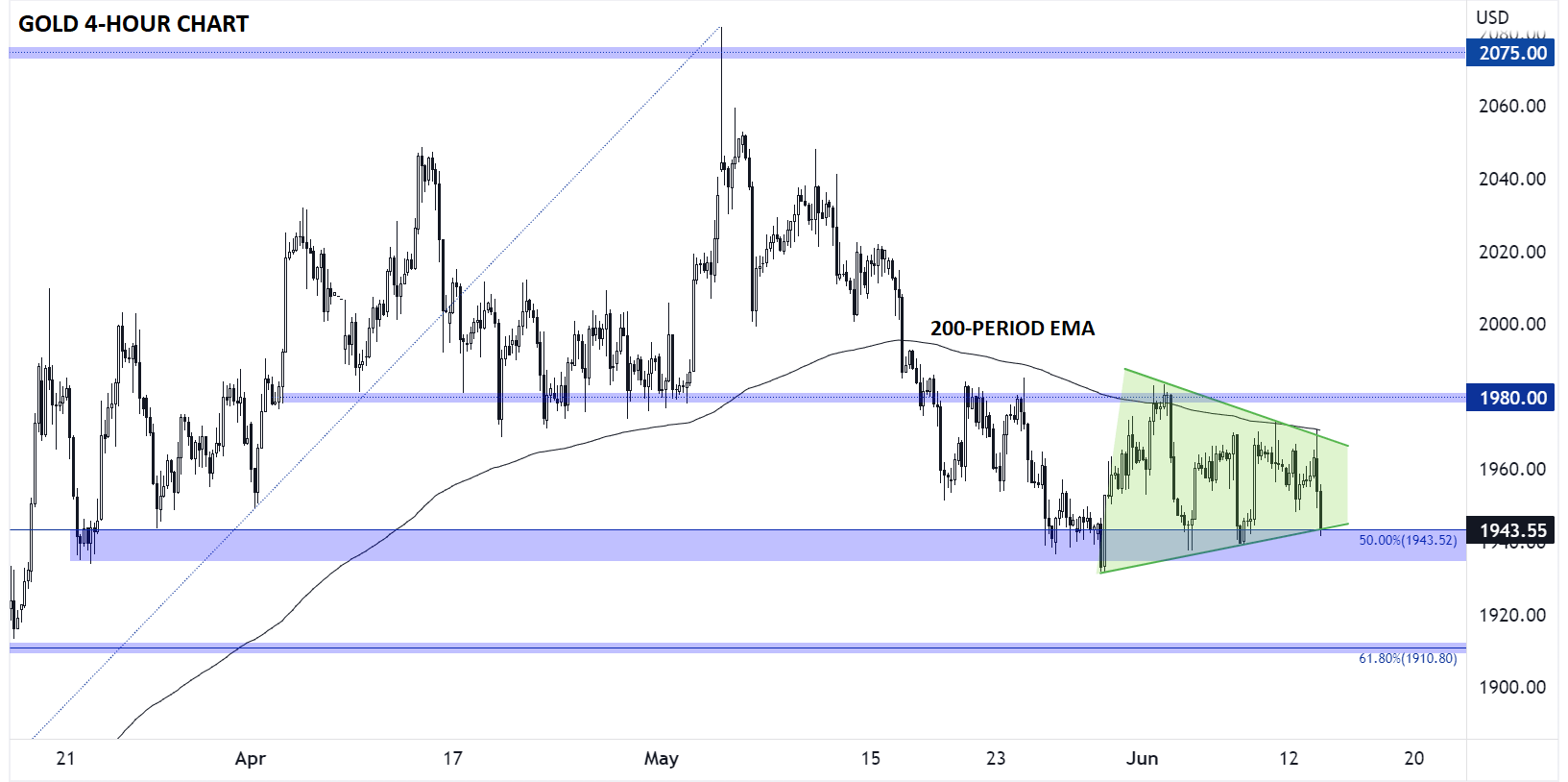

Gold technical analysis – XAU/USD 4-Hour chart

Source: TradingView, StoneX

In terms of market impacts from the Fed meeting, the US dollar and major indices will be in focus as always, but gold will also be worth watching. The yellow metal has spent the last four weeks consolidating in a tight $50 range centered around the $1960 handle.

Any surprises from the Fed could be enough to take gold out of that range; a more-hawkish-than-expected meeting would likely be a bearish catalyst for the yellow metal, and a break below support near $1930 could quickly expose the 61.8% Fibonacci retracement near $1910 next. Meanwhile, a more dovish outlook that suggests the rate hike cycle may be done already could take gold back to the top of its recent range near $1980 or even toward $2000 as we move into next week.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade