GBP/USD holds over 1.26 after the economy rebounds & ahead of the Fed rate decision

- UK GDP +0.2% MoM in April up from -0.3% in March

- Market almost fully pricing in a pause from the Fed

- GBP/USD needs a rise above 1.2680 to extend the bullish run

GBP/USD is holding steady above 1.26 following the release of UK GDP data and as investors look ahead to the FOMC interest rate decision.

The UK economy rebounded in April, growing 0.2% MoM, after contracting -0.3% MoM in March—strong growth in retail offset a slowdown in manufacturing and construction. The economy is now 0.3% bigger than ahead of the pandemic.

The data reduces the chances of a recession in the UK, at least for now. It also comes following data yesterday, which showed that the UK labour market was stronger than expected. Unemployment unexpectedly ticked lower and average wages jumped to 7.2%. The resilient jobs market and GDP growth pressure the BoE to keep raising interest rates aggressively, which increases the chances of a downturn later in the year.

Attention now turns to the Federal Reserve interest rate decision. Cooler than forecast US CPI data of 4% cemented expectations that the Fed will keep rates on hold in June while keeping the door open to further hikes if needed.

The market is pricing in just a 10% probability that the Fed will hike rates for an 11th straight meeting and a 60% probability of a July hike.

Attention will be on the dot plot and summary of economic projections, which, along with Fed Chair Powell’s statement, will paint a picture of the health of the economy and the future path for interest rates.

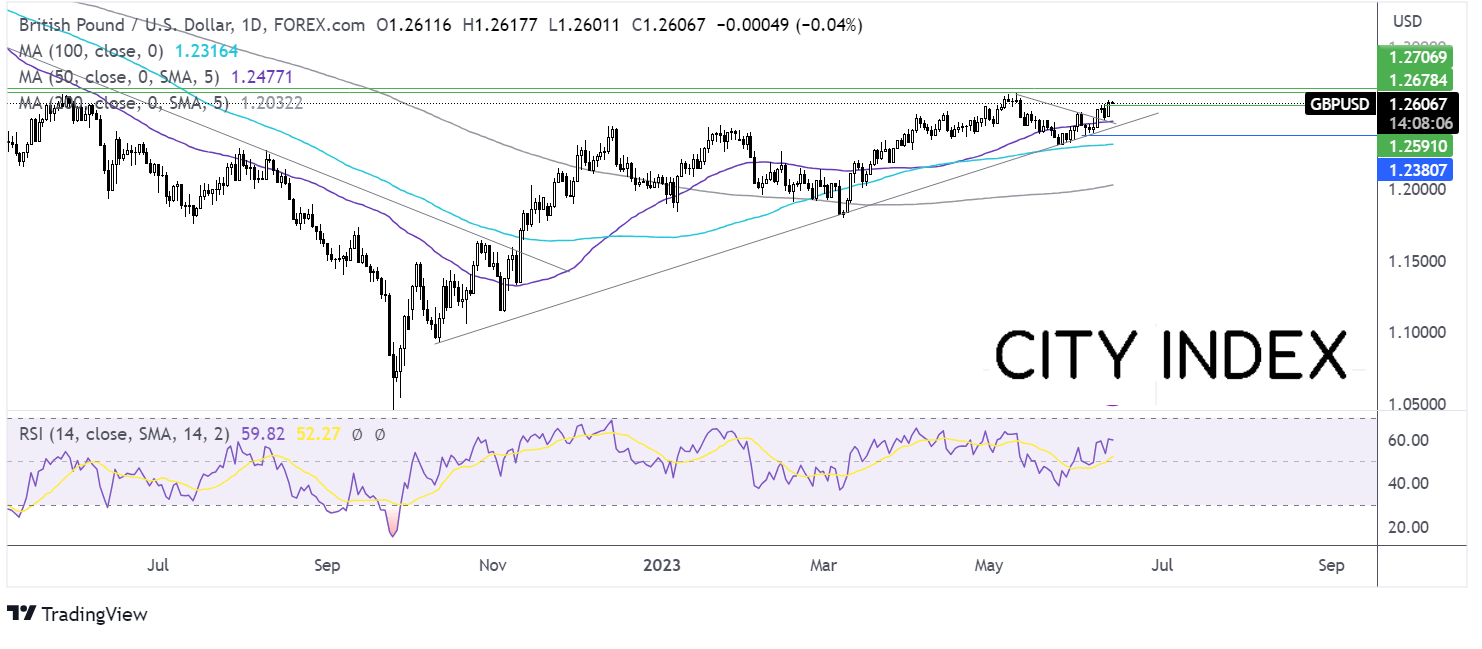

GBP/USD outlook – technical analysis

After breaking out of the symmetrical triangle, GBP/USD is struggling to advance meaningfully beyond 1.26. The RSI is over 50, keeping buyers hopeful of further upside.

A rise above 1.26 could see buyers attack resistance at 1.2680, the 2023 high, before bringing the 1.27 round number into focus.

Support can be seen at 1.2475, the 50 sma at the weekly low, with a break below here opening the door to 1.2430, the multi-month rising trendline support. A break below here brings 1.2370, the June low into focus.

Oil holds steady ahead of the Fed rate decision & EIA stockpile data

- Oil steadies after a volatile start to the week

- Fed rate decision, EIA stockpiles & China data to direct trading

- Oil sits below $70.00, trading within a holding pattern

Oil prices are holding steady after a volatile start to the week which saw oil prices drop 4% on Monday before recouping most of those losses on Tuesday.

Goldman Sachs cut its oil price forecast at the start of the week, citing higher-than-expected supply levels. It now expects WTI to be $81 by the end of the year. Meanwhile, oil prices rebounded higher on hopes of rising fuel demand after the PBoC cut its short-term interest rate.

Today the price is holding steady as the market looks to the Federal Reserve as its next catalyst, as well as China data and EIA stockpile data.

A pause in rate hikes by the Fed would be expected to boost economic growth, helping the demand outlook. A less hawkish stance from the Fed could also pull the USD lower, which could lift USD-denominated oil.

However, on Thursday, China’s retail sales and industrial production data are also due. Recent Chinese data has raised concerns that the post-pandemic recovery is losing traction.

On the supply side, API data showed that crude oil stockpiles rose by around 1 million barrels in the week ending June 9, defying expectations of a 500k draw. EIA stockpile data is due later today.

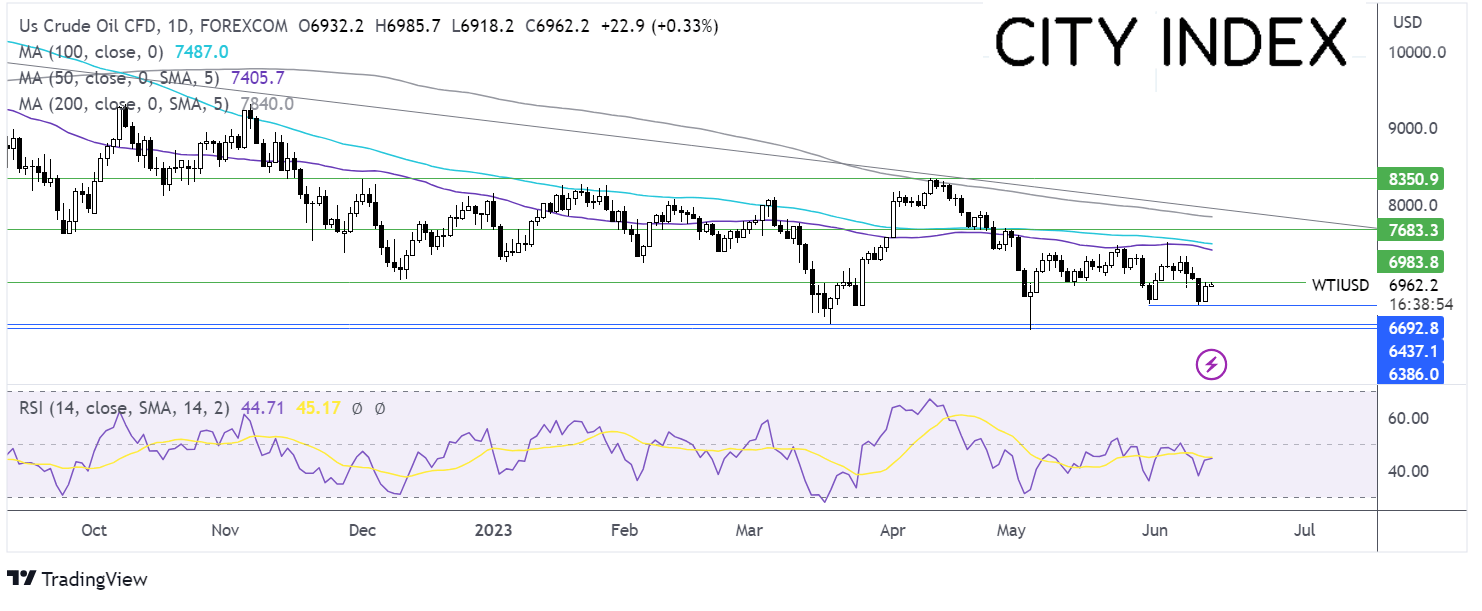

Oil outlook – technical analysis

Crude oil is holding steady below 70.00 after rebounding from 66.90, Monday’s low, but continues to trade in a holding pattern capped on the lower side by 67.00 and the 50 sma on the upside at 74.00. The RSI is modestly below 50, favouring the sellers.

Bears will look for a break below 67.00 to extend its selloff towards 63.60 the May low.

Buyers will look for a rise above 70.00 to bring 74.00 the 50 sma into play. Above here, resistance can be seen at 75.00, the June high, and 76.60, the May high.