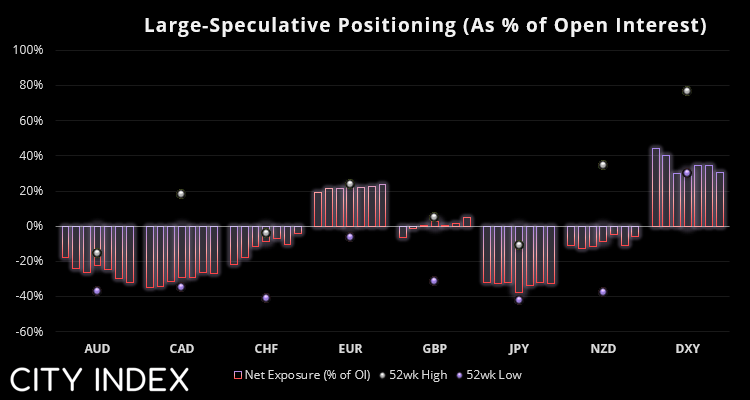

Commitment of traders – as of Tuesday 16th May:

- The weekly volume changes for net-exposure for FX futures was low (all below +8k contracts and -4.4k contracts)

- Net-long exposure to EUR/USD rose to its highest level since August 2020

- GBP/USD futures traders were their most bullish since November 2011

- Net-short exposure to AUD/USD futures rose to an 8-month high

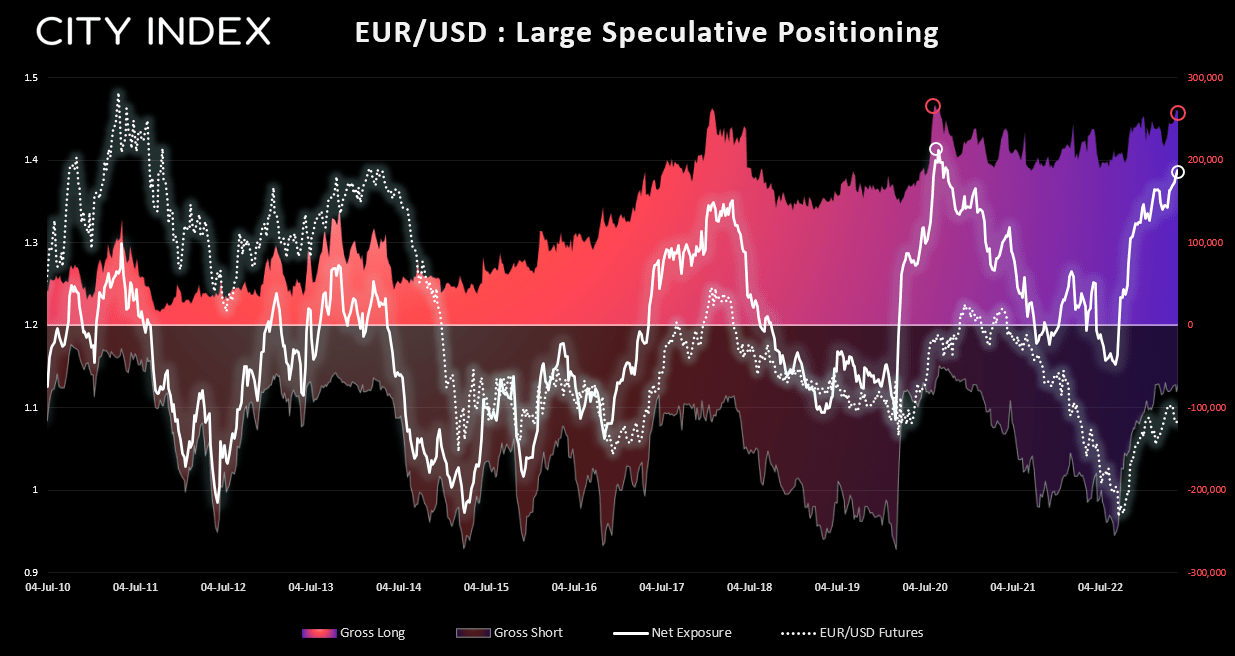

Commitment of traders – EUR/USD futures

EUR/USD rallied over 16% from the September low to its April peak, and in that time we’ve seen large speculators push their net-long exposure to levels not seen since August 2020. Gross long-exposure is also near levels not seen since August 2020, although there was a slight reduction of longs (-1.6k contracts) at these highs to suggest some nerves are setting in.

Ultimately, we have seen prices failed to test 1.1100 before momentum turned lower and, despite hawkish comments from ECB members, business sentiment reports such as the ZEW are turning lower whilst Fed members on net are mostly hawkish and push back on rate cuts. If we are to see softer than expected flash PMI data for Europe this week coupled with a weak Ifo report for Germany, it could shake out some more longs from these highs. And as the US dollar is responding well to progress with debt-ceiling talks, a resolution which results in a raised debt ceiling this week could weigh further still on EUR/USD.

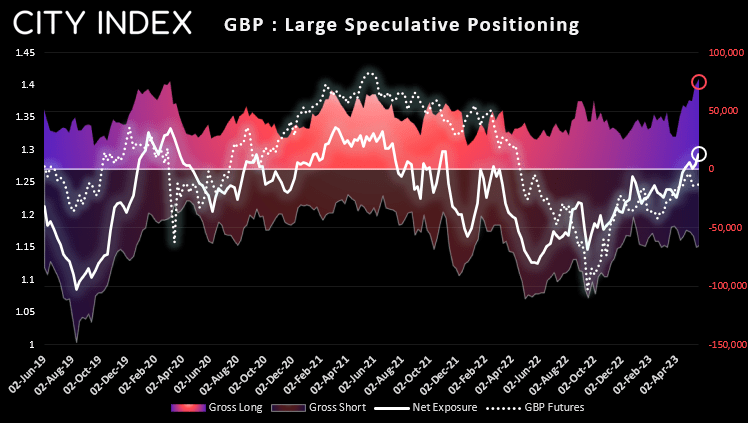

Commitment of traders – GBP/USD futures

Strong employment and wage figures alongside hawkish comments from BOE Governor Bailey and Chief economist Pill has helped futures traders flip to net-long exposure. In fact the group pf traders are their most bullish on the pair since in just under two years, with gross long exposure sitting at its most bullish level since June 2018. And if we see another hot inflation report on Thursday, it increases the odds of another bullish BOE hike and push GBP airs higher accordingly. However, take note that Friday’s upcoming COT report will not include the reaction to Thursday’s inflation report, given the data for positioning is reported on Tuesday.

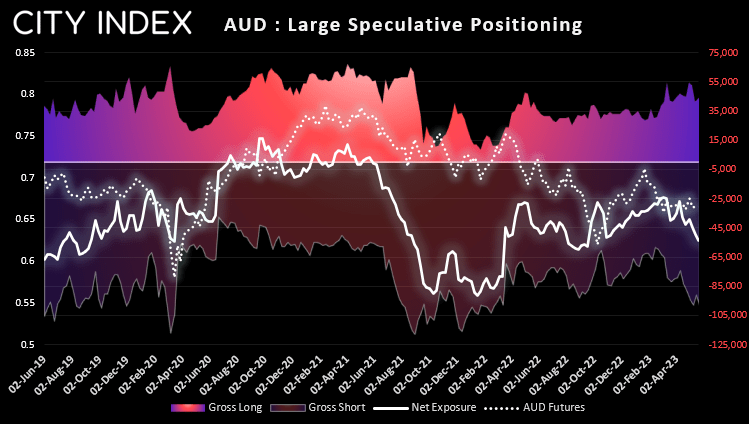

Commitment of traders – AUD/USD futures

Large speculators are their most bearish on AUD/USD futures in 35 weeks, gross shorts are near a 14-month high and gross longs have pulled back. There is no apparent sentiment extremes on these readings, but the trend provides bears with a slight edge. With no major economic news scheduled for Australia this week, it will likely be driven by US data and ongoing trade talks, a resolution being strong for the dollar and therefore applying downside pressure on AUD/USD.

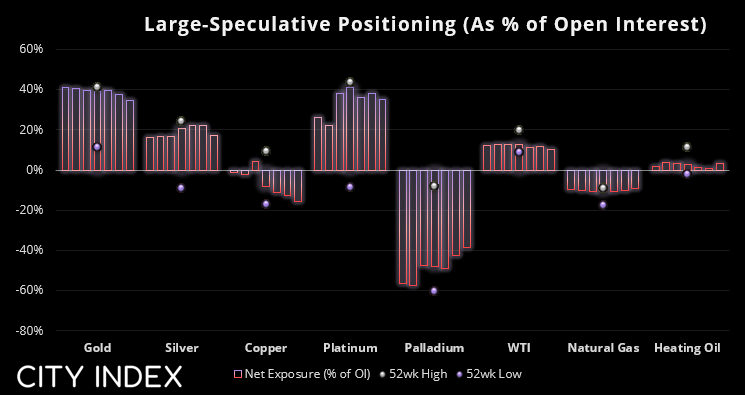

Commitment of traders – as of Tuesday 16th May:

- Large speculators reduced their net-long exposure to gold, silver, copper and platinum futures

- Net-long exposure to gold futures fell -16k contracts (4.7k short contracts added, -11.2k longs trimmed)

- Net-short exposure to copper futures was its most bearish since March 2020

Commitment of traders – as of Tuesday 16th May:

- Traders were their most bearish on S&P 500 futures since September 2007

- Net-short exposure to the 2-year yield hit a record high

- Net-long exposure to Nasdaq futures pulled back for the first week in six

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade