Asian Indices:

- Australia's ASX 200 index fell by -25.6 points (-0.34%) and currently trades at 7,532.50

- Japan's Nikkei 225 index has risen by 223.71 points (0.81%) and currently trades at 27,733.17

- Hong Kong's Hang Seng index has fallen by -500.22 points (-2.31%) and currently trades at 21,160.25

- China's A50 Index has fallen by -275.79 points (-2.01%) and currently trades at 13,472.14

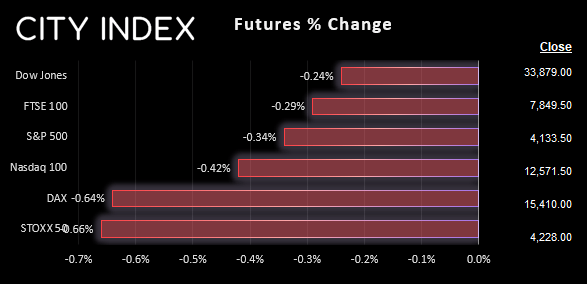

UK and Europe:

- UK's FTSE 100 futures are currently down -23 points (-0.29%), the cash market is currently estimated to open at 7,878.80

- Euro STOXX 50 futures are currently down -28 points (-0.66%), the cash market is currently estimated to open at 4,229.98

- Germany's DAX futures are currently down -100 points (-0.64%), the cash market is currently estimated to open at 15,376.43

US Futures:

- DJI futures are currently down -81 points (-0.24%)

- S&P 500 futures are currently down -51 points (-0.4%)

- Nasdaq 100 futures are currently down -14.25 points (-0.34%)

Earnings:

UK earnings: DMO - Santander, United Utilities, Oxford instruments, AMC - Tata Steel

* BMO = Before market open, DMH = During market hours, AMC = After market close, TNS = Time not specified

- The yen was the weakest major overnight on reports that the BOJ approached a very dovish candidate to take over from Kuroda in April, bolstering beliefs that the BOJ are no closer to removing their ultra-loose policy

- Friday’s employment numbers – which saw over 500k jobs added to the US economy – has seen Fed fund futures imply a 97% chance of a 25bp hike in March and another 25bp in May

- US-Sino relations are a tad strained after the US military shot down an alleged ‘spy balloon’ belonging to China, off the coast of South Carolina on Saturday

- The unexpectedly strong jobs growth and strained US-Sino relations weighed on the equity sentiment overnight

- Index futures markets are lower for US and Europe to imply a weak cash market open

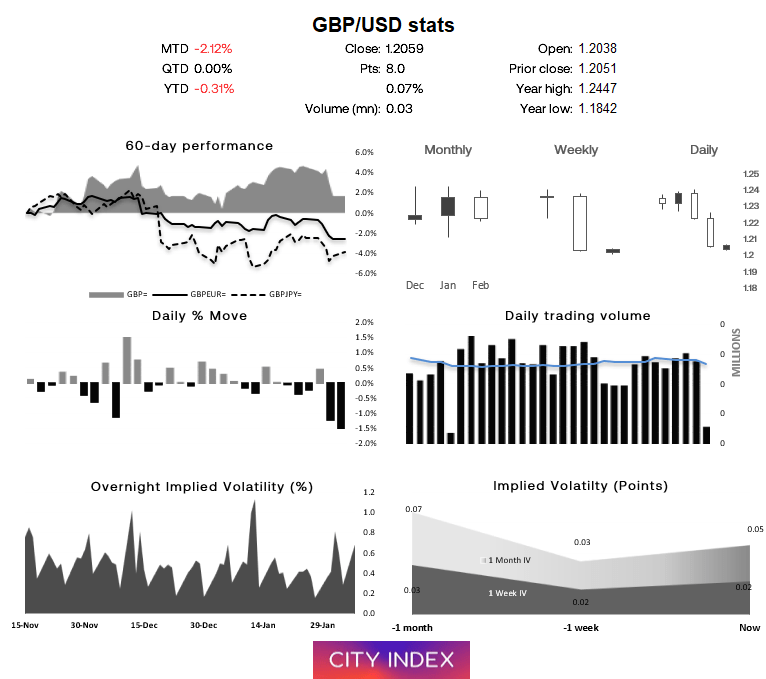

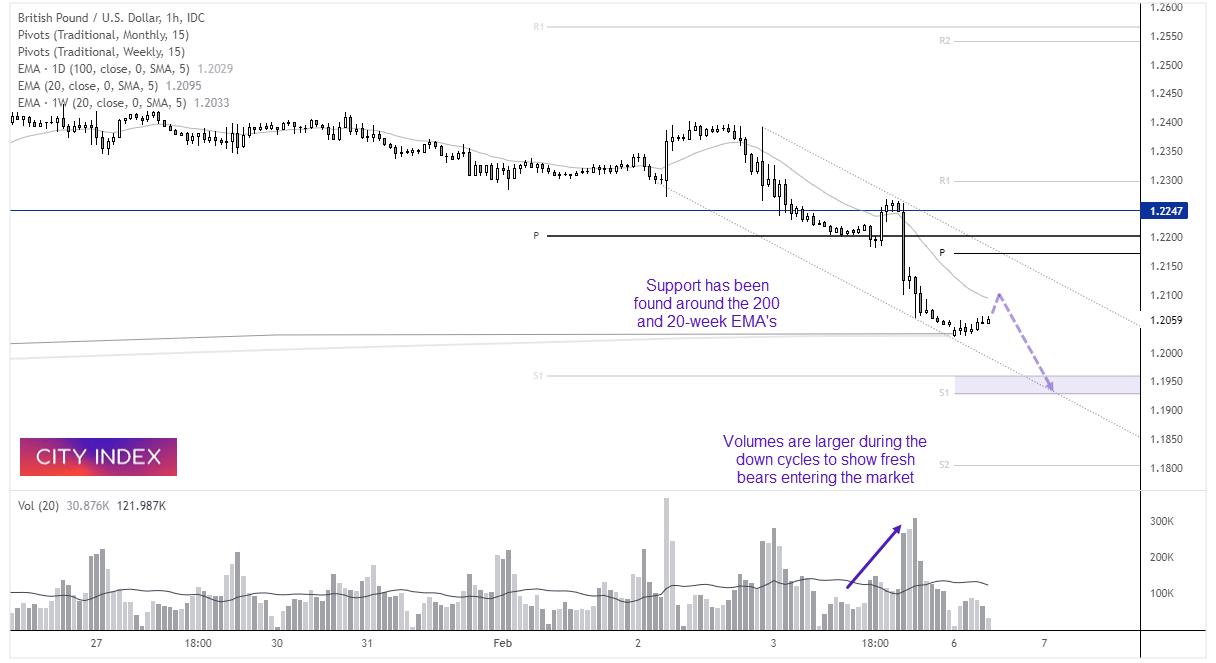

GBP/USD 1-hour chart and stats:

GBP/USD fell -2.8% last week during its worst week since September (back when the pound has ‘Truss’ issues thanks to a disastrous budget). However, it managed to find support at the 200 and 20-week EMA’s, which can be tough nuts to crack initially. Therefore I see the potential for prices to drift higher within last week’s range before printing a lower high, then resuming its bearish move. So for now, bears can seek evidence of a swing high before seeking bearish setups and eventual break below 1.2000.

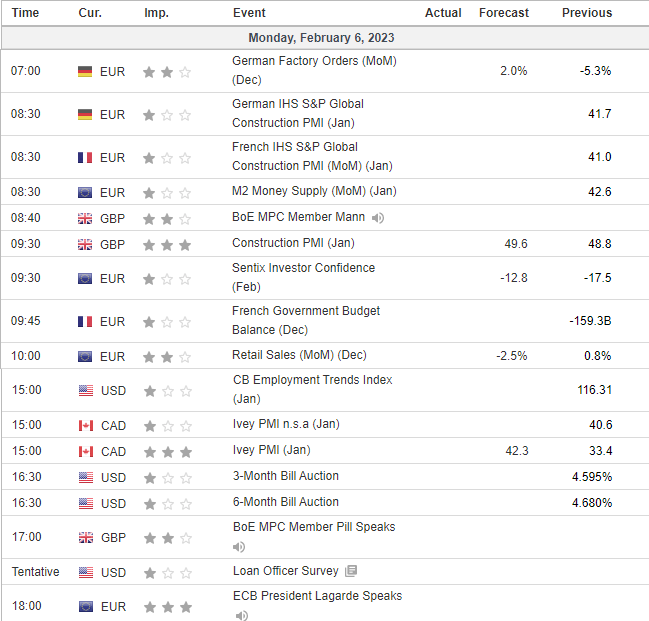

Economic events up next (Times in GMT)