Asian Indices:

- Australia's ASX 200 index rose by 57.5 points (0.78%) and currently trades at 7,410.60

- Japan's Nikkei 225 index has risen by 28.24 points (0.09%) and currently trades at 29,774.11

- Hong Kong's Hang Seng index has fallen by -268.54 points (-1.08%) and currently trades at 24,682.80

- China's A50 Index has risen by 1.45 points (0.01%) and currently trades at 15,652.82

UK and Europe:

- UK's FTSE 100 futures are currently down -18 points (-0.25%), the cash market is currently estimated to open at 7,237.46

- Euro STOXX 50 futures are currently down -21 points (-0.48%), the cash market is currently estimated to open at 4,317.69

- Germany's DAX futures are currently down -57 points (-0.35%), the cash market is currently estimated to open at 16,058.69

US Futures:

- DJI futures are currently up 17.27 points (-0.05%)

- S&P 500 futures are currently down -33.5 points (-0.2%)

- Nasdaq 100 futures are currently down -2.25 points (-0.05%)

Dollar remains firm

The US dollar held onto yesterday’s gains overnight and nudged its was higher despite thin trade over Japan’s public holiday. The combination of Powell being (re)nominated as Fed chair and then dropping relatively hawkish comments after the announcement has seen traders bring forward their expectations for a hike and / or faster tapering. The US dollar traded above 96.6 to its highest level since July 2020 and EUR/USD remained below 1.1250.

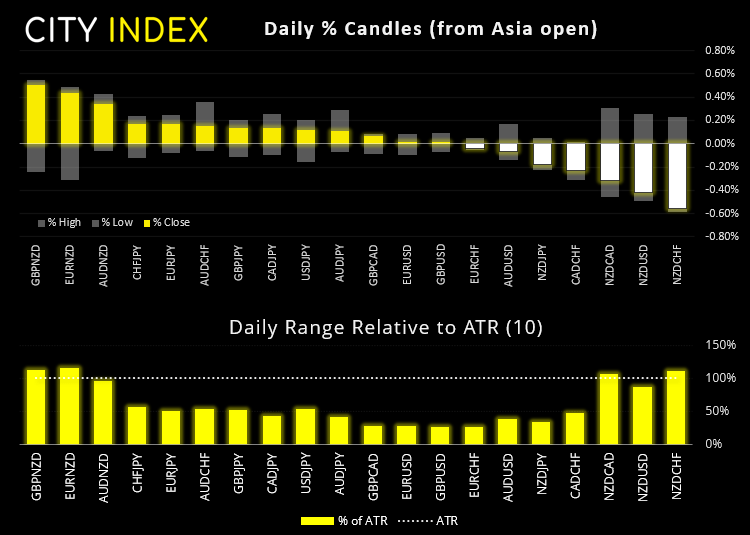

Volatility was relatively low or currencies although the New Zealand dollar was the weakest major following weak retail sales figures. On the quarter, volumes fell -8.1% and were -1.2% lower versus a year ago. And it’s possible that AUD/NZD has seen a corrective low just above 1.3000 (especially if RBNZ only hike by 25 bps tomorrow).

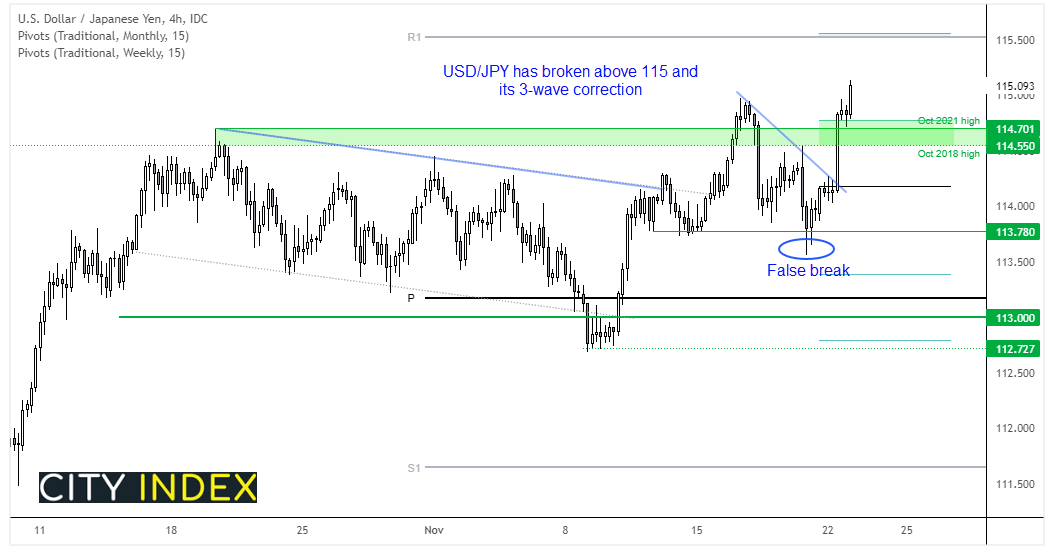

USD/JPY finally broke above 115 in line with its dominant trend as it tracks yields higher. We flipped to a bullish bias on November 10th after the strong US inflation report which saw USD/JPY rip back above 113 and mark an end to a 3-wave correction. Its rally form 113 petered out just below 115 last week and another 3-wave retracement formed. Yet its inability to break 113.78 support likely marks another important low, and momentum has now broken higher. Take note that support was found at the October 2021 high and monthly S1 pivot so our bias is now for a move towards 115.50 where the monthly R1 and weekly S2 pivots reside.

October 2018 high remains pivotal for WTI

This key level has provided both support and resistance over the past 4-sessions, and with prices trying to hug that level overnight then we expect it will also have significance today. Reports that the US is expected to tap into oil reserves to take the strong over high oil prices has weighed on prices to some degree, although we’re yet to see any follow through despite a stronger US dollar.

16,000 remains in focus for DAX traders

We had a bearish bias below 16,200 yesterday so it was nice to see that prices rolled over after probing that level yesterday. Bears now need to break below 16,092 (potential double bottom) to keep hopes of it testing 16k alive, although we do not yet anticipate prices to break that key level just yet. A break back above 16,200 switches our near-term bias to bullish.

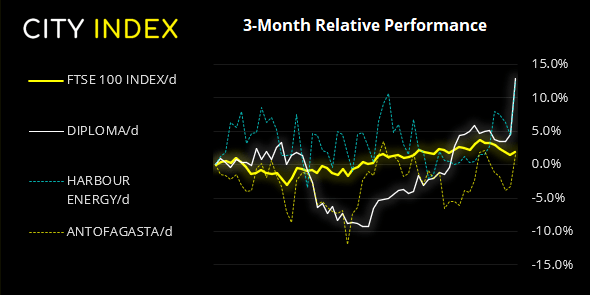

The FTSE managed an obligatory bounce from support

The FTSE 100 was almost obligated to bounce yesterday, given it had fallen for four consecutive days into a key level of support around 7200. The question now is if bulls can retain control and break back above the 7921 – 7300 resistance area, because failure to do so may tempt bears back to the table around that level for potential shorts.

Caledonia Investments PLC (CLDN) and Templeton Emerging Market Investments PLC (TEM) release earnings reports today.

FTSE 350: 4166.21 (0.44%) 22 November 2021

- 148 (42.17%) stocks advanced and 186 (52.99%) declined

- 28 stocks rose to a new 52-week high, 8 fell to new lows

- 56.98% of stocks closed above their 200-day average

- 56.98% of stocks closed above their 50-day average

- 21.08% of stocks closed above their 20-day average

Outperformers:

- + 7.99%-Diploma PLC(DPLM.L)

- + 7.80%-Harbour Energy PLC(HBR.L)

- + 5.01%-Antofagasta PLC(ANTO.L)

Underperformers:

- -27.2%-Hochschild Mining PLC(HOCM.L)

- -5.70%-AO World PLC(AO.L)

- -5.48%-Petropavlovsk PLC(POG.L)

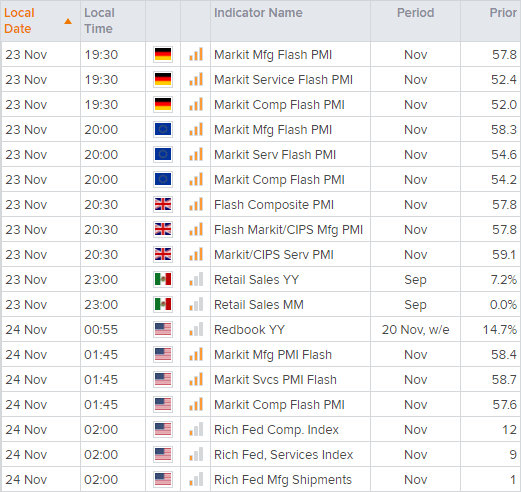

Up Next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade