Asian Indices:

- Australia's ASX 200 index fell by -29.9 points (-0.41%) and currently trades at 7,290.20

- Japan's Nikkei 225 index has risen by 404.86 points (1.44%) and currently trades at 28,453.80

- Hong Kong's Hang Seng index has risen by 550.09 points (2.21%) and currently trades at 25,387.94

UK and Europe:

- UK's FTSE 100 futures are currently down -4.5 points (-0.06%), the cash market is currently estimated to open at 7,091.05

- Euro STOXX 50 futures are currently down -4.5 points (-0.11%), the cash market is currently estimated to open at 4,068.79

- Germany's DAX futures are currently down -14 points (-0.09%), the cash market is currently estimated to open at 15,192.13

US Futures:

- DJI futures are currently down -8.65 points (-0.02%)

- S&P 500 futures are currently down -62.25 points (-0.42%)

- Nasdaq 100 futures are currently down -10.5 points (-0.24%)

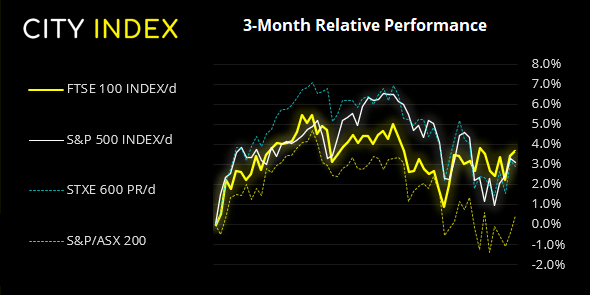

Indices

It was a mostly positive mood overnight across Asian equity markets. The Nikkei rallied for a third day as new daily COVID-19 cases fell to a 1-year low, with a weaker yen also helping the domestic market. Chinese equity markets were the strongest performers as they tracked yields higher, although the ASX 200 fell -0.4% as tech stocks tracked the Nasdaq 100 lower from Friday. That said, futures markets for European and US indices currently point to a softer open.

FTSE 350: Market Internals

FTSE 350: 4062.44 (0.25%) 08 October 2021

- 160 (45.58%) stocks advanced and 179 (51.00%) declined

- 8 stocks rose to a new 52-week high, 4 fell to new lows

- 51.57% of stocks closed above their 200-day average

- 84.05% of stocks closed above their 50-day average

- 12.54% of stocks closed above their 20-day average

Outperformers:

- + 6.64%-John Wood Group PLC(WG.L)

- + 5.97%-Baltic Classifieds Group PLC(BCG.L)

- + 5.49%-Harbour Energy PLC(HBR.L)

Underperformers:

- ·-15.48%-Tui AG(TUIT.L)

- ·-4.58%-Unite Group PLC(UTG.L)

- ·-3.26%-AVEVA Group PLC(AVV.L)

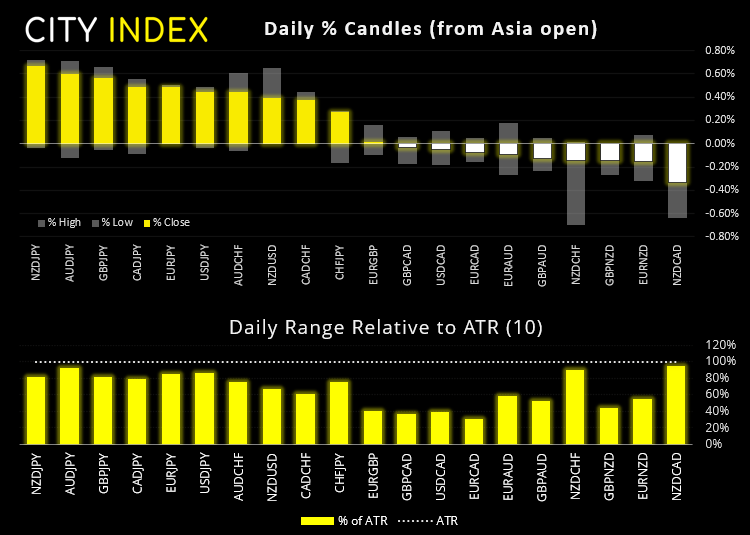

Forex:

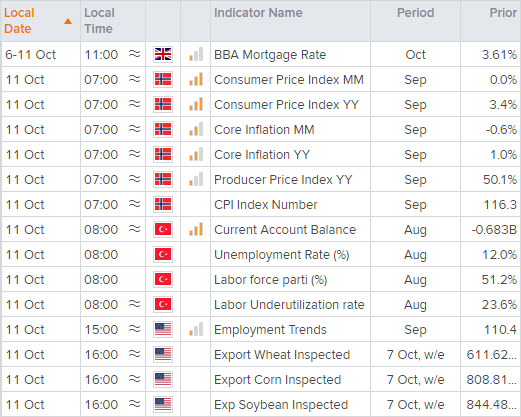

It’s a relatively quiet economic calendar today with the US celebrating Columbus day. Norwegian inflation data is scheduled for 07:00 which sees CPI and PPI data released. At 08:00 Turkey release employment data. ECB board member Philip Lane speaks at 13:00, and FOMC member Charles Evans speaks at 23:00.

GBP and AUD are currently the strongest major currencies, whilst safe-haven’s JPY and CHF are the weakest. AUD/JPY is a top performing pair and within its third consecutive bullish session, after breaking above 82.0 for the first time since July.

The US dollar index (DXY) is coiling in a potential continuation pattern on the daily chart. Even if momentum is to instead break lower from the current consolidation, the fact it is coiling suggests volatility is about to pick up.

USD/JPY broke above the February 2020 high, so we are now looking for prices to hold above 112.22 and continue its trend higher.

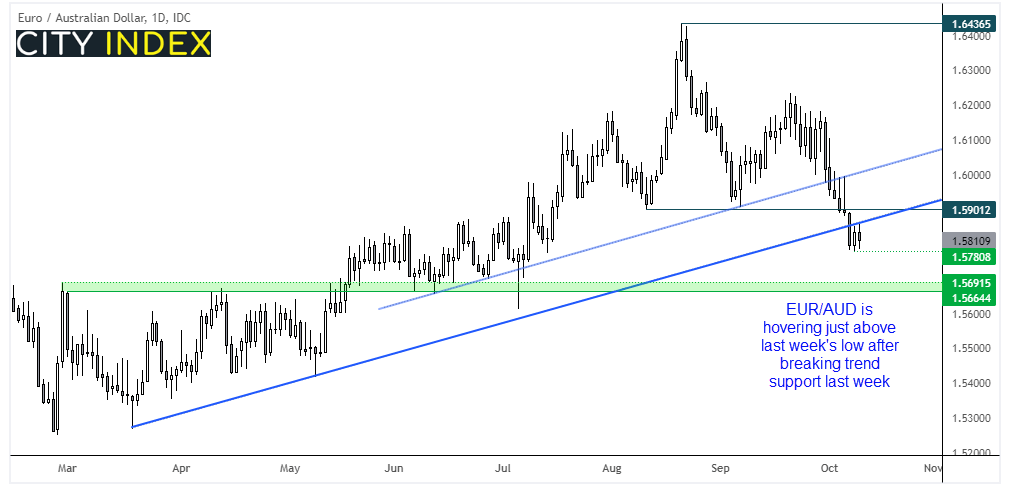

EUR/AUD is probing last week’s low after a trendline break on Thursday. Momentum points lower on the daily chart although prices are now within a sideways consolidation, so the bias is for a break of 1.5780 support for a run towards the 1.2664 – 1.5690 support zone. Whilst the broken trendline may provide resistance we can also expect some noise around it, so our bias remains bearish below 1.5900.

Commodities:

Gold failed to hold onto gains with its break above 1770 resistance on Friday, leaving a bearish pinbar on the daily chart. Should we see a decent break of last week’s low then it suggests it could be headed for the 1271 lows.

That said, silver appears to be the more compelling short opportunity given it trades in a bearish channel and has twice failed to hold onto intraday breaks above $23. A break beneath 22.20 assumes bearish continuation.

Oil prices continued higher overnight, with WTI touching a near-7-year high and on track for its 8th consecutive bullish session. Yet brent prices were a touch lower after failing to retest Friday’s high. Currently at a 3-year high the next major resistance level for bulls to test is the 2018 high of 86.69.

Up Next (Times in BST)