Asian Indices:

- Australia's ASX 200 index rose by 7.9 points (0.12%) and currently trades at 6,806.50

- Japan's Nikkei 225 index has risen by 288.83 points (1.06%) and currently trades at 27,539.11

- Hong Kong's Hang Seng index has risen by 329.56 points (2.17%) and currently trades at 15,495.15

- China's A50 Index has risen by 121.47 points (1.03%) and currently trades at 11,944.28

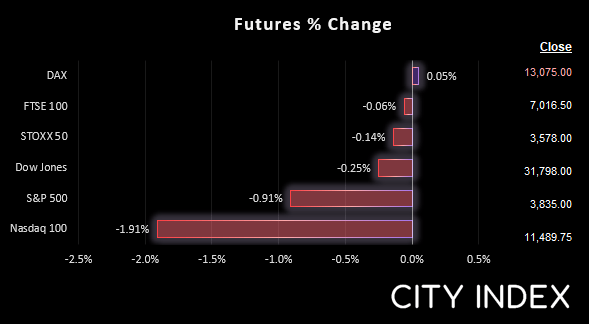

UK and Europe:

- UK's FTSE 100 futures are currently down -4 points (-0.06%), the cash market is currently estimated to open at 7,009.48

- Euro STOXX 50 futures are currently down -5 points (-0.14%), the cash market is currently estimated to open at 3,580.58

- Germany's DAX futures are currently up 6 points (0.05%), the cash market is currently estimated to open at 13,058.96

US Futures:

- DJI futures are currently down -79 points (-0.25%)

- S&P 500 futures are currently down -222.5 points (-1.9%)

- Nasdaq 100 futures are currently down -35 points (-0.9%)

The Bank of Japan (BOJ) increased their bond purchases at a scheduled operation overnight, prompting a sharp reaction in yields with the 30-year which fell -12.5bps and to a 2-week low of 1.45%. Volatility on USD/JPY remains eerily quiet, with speculators seemingly over their desire to short Japan’s currency (for now at least).

Australian inflation rose to a 32-year high and came in far beyond expectations. Whilst this has naturally caused a chorus of calls for a 50bp hike, a 25bp hike may still remain the more likely given the RBA is placing greater emphasis on inflation expectations over the current rate of inflation. Still, we will find out how “finely balanced” the 25 vs 50bp hike debate remains at their next meeting.

The Bank of Canada (BOC) are expected to hike interest rates by 75bp today and take their overnight cash rate to 4%. Whilst this is the clear favourite outcome, there’s no harm in being prepared for a 100bp hike given hawkish comments from BOC officials and their issue with the stronger US dollar.

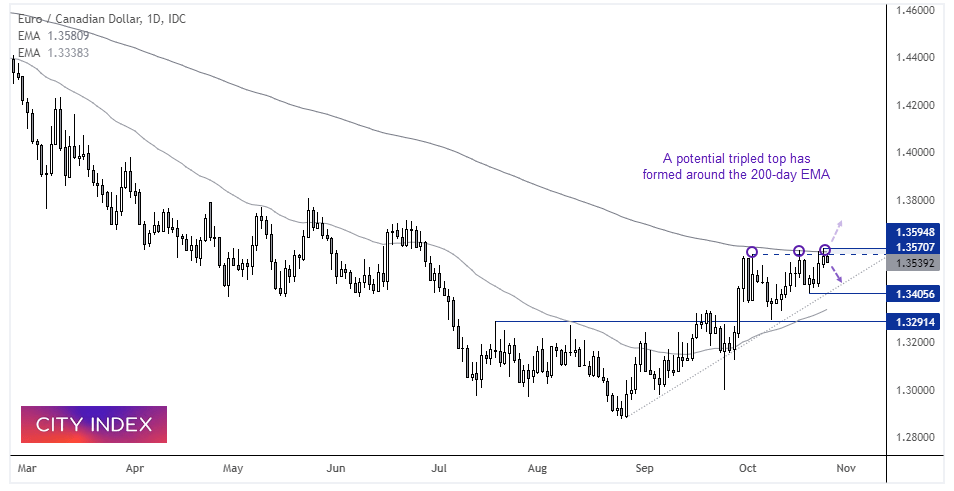

EUR/CAD daily chart:

EUR/CAD has been within an uptrend since its August low, and the cross shows the potential to break higher – at least eventually. The 200-day EMA is currently capping as resistance and a potential tripled top has formed around 1.3570. If the BOC deliver a hawkish hike (or larger than expected hike) then EUR/CAD is one for bears to consider whilst prices remain beneath the latest cycle high. If the BOC are to surprise with a dovish hike (although unlikely) then EUR/CAD could be a prime candidate for a bullish breakout.

FTSE 350 – Market Internals:

FTSE 350: 3874.61 (-0.01%) 25 October 2022

- 318 (90.86%) stocks advanced and 30 (8.57%) declined

- 1 stocks rose to a new 52-week high, 9 fell to new lows

- 18.29% of stocks closed above their 200-day average

- 64% of stocks closed above their 50-day average

- 27.14% of stocks closed above their 20-day average

Outperformers:

- + 17.81% - Molten Ventures PLC (GROW.L)

- + 13.82% - ASOS PLC (ASOS.L)

- + 11.55% - Urban Logistics Reit PLC (SHED.L)

Underperformers:

- -6.83% - HSBC Holdings PLC (HSBA.L)

- -2.37% - Shell PLC (SHEL.L)

- -2.33% - WAG Payment Solutions PLC (WPS.L)

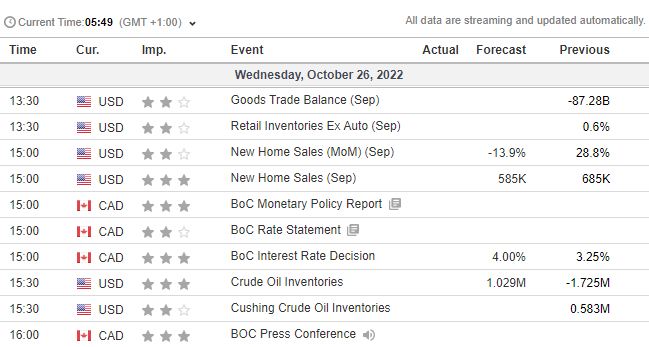

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade