Asian Indices:

- Australia's ASX 200 index rose by 42.1 points (0.59%) and currently trades at 7,120.10

- Japan's Nikkei 225 index has risen by 153.8 points (0.55%) and currently trades at 27,390.98

- Hong Kong's Hang Seng index has risen by 717.26 points (3.01%) and currently trades at 24,519.52

- China's A50 Index has fallen by -254.78 points (-1.7%) and currently trades at 14,769.78

UK and Europe:

- UK's FTSE 100 futures are currently up 44 points (0.59%), the cash market is currently estimated to open at 7,572.84

- Euro STOXX 50 futures are currently up 12.5 points (0.3%), the cash market is currently estimated to open at 4,153.52

- Germany's DAX futures are currently up 59 points (0.38%), the cash market is currently estimated to open at 15,427.47

US Futures:

- DJI futures are currently up 213 points (0.61%)

- S&P 500 futures are currently up 302.75 points (2.09%)

- Nasdaq 100 futures are currently up 54.25 points (1.21%)

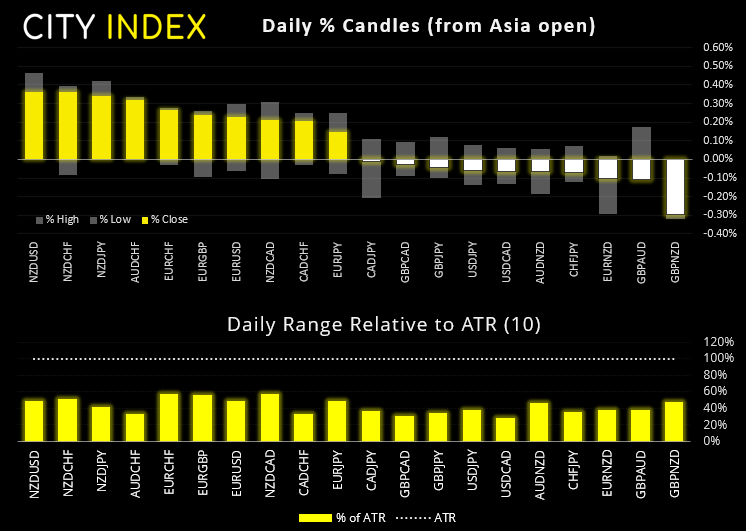

Asian equity markets posted gains overnight, led by the Hang Seng which opened after a 3-day break for Chinese New Year. HSI is up around 3% and the Nikkei rose 0.5%. US futures are also higher after rallying into yesterday’s close and extending those gains at the open. The S&P 500 E-mini futures market is back above 4500 and up 1.2%, although the Nasdaq future contract rose over 2% thanks to a 15% rebound in Amazon shares after a strong earnings report. European futures also higher with the FTSE leading by around 0.5%.

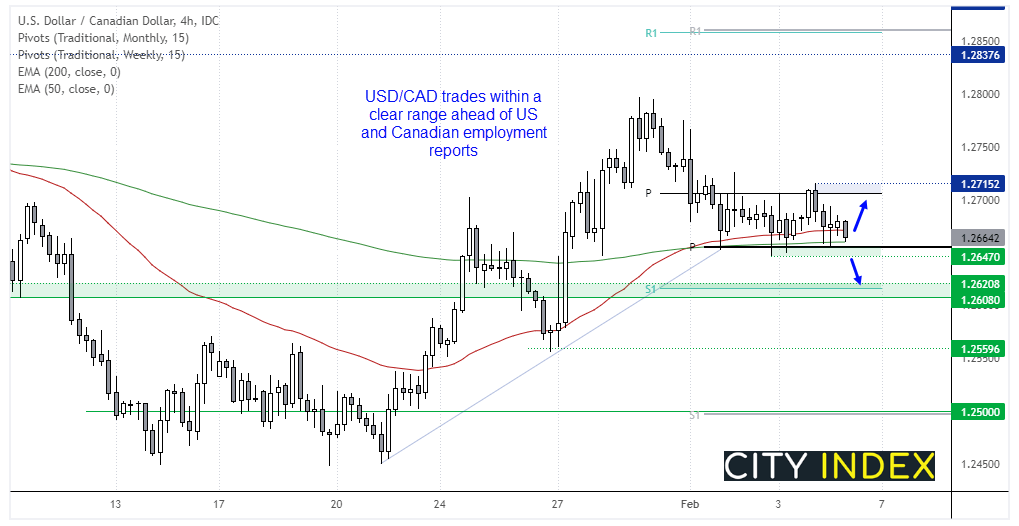

USD/CAD holds the 200-day eMA ahead of today’s NFP report

Expectations for a strong NFP print today are very low, due to millions of employees taking sick leave with Omicron. And this has been echoed by Fed members this week, so on one hand it would take a pretty dire employment print for this to have more of a knock on the US dollar than we’ve seen already in recent days. Pencilled in at 145k jobs added in January, it would be the lowest print in 12-months. The contrarian in me suspect we could see a decent bounce on the US dollar should it come in above this relatively weak number.

As outlined in today’s Asian Open report, we like the look of USD/JPY longs but that assumes we do not see a drastically weaker-than-expected NFP print today. But as we also have Canadian employment released simultaneously then USD/CAD is clearly a currency for traders. It’s holding above the monthly pivot point and 200-day eMA at the lows of a 3-week range, so it could be tempting for bulls to pick up a bargain should Canadian employment miss expectations and NFP beats them. Otherwise, a break below 1.2647 warns of a deeper countertrend move for the pair.

What are non farm payrollsWTI extends gains above $90

Oil extended gains overnight after WTI closed above $90 yesterday for the first time since October 2014. Clearly it is a potential support level today, along with the weekly R1 pivot at 89.80, with next resistance at the 91.77 high. However, brent is yet to break above last week’s high which places 91.72 as a pivotal level for today.

Gold bugs continue to step in

We are having to reconsider our near-term bearish bias given the strong ‘buying tail’ seen yesterday, which saw prices quickly rebound after a quick dip below 1790. A close above 1810 could spur some bullish follow-through as there could be plenty of stops around that level, as it would also clear the 50-day eMA and 200-bar eMA on the four-hour chart. But until that level breaks then another spike lower is not out of the question.

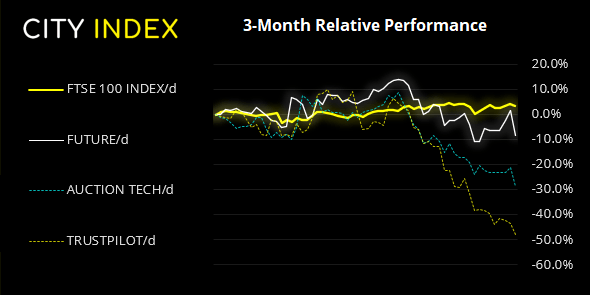

FTSE 350: Market Internals

FTSE 350: 4249.35 (-0.71%) 03 February 2022

- 62 (17.71%) stocks advanced and 278 (79.43%) declined

- 11 stocks rose to a new 52-week high, 6 fell to new lows

- 36% of stocks closed above their 200-day average

- 30% of stocks closed above their 50-day average

- 14.86% of stocks closed above their 20-day average

Outperformers:

- + 8.29% - Playtech PLC (PTEC.L)

- + 6.71% - Renishaw PLC (RSW.L)

- + 4.02% - Compass Group PLC (CPG.L)

Underperformers:

- -9.74% - Future PLC (FUTR.L)

- -9.62% - Auction Technology Group PLC (ATG.L)

- -7.72% - Trustpilot Group PLC (TRST.L)

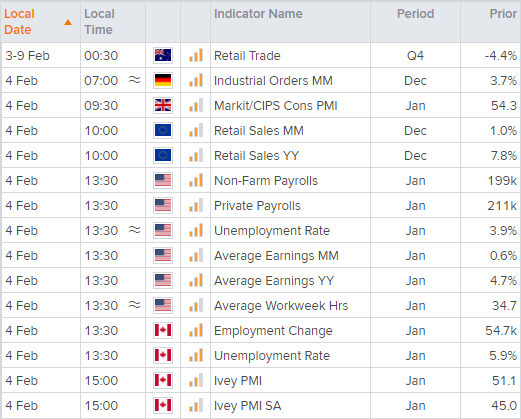

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade