Asian Indices:

- Australia's ASX 200 index fell by -9.4 points (-0.13%) and currently trades at 7,110.80

- Japan's Nikkei 225 index has fallen by -210.82 points (-0.77%) and currently trades at 27,229.17

- Hong Kong's Hang Seng index has fallen by -62.44 points (-0.25%) and currently trades at 24,510.85

- China's A50 Index has risen by 290.68 points (1.97%) and currently trades at 15,060.46

UK and Europe:

- UK's FTSE 100 futures are currently up 28.5 points (0.38%), the cash market is currently estimated to open at 7,544.90

- Euro STOXX 50 futures are currently up 21 points (0.52%), the cash market is currently estimated to open at 4,107.58

- Germany's DAX futures are currently up 65 points (0.43%), the cash market is currently estimated to open at 15,164.56

US Futures:

- DJI futures are currently down -36 points (-0.1%)

- S&P 500 futures are currently up 7.5 points (0.05%)

- Nasdaq 100 futures are currently down -1.5 points (-0.03%)

Asian equity markets were mostly lower overnight as they tracked Wall Street lower. China’s markets reopened after most of last week’s closure due to the Lunar New year, so they had some catching up to do.

European indices continued to sell off into the week’s end following ECB’s slightly hawkish stance at last week’s press conference. This has seen the TOXX fall back to its 200-day eMA after failing to hold onto a rally above a (now broken) trendline. The DAX closed well beneath its 200-day eMA on Friday to an 8-day low and appears less than a day’s trade away from testing 15k. US futures have opened slightly lower whilst European futures are currently up around 0.4% but we’re not reading too much into it, given the losses sustained since Wednesday’s highs.

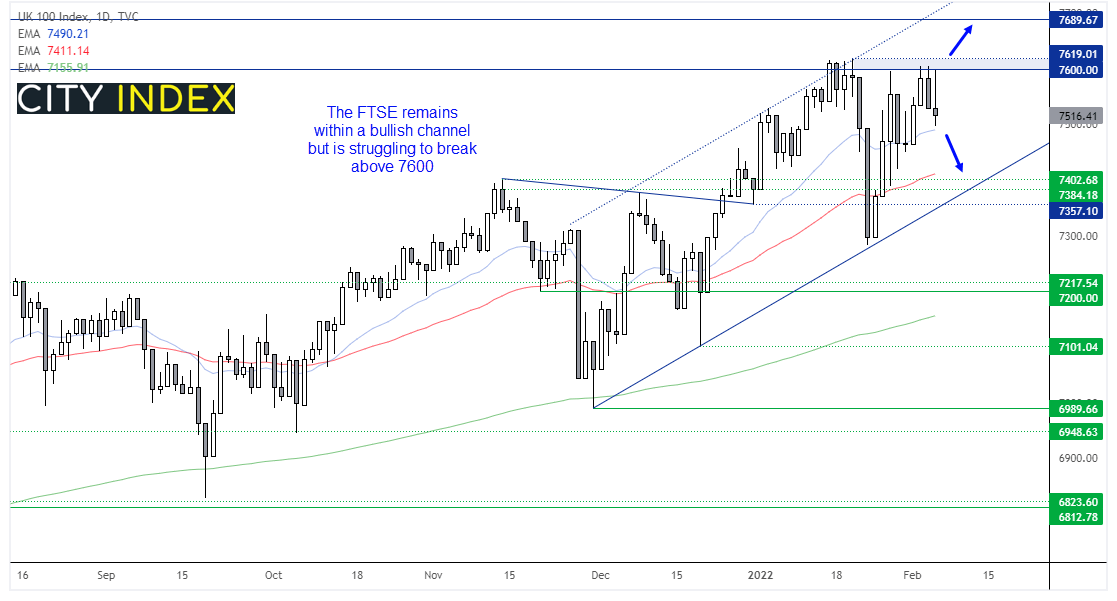

FTSE 100 struggles to break 7600

The FTSE is another global index that is struggling to make up its directional mind over the near-term. On one hand it remains within a bullish channel and has risen back to 7600. On the other, it is struggling to break above 7600 and printed a potential bearish hammer on Friday, which would be confirmed with a break of its low. For now we have a neutral bias, which can switch to bearish bias with a break below the 20-day eMA and 7500 handle, or return to the bullish bias with a break above 7620.

FTSE 100 trading guide>

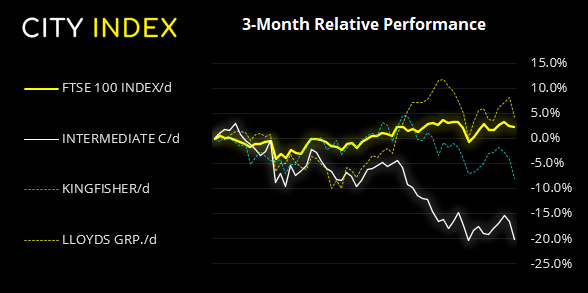

FTSE 350: Market Internals

FTSE 350: 4235.3 (-0.17%) 04 February 2022

- 62 (17.71%) stocks advanced and 278 (79.43%) declined

- 36% of stocks closed above their 200-day average

- 30% of stocks closed above their 50-day average

- 14.86% of stocks closed above their 20-day average

Outperformers:

- +6.4% - BT Group PLC (BT.L)

- +3.4% - BP PLC (BP.L)

- +2.7% - Avast PLC (AVST.L)

Underperformers:

- -4.1% - Intermediate Capital Group PLC (ICP.L)

- -3.9% - Kingfisher PLC (KGF.L)

- -3.6% - Lloyds Banking Group PLC (LLOY.L)

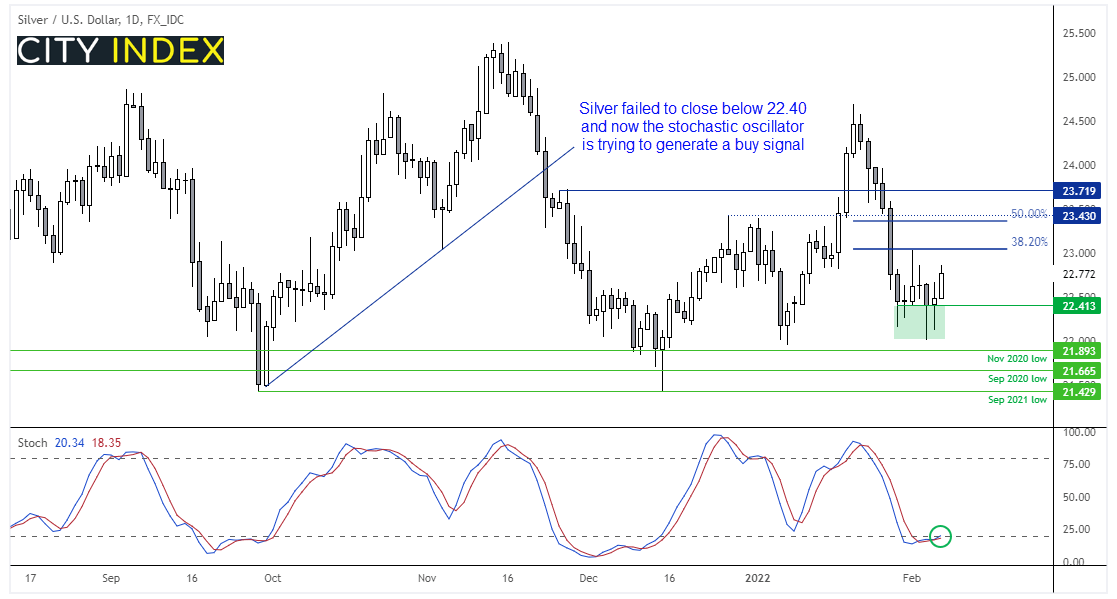

Silver tries to carve out a swing low

Silver managed to fall over -10% in just ten days after it fell from its January high. It has since been within a choppy, sideways range but we noticed that it has failed to see a daily close below 22.40 on the daily chart, and prices have broken above Friday’s doji high during overnight trade. It also means the stochastic oscillator is trying to print a buy signal, but we would need to wait for a day’s close to confirm it as such. Still, it appears a countertrend bounce is underway which leave s move back to $23 in focus, near the hammer high and 38.2% retracement ratio. Beyond that we may look to seek bearish setups around the 38.2% or 50% ratio’s, to take momentum back in line with the fall from the January high.

How to start silver trading

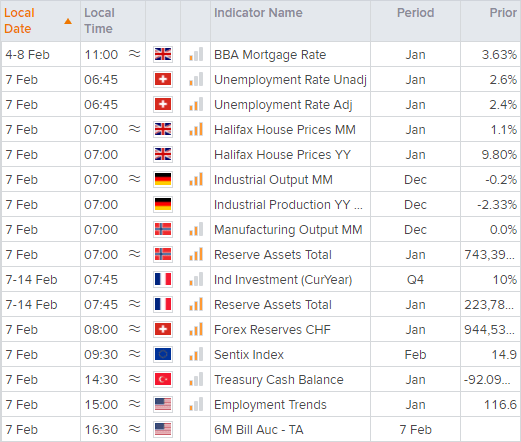

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade