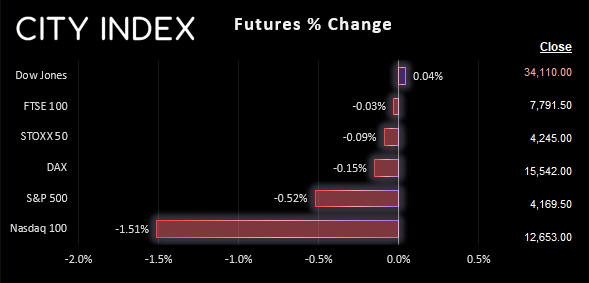

UK and Europe:

- UK's FTSE 100 futures are currently down -2.5 points (-0.03%), the cash market is currently estimated to open at 7,817.66

- Euro STOXX 50 futures are currently down -4 points (-0.09%), the cash market is currently estimated to open at 4,237.12

- Germany's DAX futures are currently down -23 points (-0.15%), the cash market is currently estimated to open at 15,486.19

US Futures:

- DJI futures are currently up 14 points (0.04%)

- S&P 500 futures are currently down -193.5 points (-1.51%)

- Nasdaq 100 futures are currently down -22.25 points (-0.53%)

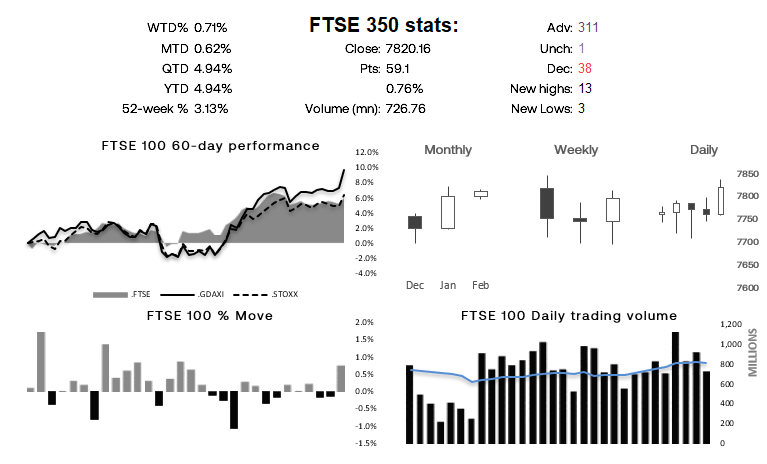

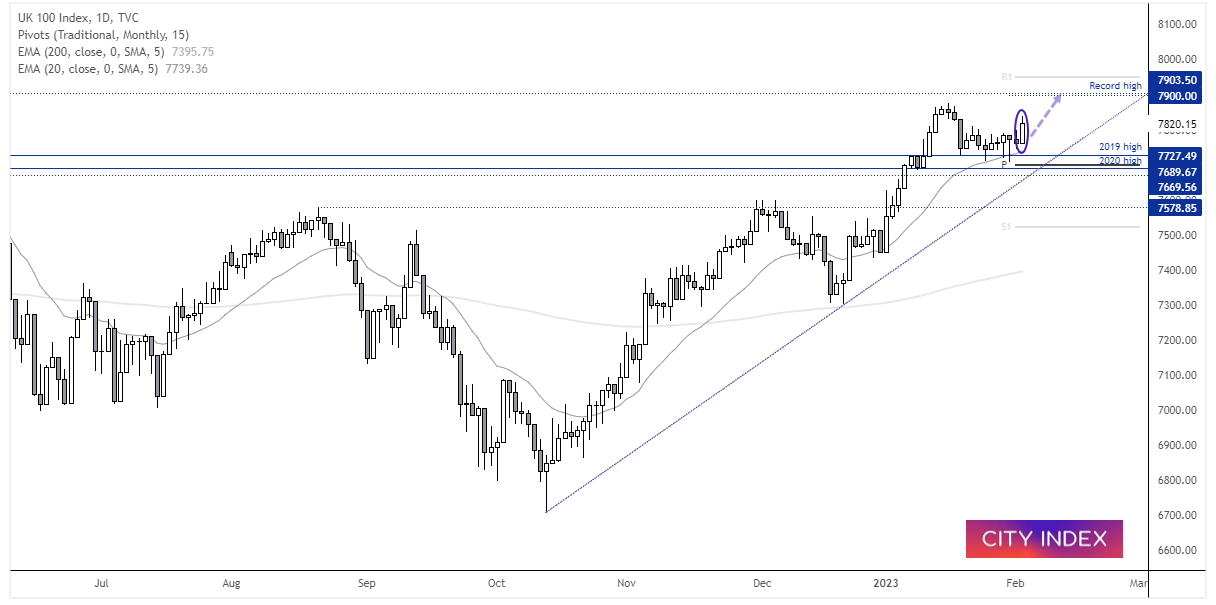

FTSE 100 daily chart:

We have been patiently waiting for momentum to turn higher, which it finally did yesterday thanks to the dovish 50bp BOE hike. It closed above its recent consolidation, having formed several lower spikes which held above historic highs. From here we now fancy a retest of its YTD high and move towards 7900, near its record high.

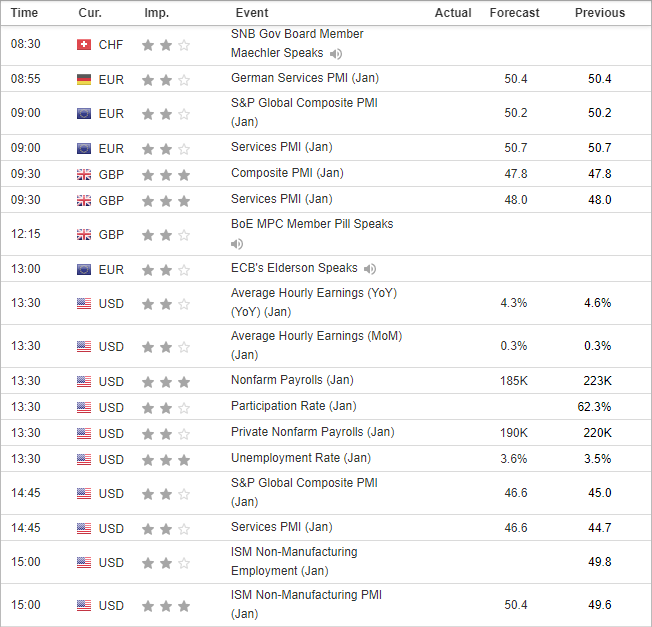

Economic events up next (Times in GMT)

The US economy is expected to have added 188k jobs in January, which would be its lowest level since December 2020. But let’s not lose sight of the fact that job growth was expected to decelerate, and whilst it trends gradually lower the economy is still adding jobs whilst employment remains near historic lows.

Still, the ADP private employment missed estimates of 178k to add just 106k (~60% lower) so we should be prepared for a weak NFP print today. But we’d likely need to see a sub-100 print for it to make a noteworthy reaction, with unemployment also rising to 3.7% or higher.

However, markets may rejoice if we see a particularly soft print from average earnings as this would be deflationary. And that could weigh on the dollar as traders assumes an even less hawkish Fed.

Ultimately, the employment sector has held up relatively well considering the trajectory of rate hike and job openings continue to rise. So I suspect today’s NFP report will remain to be a day-traders event over a macro turning point.