Asian Indices:

- Australia's ASX 200 index fell by -68.2 points (-1.04%) and currently trades at 6,486.80

- Japan's Nikkei 225 index has fallen by -591.48 points (-2.24%) and currently trades at 25,830.57

- Hong Kong's Hang Seng index has fallen by -53.1 points (-0.31%) and currently trades at 17,112.77

- China's A50 Index has fallen by -40.71 points (-0.31%) and currently trades at 12,915.58

UK and Europe:

- UK's FTSE 100 futures are currently down -12 points (-0.17%), the cash market is currently estimated to open at 6,869.59

- Euro STOXX 50 futures are currently down -1 points (-0.03%), the cash market is currently estimated to open at 3,278.04

- Germany's DAX futures are currently down -23 points (-0.19%), the cash market is currently estimated to open at 11,952.55

US Futures:

- DJI futures are currently down -59 points (-0.2%)

- S&P 500 futures are currently down -2.25 points (-0.02%)

- Nasdaq 100 futures are currently down -2.5 points (-0.07%)

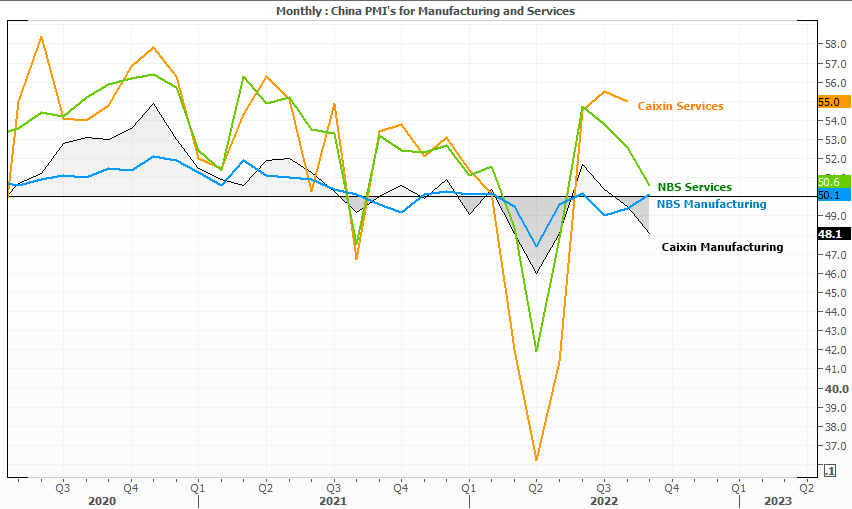

China’s service sector running out of steam

China’s manufacturing sectors expanded at a snail’s pace in September, according to the National Bureau of Statistics (NBS). But it is the first month in three (or second in seven) that the sector hasn’t contracted. Meanwhile the Caixin survey – which is run privately – fell to a 4-month low of 48.1 to show contraction. Furthermore, the NBS services PMI barely expanded at 50.6which shows further deterioration for the world’s second largest economy.

USD/CNH rose comfortably back above 0.7100 after the data, but has since given back around half of the day’s gains. The pair remains within a corrective phase after the dollar began to soften earlier this week, and the PBOC have been vocal about supporting the yuan.

The USD is currently the strongest major currency whilst CAD, AUD and NZD are the weakest.

US inflation is the main focus for traders today

UK GDP is released at 07:00 BST and expected to contract by -0.1% q/q, which would be its first contraction since Q3 2021. And we may need to get used to contracting GDP with the new UK budget being supported by the government despite the market backlash.

German retail sales are likely to contract as expected, given inflation rose 10% y/y versus 9.4% expected yesterday. Inflation and employment data is released for the Euro area at 10:00 and an ECB member speaks at 12:00.

But the main focus for traders is the Fed’s preferred inflation print – core PCE – at 13:30. Core PCE is expected to have risen 0.5% in September, up from 0.1% previously. Any signs of inflation coming in below expectations would be seen as a win, weigh on the dollar and likely support stocks. But if a short EUR/USD stands any chance then the ideal scenario is softer euro inflation coupled with stronger CPI for the US.

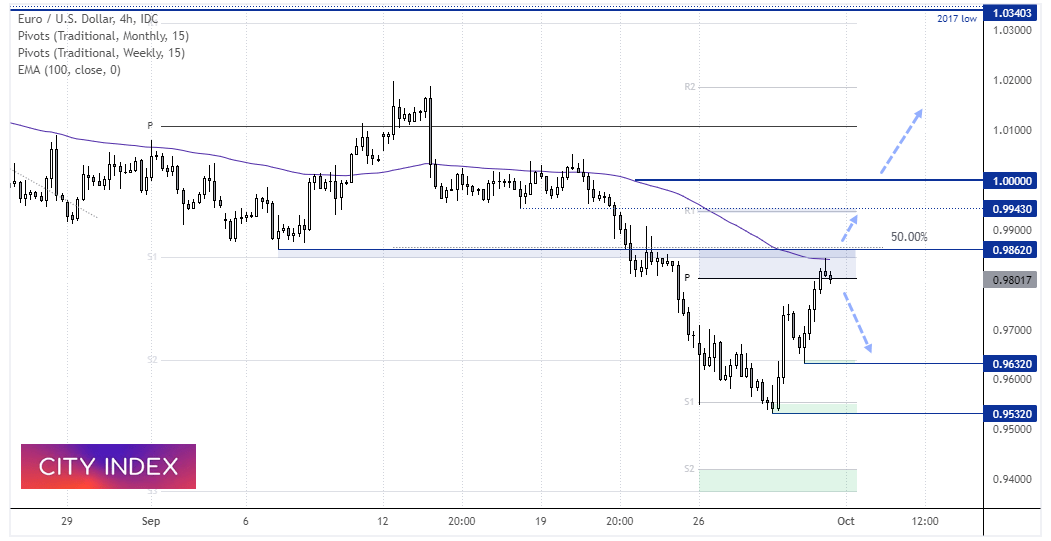

EUR/USD 4-hour chart:

EUR/USD is within a 3-wave retracement against its bearish trend. The rally has found resistance at the Sep 11th low, monthly S1 pivot point, 50% retracement level and 100-bar EMA and a small bearish hammer has formed. So perhaps there is the potential for a swing high develop. To switch to a bearish bias, we would like to see a series of reversal candles or a prominent bearish engulfing/outside candle to assume a swing high. A break above 0.9862 assumes bullish continuation.

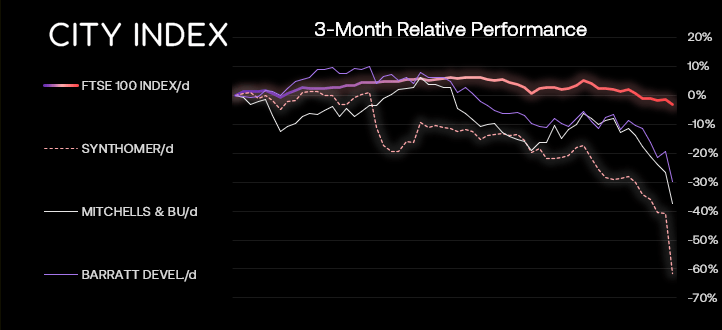

FTSE 350 – Market Internals:

FTSE 350: 3779.32 (-1.77%) 29 September 2022

- 32 (9.12%) stocks advanced and 316 (90.03%) declined

- 1 stocks rose to a new 52-week high, 97 fell to new lows

- 13.68% of stocks closed above their 200-day average

- 78.92% of stocks closed above their 50-day average

- 0% of stocks closed above their 20-day average

Outperformers:

- +9.43% - HICL Infrastructure PLC (HICL.L)

- +3.96% - PureTech Health PLC (PRTC.L)

- +3.05% - Diversified Energy Company PLC (DEC.L)

Underperformers:

- -34.75% - Synthomer PLC (SYNTS.L)

- -14.74% - Mitchells & Butlers PLC (MAB.L)

- -12.76% - Barratt Developments P L C (BDEV.L)

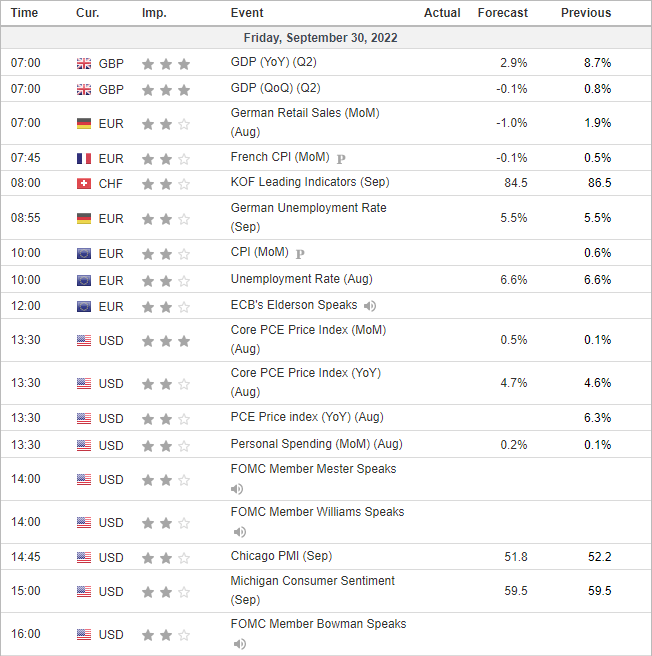

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade