Asian Indices:

- Australia's ASX 200 index fell by -6.9 points (-0.1%) and currently trades at 7,139.40

- Japan's Nikkei 225 index has risen by 36.65 points (0.13%) and currently trades at 28,000.12

- Hong Kong's Hang Seng index has risen by 637.98 points (3.62%) and currently trades at 18,257.69

- China's A50 Index has risen by 142.35 points (1.16%) and currently trades at 12,436.49

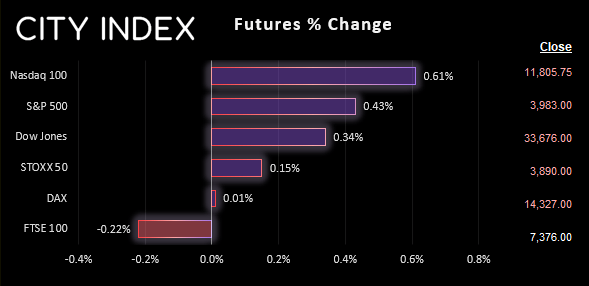

UK and Europe:

- UK's FTSE 100 futures are currently down -16 points (-0.22%), the cash market is currently estimated to open at 7,369.17

- Euro STOXX 50 futures are currently up 6 points (0.15%), the cash market is currently estimated to open at 3,893.51

- Germany's DAX futures are currently up 2 points (0.01%), the cash market is currently estimated to open at 14,315.30

US Futures:

- DJI futures are currently up 117 points (0.35%)

- S&P 500 futures are currently up 71.75 points (0.61%)

- Nasdaq 100 futures are currently up 17 points (0.43%)

Looking across key market reveals an underlying theme; they have all paused at their respective support or resistance levels as the post-CPI moves have fizzled out. This means that most markets are trading within tight consolidation patterns ahead of the European open and could just as easily retrace against last week’s moves as they could continue them.

Mixed data from China saw retail sales, industrial production and fixed asset investment all miss expectations, with retail sales actually contracting by -0.5%, down from 2.5% previously and well below the 1% forecast.

Japan’s growth unexpectedly contracted in Q3 by -0.3%, compared with 1.1% forecast. It is the fourth month of negative over the past seven, with each quarter oscillating between mild expansion and contraction. Yet this is unlikely to spur the BOJ to spring into any action, given they’re still uber-dovish.

The RBA minutes continue to suggest that the RBA will continue to hie in 25bp increment and perhaps even pause their tightening cycle. The debate over a 25 vs a 50bp hike is no longer a ‘finely balanced’ one and the smaller amount made for the stronger case.

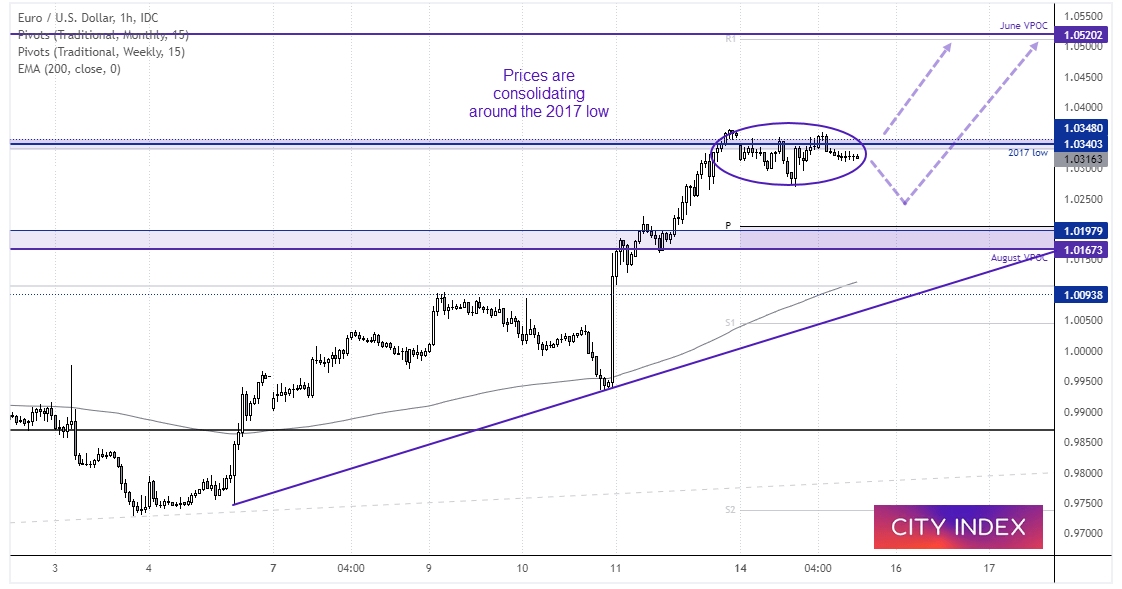

EUR/USD 4-hour chart:

Rising nearly 4% last week – it was the euro’s best week since the pandemic and second best since 2009. And at current levels, EUR/USD is on track for its best week since July 2020. Yet its rally has stalled Just below the August high, which brings the potential for a pullback before it resumes it trend.

The 1-hour chart shows prices are consolidating in its range and just beneath the 2017 low, and could pull back further should US producer pries come in hotter than expected. Yet we’re also equally open to a bullish breakout from a continuation pattern, should producer prices fall lower than expected.

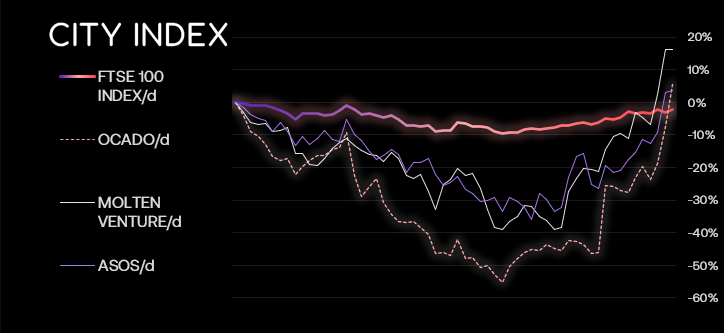

FTSE 350 – Market Internals:

FTSE 350: 4106.8 (0.66%) 14 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 1 stocks rose to a new 52-week high, 1 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 13.99% - Ocado Group PLC (OCDO.L)

- + 5.76% - Informa PLC (INF.L)

- + 5.28% - Carnival PLC (CCL.L)

Underperformers:

- -9.86% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- -9.63% - Harbour Energy PLC (HBR.L)

- -4.42% - Close Brothers Group PLC (CBRO.L)

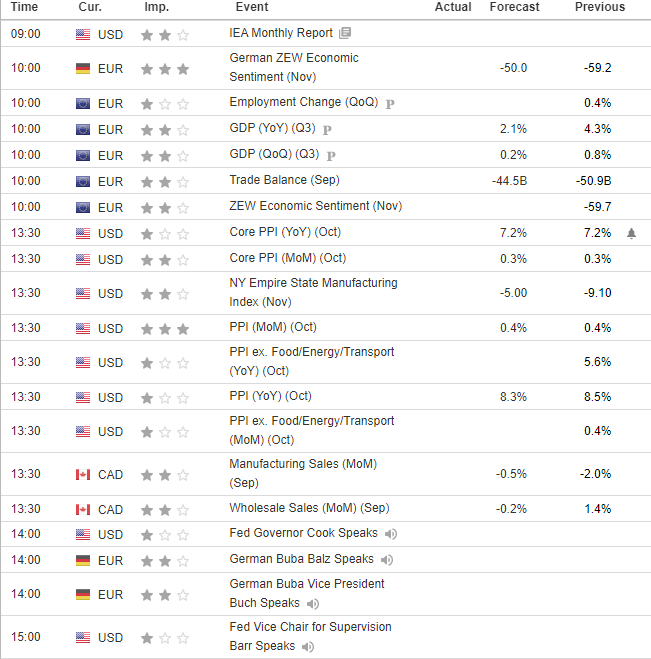

Economic events up next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade