Asian Indices:

- Australia's ASX 200 index fell by -24.5 points (-0.33%) and currently trades at 7,424.20

- Japan's Nikkei 225 index has fallen by -296.39 points (-1.02%) and currently trades at 28,806.24

- Hong Kong's Hang Seng index has fallen by -23.93 points (-0.09%) and currently trades at 25,604.81

- China's A50 Index has fallen by -39.24 points (-0.25%) and currently trades at 15,819.07

UK and Europe:

- UK's FTSE 100 futures are currently up 5.5 points (0.08%), the cash market is currently estimated to open at 7,258.77

- Euro STOXX 50 futures are currently down -0.5 points (-0.01%), the cash market is currently estimated to open at 4,220.38

- Germany's DAX futures are currently down -2 points (-0.01%), the cash market is currently estimated to open at 15,703.81

US Futures:

- DJI futures are currently down -266.19 points (-0.74%)

- S&P 500 futures are currently up 33.25 points (0.21%)

- Nasdaq 100 futures are currently up 8.5 points (0.19%)

Indices

Asian equities remain under selling pressure with Japan’s share markets leading the way lower on weak corporate outlooks. The TOPIX 70 (mega caps) was the weakest performer, down -1.2% with China’s SSE composite a close 2nd. Later in the session, ratings agencies S&P and Fitch downgraded property developer Kaisa as their capital structures are deemed unsustainable.

Futures markets point towards a flat open for the FTSE 100. It may have not extended gains following its bull flag breakout on Tuesday, but the four-hour chart remains in an uptrend and support has ben found at the monthly R1 pivot and last week’s high. We remain bullish above 7180. The STOXX 50 and DAX remain in similar setups, as they produced small inside candles after Tuesday’s range expansion.

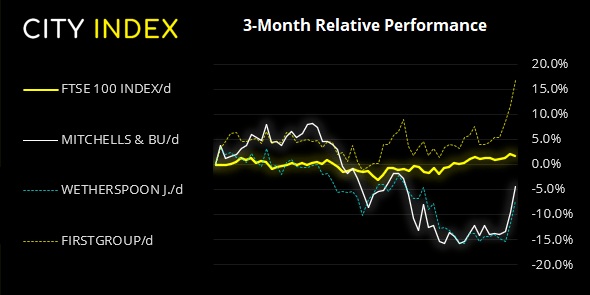

FTSE 350: Market Internals

FTSE 350: 4157.02 (-0.33%) 27 October 2021

- 156 (44.44%) stocks advanced and 173 (49.29%) declined

- 10 stocks rose to a new 52-week high, 3 fell to new lows

- 60.68% of stocks closed above their 200-day average

- 54.99% of stocks closed above their 50-day average

- 25.07% of stocks closed above their 20-day average

Outperformers:

- + 5.68%-Mitchells & Butlers PLC(MAB.L)

- + 5.27%-J D Wetherspoon PLC(JDW.L)

- + 4.52%-FirstGroup PLC(FGP.L)

Underperformers:

- -5.51%-Admiral Group PLC(ADML.L)

- -4.59%-Plus500 Ltd(PLUSP.L)

- -4.38%-Network International Holdings PLC(NETW.L)

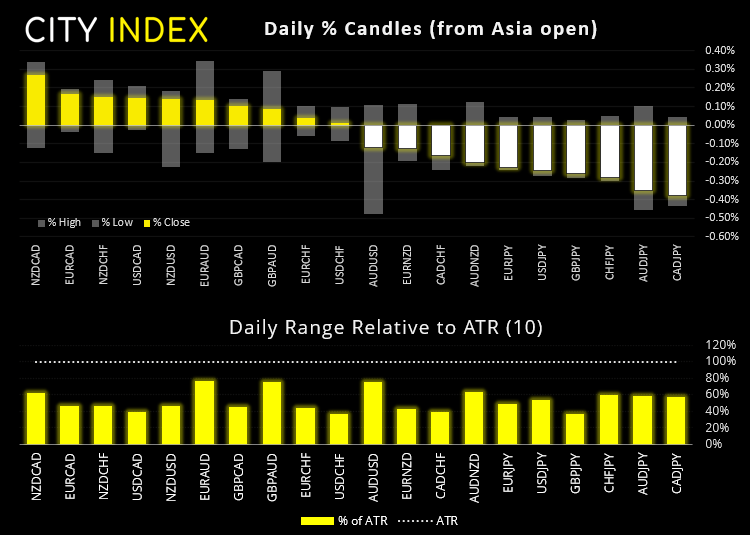

Forex:

BOJ maintained policy with rates at -0.1%, 10-year JGB’s around 10% and corporate bond buying. CPI and growth forecasts were also lowered.

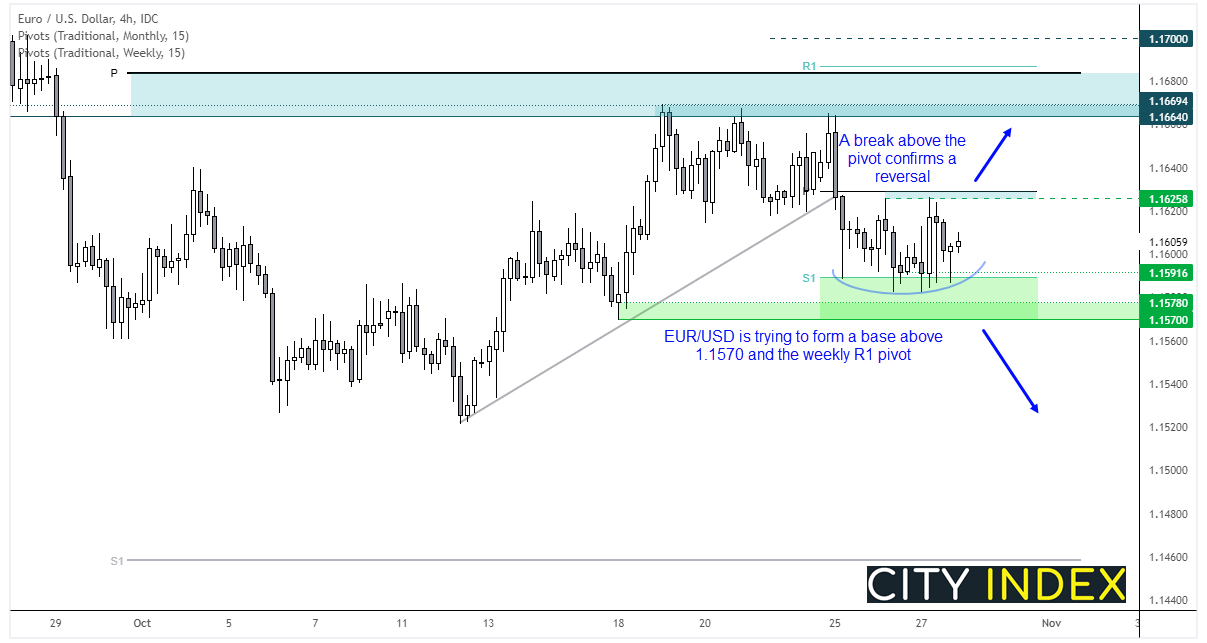

The ECB meeting at 12:45 is the main calendar event for traders today, although it is debatable as to how much ECB will deviate from their script given December is the meeting where new staff forecasts are presented. Sure, inflation is at 13-year high, so they may at least signal some risks to their outlook. And given the euro has been heavily sold in recent weeks against all but the yen, then we may even see the euro pop higher if they disappoint bears.

If we look at EUR/USD, there’s no shortage of support level above 1.1570. The decline from the 1.1670 high lacks conviction the four-hour chart has remained above the weekly S1 pivot level. A small bullish pinbar also formed recently with a slightly higher low, so there are some buyers around these lows.

Ultimately, we need to see a break above 1.1625 for a bullish follow-though and to confirm the recent consolidation as a basing pattern, which would then bring the highs around 1.1670 into focus. Yet for us to prefer bearish sets we’d like to see a break below 1.1570.

US Advanced GDP is also released at 13:30 BST along with unemployment claims, and most estimates place softer growth in Q3 given the ‘great reopening’ has long passed and bottlenecks remain stubbornly in the supply chain. But if we see a particularly weak print then it undermines the recovery somewhat, although we doubt it will prevent the Fed from announcing tapering at their next meeting. It could help lift EUR/USD though.

Commodities:

Silver failed to push materially lower yesterday, although its high did come in around the daily resistance zone we mentioned in yesterday’s video. As prices are coiling up above trend support (with some wriggle room to the downside) but having printed a lower high, it feels like a flip of a coin as to which way it may break.

Gold has probed trend resistance overnight and appears to be the more bullish of the two metals. A swing low has likely formed just above 1780 and a higher low has formed on the 1-hour chart. A weaker US dollar could help this move higher today.

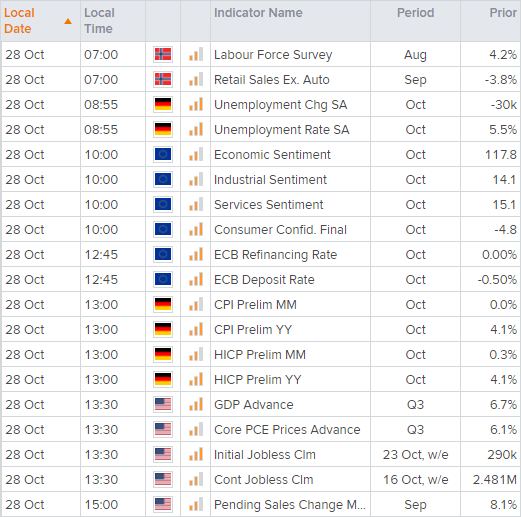

Up Next (Times in BST)

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade