Asian Indices:

- Australia's ASX 200 index rose by 34.3 points (0.46%) and currently trades at 7,428.20

- Japan's Nikkei 225 index has risen by 215.28 points (0.77%) and currently trades at 28,339.56

- Hong Kong's Hang Seng index has fallen by -143.21 points (-0.59%) and currently trades at 24,240.11

- China's A50 Index has risen by 90.63 points (0.6%) and currently trades at 15,154.83

UK and Europe:

- UK's FTSE 100 futures are currently down -3 points (-0.04%), the cash market is currently estimated to open at 7,539.95

- Euro STOXX 50 futures are currently up 14 points (0.33%), the cash market is currently estimated to open at 4,286.19

- Germany's DAX futures are currently up 61 points (0.38%), the cash market is currently estimated to open at 15,944.24

US Futures:

- DJI futures are currently down -50 points (-0.14%)

- S&P 500 futures are currently down -60.5 points (-0.39%)

- Nasdaq 100 futures are currently down -9.25 points (-0.2%)

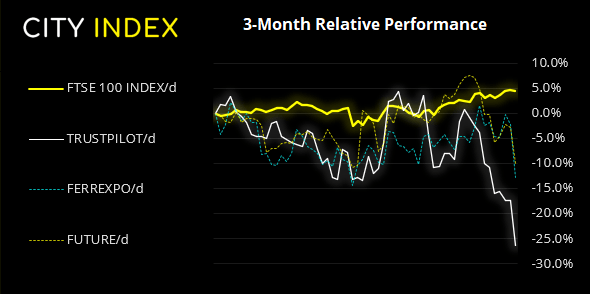

FTSE 350: Market Internals

FTSE 350: 4280.34 (-0.28%) 14 January 2022

- 104 (29.55%) stocks advanced and 235 (66.76%) declined

- 17 stocks rose to a new 52-week high, 22 fell to new lows

- 49.15% of stocks closed above their 200-day average

- 44.03% of stocks closed above their 50-day average

- 18.75% of stocks closed above their 20-day average

Outperformers:

- + 8.02% - Countryside Properties PLC (CSPC.L)

- + 5.77% - NCC Group PLC (NCCG.L)

- + 4.02% - Cineworld Group PLC (CINE.L)

Underperformers:

- -10.9%-Trustpilot Group PLC (TRST.L)

- -10.7%-Ferrexpo PLC (FXPO.L)

- -7.34%-Future PLC (FUTR.L)

FTSE 100 trading guide>

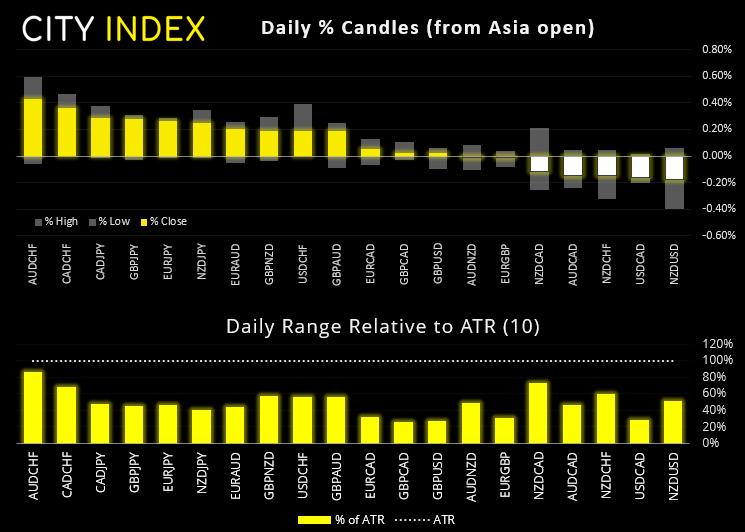

China’s GDP not as soft as expected

Trading ranges were very narrow for currencies overnight despite the data dump from China. Forecasts for China’s Q4 GDP landed around 3.3%, yet the world’s second largest economy grew by 4% y/y according to today’s report. Sure, it’s lower than Q3’s 4.9% yet significantly above scant expectations. Therefore it’s not as good as it was, but not as bad as it could have been. Interestingly, PBOC (People’s Bank of China) provided some stimulus an hour before the report came out and injected around 700 billion yuan of liquidity via their 1-year MLF and cut rates on policy loans for the first time since April 2020.

USD/CNH is back below 6.3500, a level which it has so far failed to hold beneath for very long. The China A50 is up around 0.6%. The US dollar index is currently flat for the session. The British pound is slightly higher against all majors except the Canadian dollar. Trading volumes will be lower than usual after lunch today due to the 3-day weekend in the US.

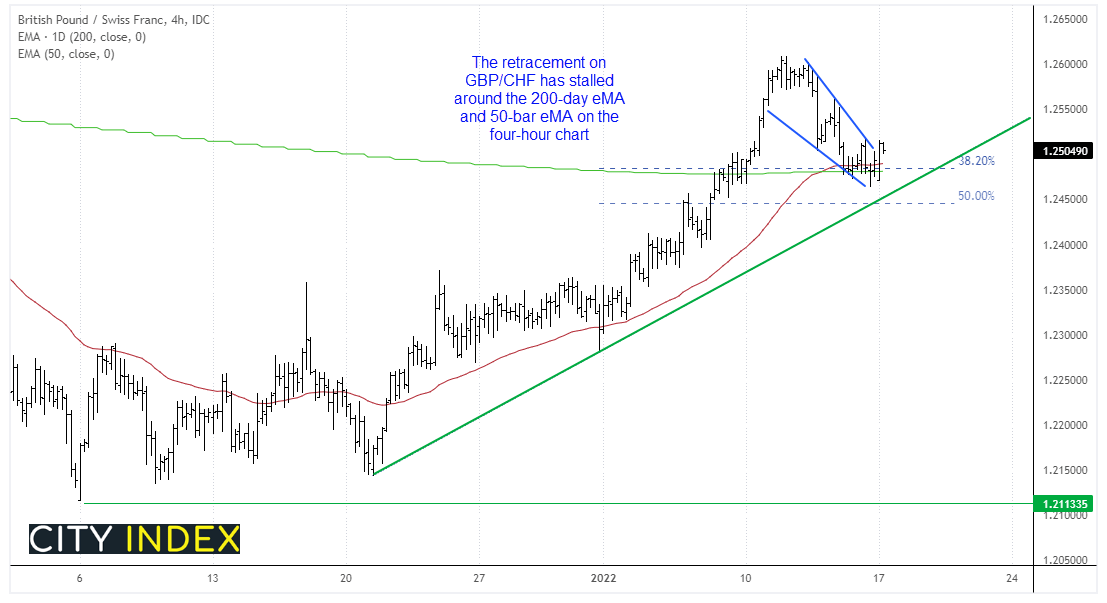

GBP/CHF: Correction complete?

We’ve identified a strong trend on the GBP/CHF four-hour chart, although it has been within a corrective phase since its rally stalled around 1.2600. However, it is holding above trend support and the 38.2% Fibonacci level. Furthermore, bearish momentum has been waning and it is trying to form a trough around the 200-day eMA and 50-bar eMA on the four-hour chart. A break above Friday’s high confirms Friday’s candle as a Spinning Top (reversal) candle. Should this materalise then bulls could maintain a bullish bias either above the recent swing lows, or along the trendline.

Guide to Pound sterling

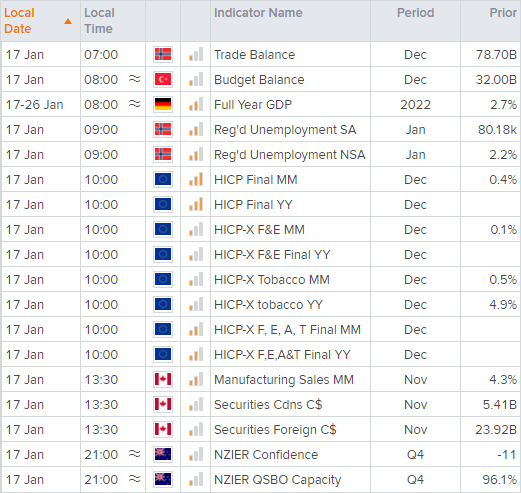

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade