Asian Indices:

- Australia's ASX 200 index rose by 27.8 points (0.38%) and currently trades at 7,281.10

- Japan's Nikkei 225 index has risen by -95.63 points (0.34%) and currently trades at 27,932.21

- Hong Kong's Hang Seng index has risen by 40.36 points (0.22%) and currently trades at 18,245.04

- China's A50 Index has risen by 39.71 points (0.32%) and currently trades at 12,597.29

UK and Europe:

- UK's FTSE 100 futures are currently up 24.5 points (0.33%), the cash market is currently estimated to open at 7,536.50

- Euro STOXX 50 futures are currently up 20 points (0.51%), the cash market is currently estimated to open at 3,954.44

- Germany's DAX futures are currently up 79 points (0.55%), the cash market is currently estimated to open at 14,434.45

US Futures:

- DJI futures are currently up 40 points (0.12%)

- S&P 500 futures are currently up 14.25 points (0.12%)

- Nasdaq 100 futures are currently up 5.5 points (0.14%)

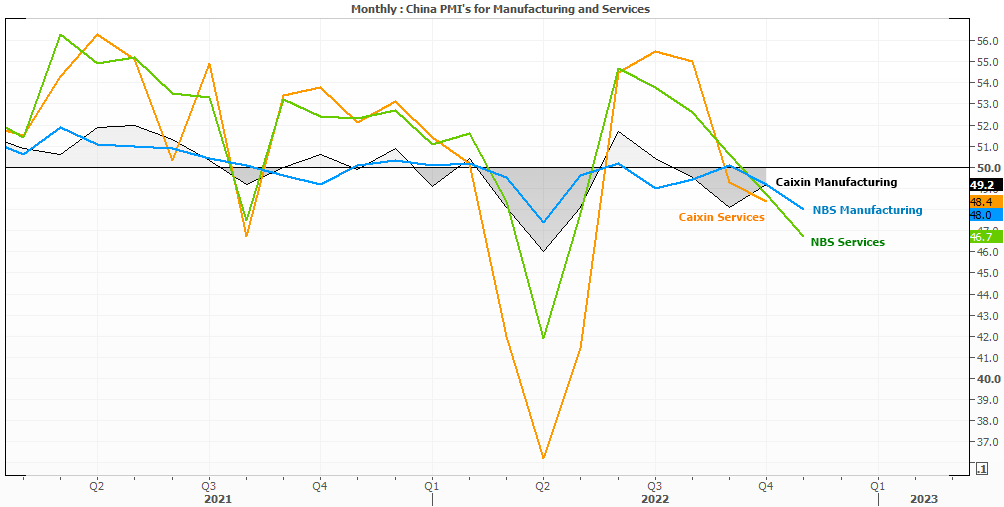

Official government data showed that China’s manufacturing and service PMI’s contracted for a second consecutive month and at a faster pace. Manufacturing fell to its lowest level since April 2022 at 48, and services down to 46.7. There was a time this would have sent rippled across markets, but not today. The Aussie and Kiwi dollars are the strongest majors and commodities are mostly higher as markets are paying more attention to the potential for China to reopen, over the current bottlenecks brought on by lockdowns.

Australian inflation hints at a peak

The new monthly inflation gauge came in below expectations at 6.9% y/y, with its fall from 7.4% suggesting the peak rate may be in. Of course, we’ll need more than one data point but it is a step in the right direction, and one which the RBA will be pleased be. It’s the last inflation report until January and brings the potential for the RBA to pause in December and reassess in February.

US GDP and Powell speech in focus

With US GDP data being the second release, it is unlikely to be much of a market mover without a significant revision. Jerome Powel is set to speak at 18:30 GMT on the economy and labour market, which leaves far more potential for a volatile reaction. We have seen the Fed retain a hawkish stance since US inflation moved lower and dragged the US dollar down with it. So there is a decent chance he’ll extend this hawkish rhetoric, and potentially support and oversold dollar.

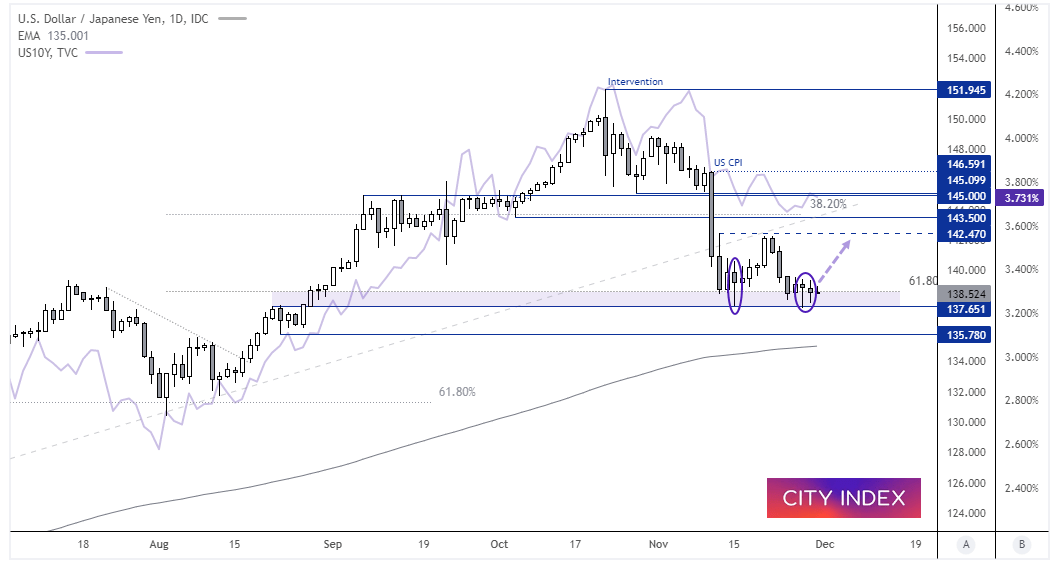

USD/JPY daily chart:

USD/JPY has formed a double bottom around 137.65, a level which has now seen a two bullish hammers and a doji form at near a suspected swing low. The US10Y yield is moving higher and its retracement from its own high is relatively shallow compared with USD/JPY. Given the hawkish rhetoric of Fed members and likelihood of hawkish comments from Powell tonight, I’m looking for USD/JPY to break higher to the 142 area – initially at least.

FTSE 350 market internals:

FTSE 350: 4152.78 (0.66%) 29 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 4 stocks rose to a new 52-week high, 1 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

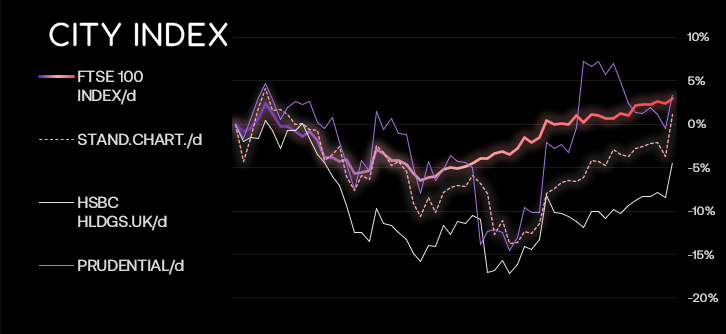

Outperformers:

- + 5.04% - Standard Chartered PLC (STAN.L)

- + 4.44% - HSBC Holdings PLC (HSBA.L)

- + 3.92% - Prudential PLC (PRU.L)

Underperformers:

- -15.94% - John Wood Group PLC (WG.L)

- -10.06% - Petrofac Ltd (PFC.L)

- -8.41% - Renishaw PLC (RSW.L)

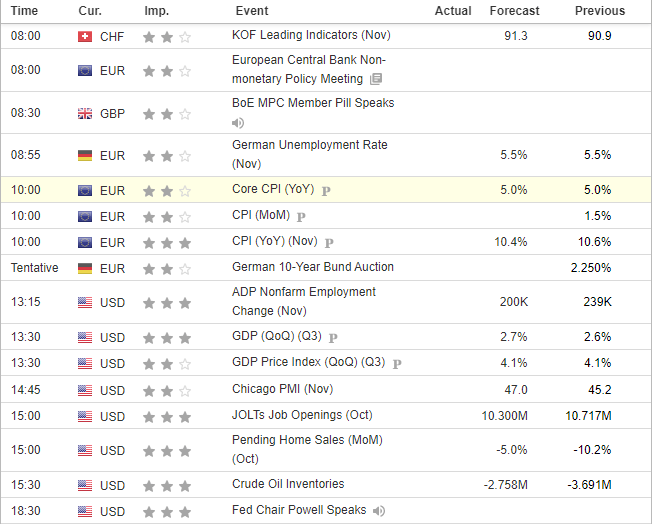

Economic events up next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade