Asian Indices:

- Australia's ASX 200 index fell by -96.3 points (-1.38%) and currently trades at 6,898.50

- Japan's Nikkei 225 index has fallen by -360.97 points (-1.34%) and currently trades at 26,972.82

- Hong Kong's Hang Seng index has fallen by -534.15 points (-2.74%) and currently trades at 18,984.44

- China's A50 Index has fallen by -28.09 points (-0.22%) and currently trades at 12,866.03

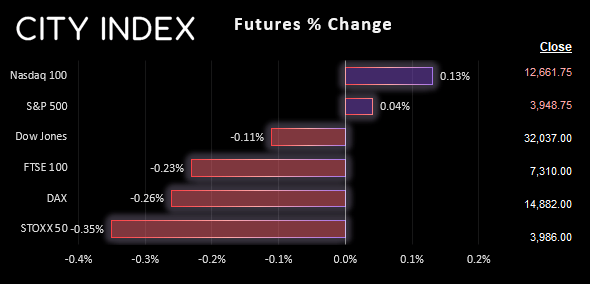

UK and Europe:

- UK's FTSE 100 futures are currently down -16.5 points (-0.23%), the cash market is currently estimated to open at 7,318.90

- Euro STOXX 50 futures are currently down -11 points (-0.28%), the cash market is currently estimated to open at 4,053.99

- Germany's DAX futures are currently down -35 points (-0.23%), the cash market is currently estimated to open at 14,733.20

US Futures:

- DJI futures are currently down -30 points (-0.09%)

- S&P 500 futures are currently up 2.25 points (0.06%)

- Nasdaq 100 futures are currently up 16 points (0.13%)

- It has been a quiet session overnight, as traders wait to see how Europe reacts to the weekend’s headlines

- The Fed, ECB, BOJ, SNB, BOE and BOC have coordinated action to boost liquidity via their standing swap arrangements to support financial stability

- UBS agreed to purchase Credit Suisse for Fr 3 billion in a government-backed deal, with the SNB (Siss National Bank) expected to inject around 100 billion and the Swiss federal government agreeing up to $9 billion loss guarantee

- The beginning of the Asian session saw commodity FX (AUD and CAD) lead the way higher with a mild risk-on vibe, yet these early gains were handed back and currency majors are effectively flat for the day

- The ASX 200 probed jet support around 6900 and briefly touched a year-to-day low, whilst the Hang Send fell to its lowest level since December 20th

- Wall Street and European index futures are effectively flat, which points to an uneventful open

- The US 2-year trades above Friday’s low but failed to hold onto an earlier break above the 200-day MA and 4%

- Gold has also pulled back from its 11-month high of $1990.75, which leaves the potential for a retracement towards the $1960 high – but it is clear that investors are not yet ready to dump the safe-haven metal and may well have another crack at $2000

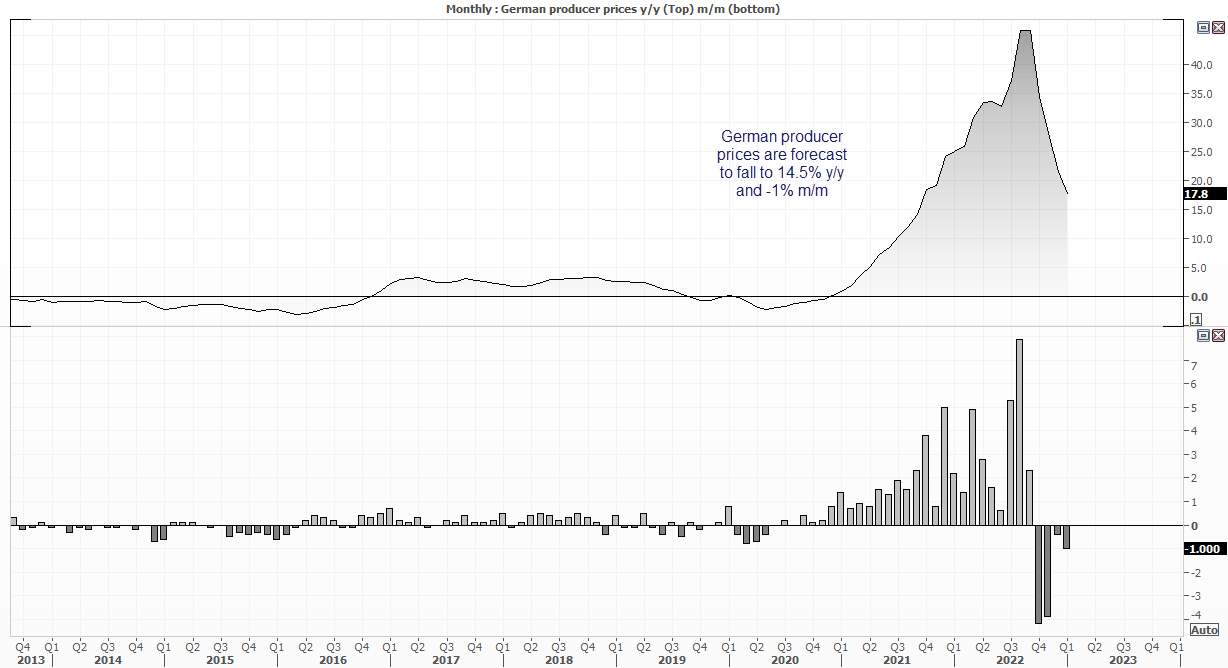

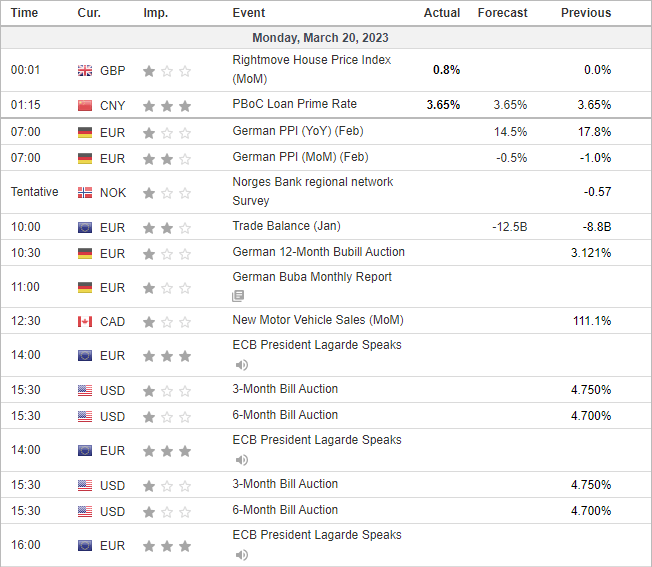

Whilst there’s no top tier economic data scheduled today, German producer prices warrants a look at 07:00 GMT. It is fair to say that it peaked at a whopping 45.8% in August, and has spent the past four months disinflating (growing at a slower pace). But a fifth consecutive month of lower PPI is encouraging, even if it remains historically high. SO for a meaningful market reaction, we’ll either need to see it fall beneath the consensus of 14.5% y/y or -0.5% m/m.

The monthly Bundesbank report is out at 11:00 GMT. February’s report highlighted that economic activity was somewhat brighter, whilst inflationary pressures persisted. Perhaps they will shed some light on what, if any, impact the failure of SVB, Signature Bank and Credit Suisse could have the economic outlook.

Christine Lagarde speaks three times today, at 11:00, 14:00 and 16:00 GMT, although we suspect she’ll keep her cards close to her chest regarding any monetary policy clues given the lack of clarity the ECB delivered for forward guidance at last week’s meeting.

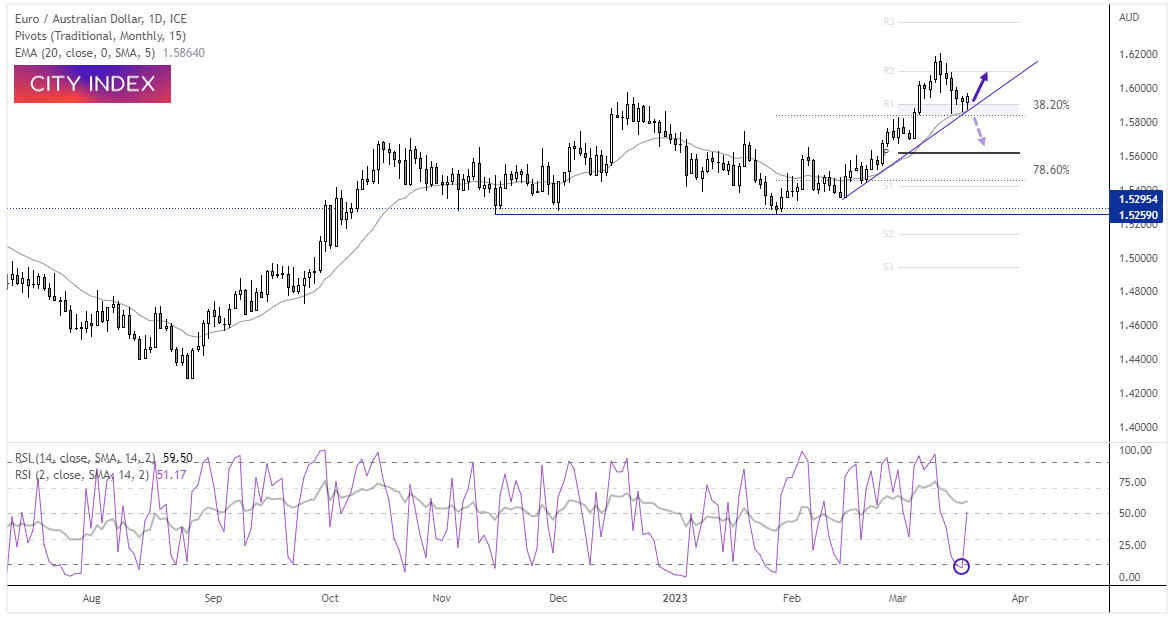

EUR/AUD daily chart:

EUR/AUD ha caught my eye purely on a technical front, as it is trying to snap a 5-day losing streak and carve out a swing low around a support cluster. Last week’s low respected a 38.2% Fibonacci ratio, trend support and the daily closes held above the monthly R1 pivot. Should prices hold above last week’s low the bias is for a move towards the monthly R1 pivot around 1.6100. Given the uncertainty with market sentiment at the moment, we’re not looking for oversized moves, and equally open to a deeper retracement, with a break beneath trend support / last week’s low.

Economic events up next (Times in GMT)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade