Asian Indices:

- Australia's ASX 200 index rose by 60 points (0.86%) and currently trades at 7,068.90

- Japan's Nikkei 225 index has fallen by -81.52 points (-0.3%) and currently trades at 27,140.52

- Hong Kong's Hang Seng index has risen by 248.14 points (1.29%) and currently trades at 19,496.10

- China's A50 Index has risen by 14.63 points (0.11%) and currently trades at 13,010.20

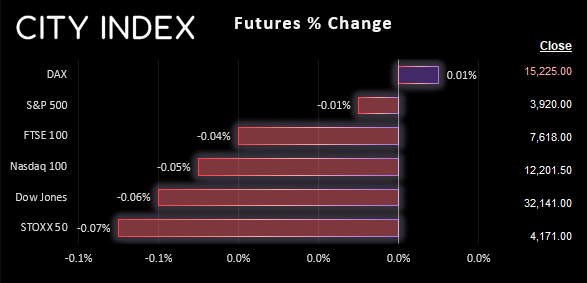

UK and Europe:

- UK's FTSE 100 futures are currently down -3 points (-0.04%), the cash market is currently estimated to open at 7,634.11

- Euro STOXX 50 futures are currently down -2 points (-0.05%), the cash market is currently estimated to open at 4,177.47

- Germany's DAX futures are currently up 1 points (0.01%), the cash market is currently estimated to open at 15,233.83

US Futures:

- DJI futures are currently down -20 points (-0.06%)

- S&P 500 futures are currently down -0.25 points (-0.01%)

- Nasdaq 100 futures are currently down -4.25 points (-0.03%)

The BOJ’s minutes of the meeting from January revealed that members discussed the feasibility of making further tweaks to its yield curve control.

If you cast your mind back to early January, you may remember the out-of-meeting policy change the BOJ dropped by expanding their YCC band from +/- 0.25% to 0.5%. This sent shockwaves across currency and bond markets on the anticipation that they would scrap YCC altogether.

Today we learned the BOJ did in fact discuss various way of tweaking the band, but opted to err on the side of caution as changing it ‘so soon after the previous modification’ could make future policy guidance ‘unclear’. Which is odd when you think about it, given they completely caught low-liquidity markets off guard with their out-of-meeting change to that very policy.

Still, it’s interesting that they discussed curbing yields across the entire curve, as it’s a scenario few (if any) are prepared for. And it really hammers home just how dovish they intend to be, for quite some time.

But ultimately, the central bank want to take their time examining the effects of future changes and, as the incoming Governor gave nothing but dovish remarks, we’ll not hold our breath for a change soon (but understand they may just do one anyway, seemingly randomly).

- Sentiment was given a little boost on slightly stronger-than-expected China data

- Whilst the numbers do not set the world alight, in context of a poor start to the week it was enough to weaken the yen and USD against AUD, EUR and GBP

- Ratings agency S&P Global warned that New Zealand’s credit rating could be lost if their balance of trade does not improve

- Business sentiment in Australia is cooling according to a Westpac survey, with slower new orders and an economy that is close to full capacity (which plays further into the potential for the RBA to pause in April)

- As for these alleged ‘drone wars’… the US military has claimed that one of its spy drones was forced to crash into the black sea when a Russian fighter jet clipped its propeller

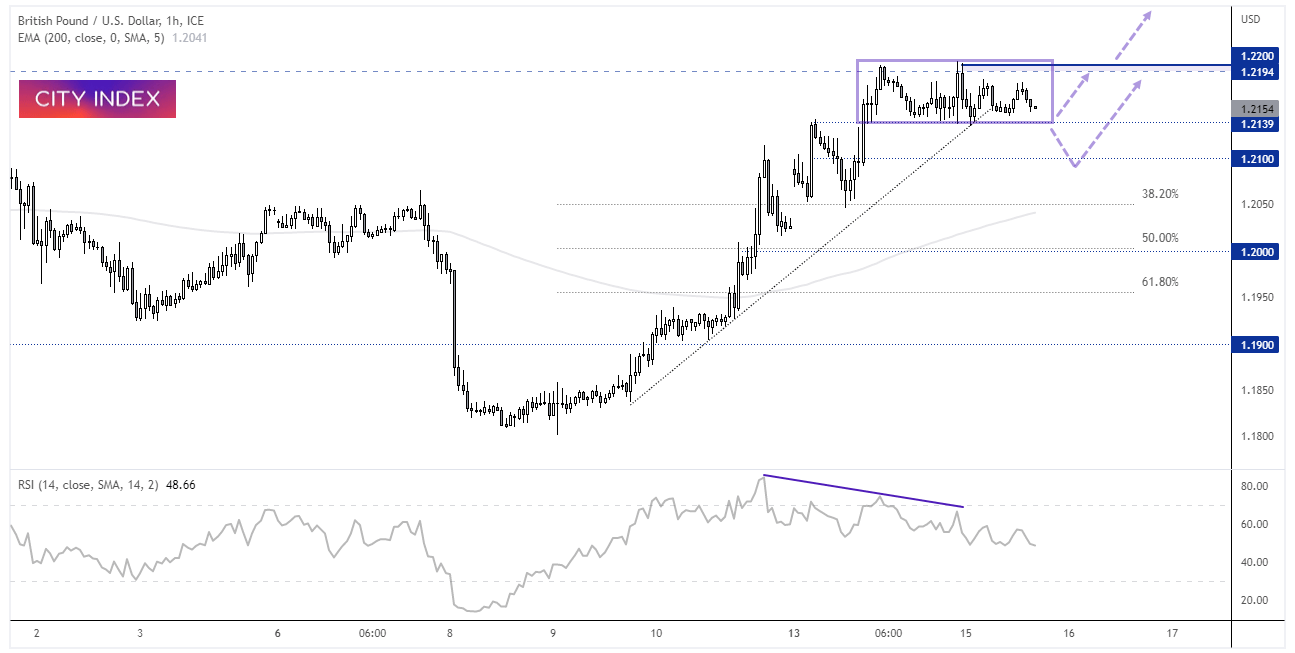

GBP/USD 1-hour chart:

GBP/USD has performed a strong rally into the 1.2200 handle and is now consolidating within a sideways range. The strength of the rally into resistance likely favours an eventual breakout above 1.2200, but we’re conscious that the 4-hour RSI reached overbought and is now pointing lower, and a bearish divergence has formed on the 1-hour timeframe.

Whilst prices remain above 1.2140, range-trading strategies could be considered. Whereas a break beneath these lows assumes a correction is underway, and 1.2100 and 1.2050 come into focus for a potential corrective low. A break above 1.2000 assumes bullish continuation.

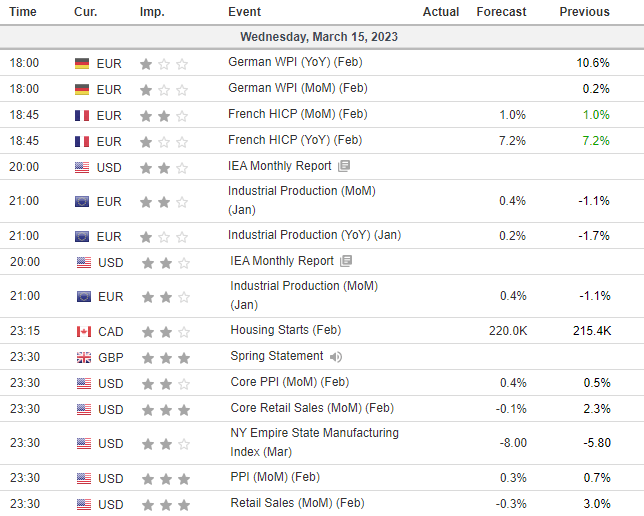

Economic events up next (Times in GMT)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade