Asian Indices:

- Australia's ASX 200 index fell by -0.1 points (0%) and currently trades at 7,258.30

- Japan's Nikkei 225 index has risen by 42.38 points (0.15%) and currently trades at 27,487.94

- Hong Kong's Hang Seng index has risen by 666.01 points (3.37%) and currently trades at 20,451.95

- China's A50 Index has risen by 190.83 points (1.43%) and currently trades at 13,581.34

UK and Europe:

- UK's FTSE 100 futures are currently up 14 points (0.18%), the cash market is currently estimated to open at 7,890.28

- Euro STOXX 50 futures are currently up 1 points (0.02%), the cash market is currently estimated to open at 4,239.38

- Germany's DAX futures are currently up 13 points (0.08%), the cash market is currently estimated to open at 15,378.14

US Futures:

- DJI futures are currently up 14 points (0.04%)

- S&P 500 futures are currently down 0 points (0%)

- Nasdaq 100 futures are currently down -2.75 points (-0.02%)

The RBA will be pleased to see that GDP and inflation data came in soft today, even if the latter remains highly elevated. The Australian economy grew just 0.5% in Q4, or 2.7% y/y – which is right on their December growth target. Of particular interest is to see the household savings ratio fall to a 4-year low of 4.5% q/q.

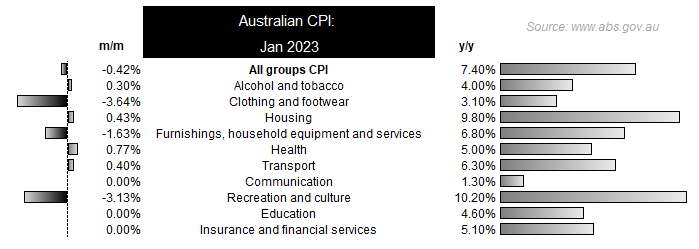

CPI data came in at 7.4% y/y, much less than the 8.1% forecast and 8.4% prior – but it is by a wide enough margin to tease the thought that inflation may have peaked. But it’s not coming down fast enough to say the RBA will not hike for at least two more meetings, given it remains more than twice their 2-3% target range. Still, it’s a start.

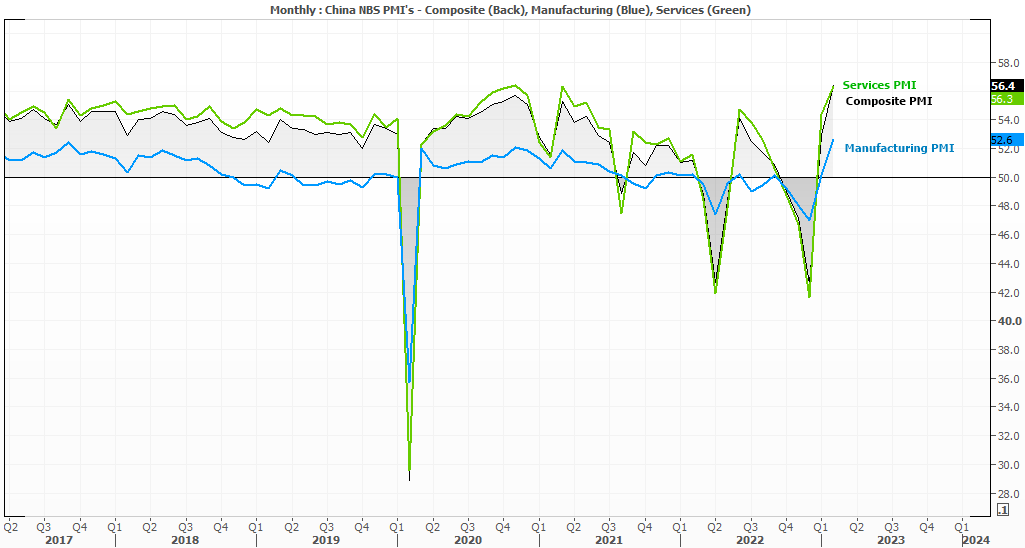

- China’s PMI’s beat expectations and expanded in February as the economy began to feel the benefits of its reopening

- According to official government statistics data, manufacturing PMI rose to a 10-year high of 52.6 and a separate private read shows expansive activity for the first time in seven months

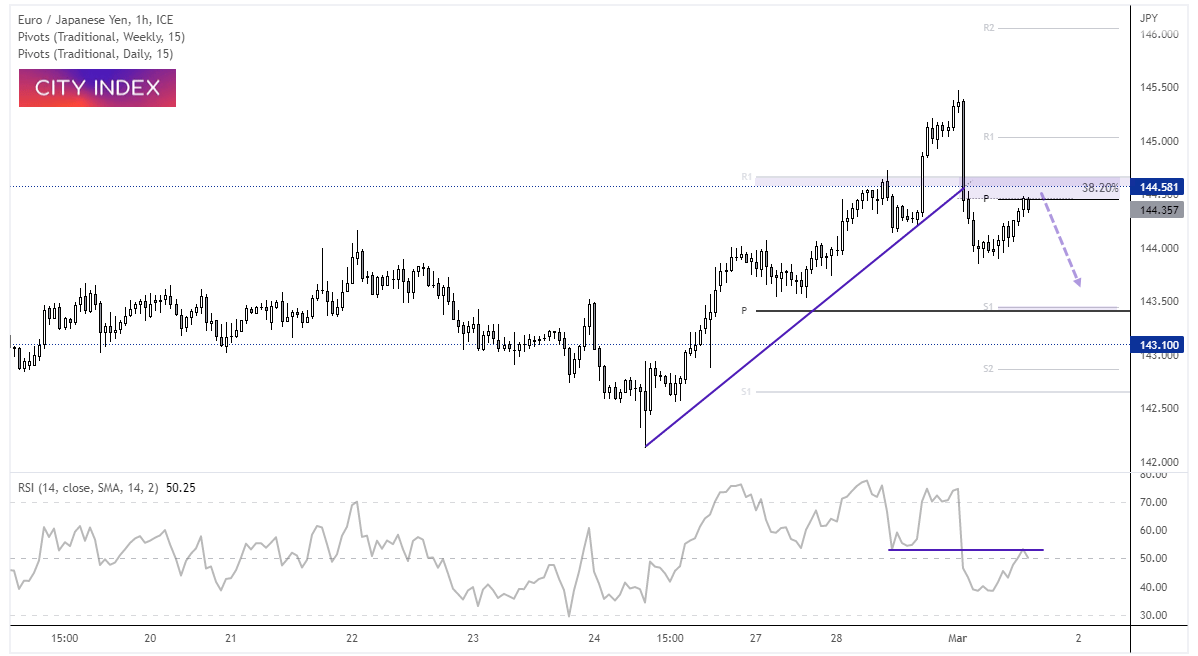

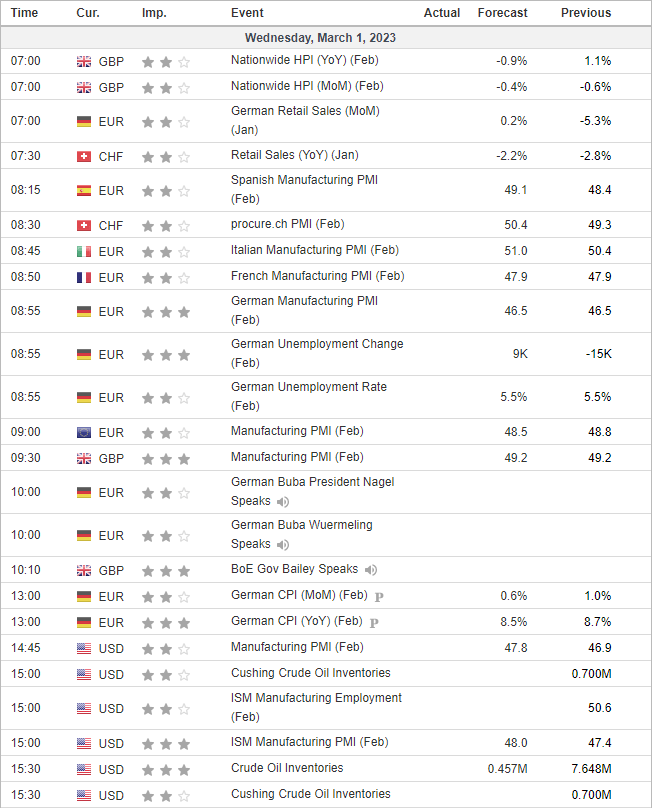

- A host of regional CPI figures for Germany a released between 07:30 to 09:00 GMT, which could prompt further buying for the euro if they came in hot (like Spanish and French PMI did yesterday

- Yet a weak data set could help push EUR/JPY lower again, in line with our daily bias

- BOE governor Andrew Bailey speaks at 10:10 GMT at the Cost of Living Crisis Conference organised by the Brunswick Group, hosted at Coin Street Social Enterprise, London

- Fed member Christopher Waller provides his economic outlook at 21:00 GMT

- ISM manufacturing data is at 15:00 today, and if it contracts at a faster pace and shows lower ‘prices paid’, it could further weigh on the US on bets of a lower terminal Fed rate

EUR/JPY 1-hour chart:

A bout of risk-off saw EUR/JPY fall sharply from its highs yesterday and break trend support on the 1-hour chart. Given prices have retraced just under half of yesterday’s losses and is headed for a resistance zone, were now looking for a swing high and move down towards the daily S1 pivot. At the time of writing, the pair is trying to form a bearish engulfing candle around the daily pivot point, weekly R1 and 144.58 high. And a weak set of inflation reports from Germany could potentially help send it lower.

Economic events up next (Times in GMT)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade