Asian Indices:

- Australia's ASX 200 index rose by 4.3 points (0.06%) and currently trades at 7,519.20

- Japan's Nikkei 225 index has fallen by -282.34 points (-0.77%) and currently trades at 36,235.23

- Hong Kong's Hang Seng index has risen by 231.67 points (1.51%) and currently trades at 15,585.65

- China's A50 Index has risen by 39.2 points (0.36%) and currently trades at 11,009.26

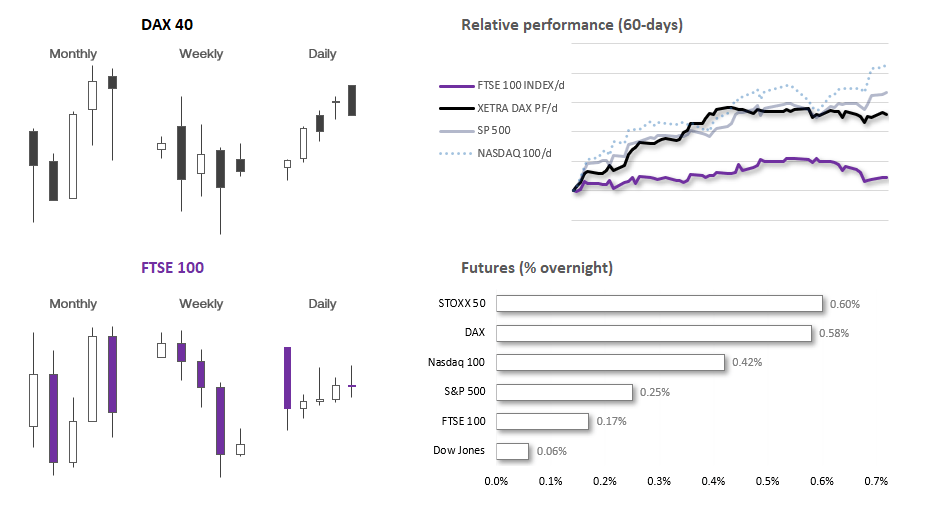

UK and European indices:

- UK's FTSE 100 futures are currently up 14 points (0.19%), the cash market is currently estimated to open at 7,499.73

- Euro STOXX 50 futures are currently up 27 points (0.6%), the cash market is currently estimated to open at 4,492.91

- Germany's DAX futures are currently up 100 points (0.6%), the cash market is currently estimated to open at 16,727.09

US index futures:

- DJI futures are currently up 24 points (0.06%)

- S&P 500 futures are currently up 12.5 points (0.26%)

- Nasdaq 100 futures are currently up 74.25 points (0.42%)

Events in focus (GMT):

- 08:15 – French flash PMIs (manufacturing, services, composite)

- 08:30 – Germany flash PMIs (manufacturing, services, composite)

- 09:00 – Eurozone flash PMIs (manufacturing, services, composite)

- 09:30 – UK flash PMIs (manufacturing, services, composite)

- 14:45 – US flash PMIs (manufacturing, services, composite)

- 15:00 – BOC interest rate decision (looking for dovish clues)

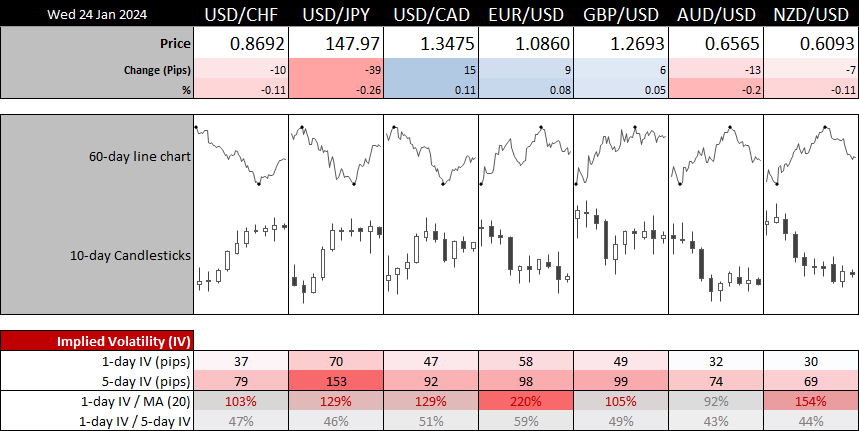

S&P global release their flash PMI reports for the major regions today. So far we have seen quite a mix amongst PMI reports in Asia, with New Zealand manufacturing souring, manufacturing for Australia expand and above expectations, yet contract in Japan whilst their services surprised to the upside with an expansion. With no clear pattern from Asia, we’re hoping for some cleaner data sets from Europe and the US. Currency traders will like to see a divergence between regions; such as weak PMI data for Europe and strong from the US for bearish EUR/USD bets (or bullish on the US dollar). And if UK data were to disappoint, it could see GBP/JPY pull back further from its highs after failing to break the December 2015 high yesterday.

The Bank of Canada are highly likely to hold their rates at 5% for a fourth consecutive meeting, with no immediate case for any hikes and a growing case for their first cut. Their last statement noted that there is “growing evidence that past interest rate increases are dampening economic activity and relieving price pressures”, so focus will shift straight to the statement to see if it delivers a similar tone. However, also note that their quarterly monetary policy report will be released which includes their updated forecasts for growth an inflation, which itself can provide guidance on if or when they may begin easing rates.

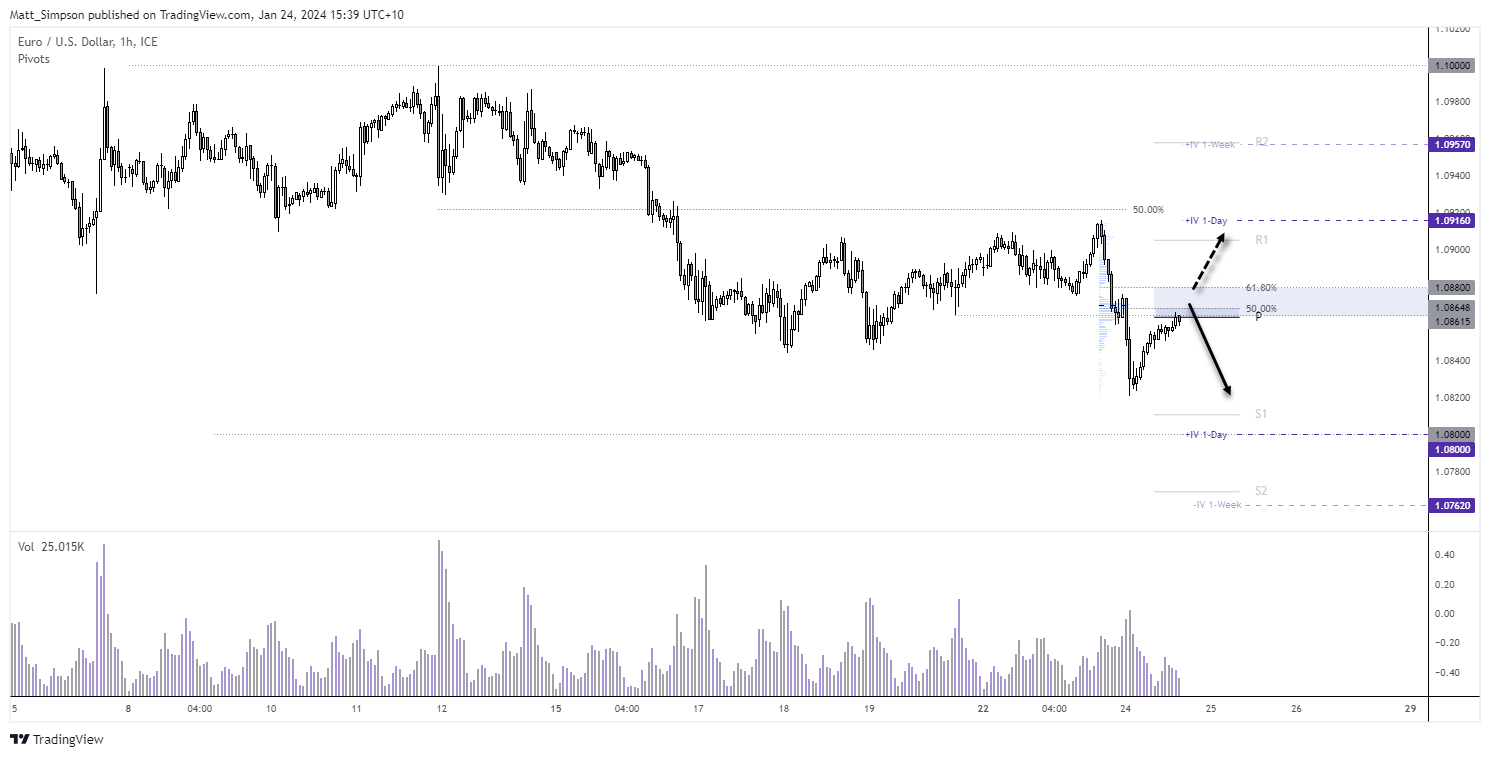

EUR/USD technical analysis (1-hour chart):

The euro if suffering from the same chart noise as the US dollar index; current price action on the daily chart is surrounded by 50 and 200-day averages and EMAs. Still, EUR/USD has retraced around 50% of Tuesday’s decline, and prices are now meandering around the weekly pivot point and prior cycle lows. There’s also a high-volume node (HVN) just above the 50% retracement level which could well attract prices, so I’m on guard for a spike or two higher before momentum turns lower.

Ultimately, I am bullish on the US dollar so seeking short opportunities on EUR/USD. A weak PMI report form Europe and strong data from the US could do wonders for that bias. Bears could seek to fade into resistance levels with a stop above. In anticipation of an eventual leg lower.

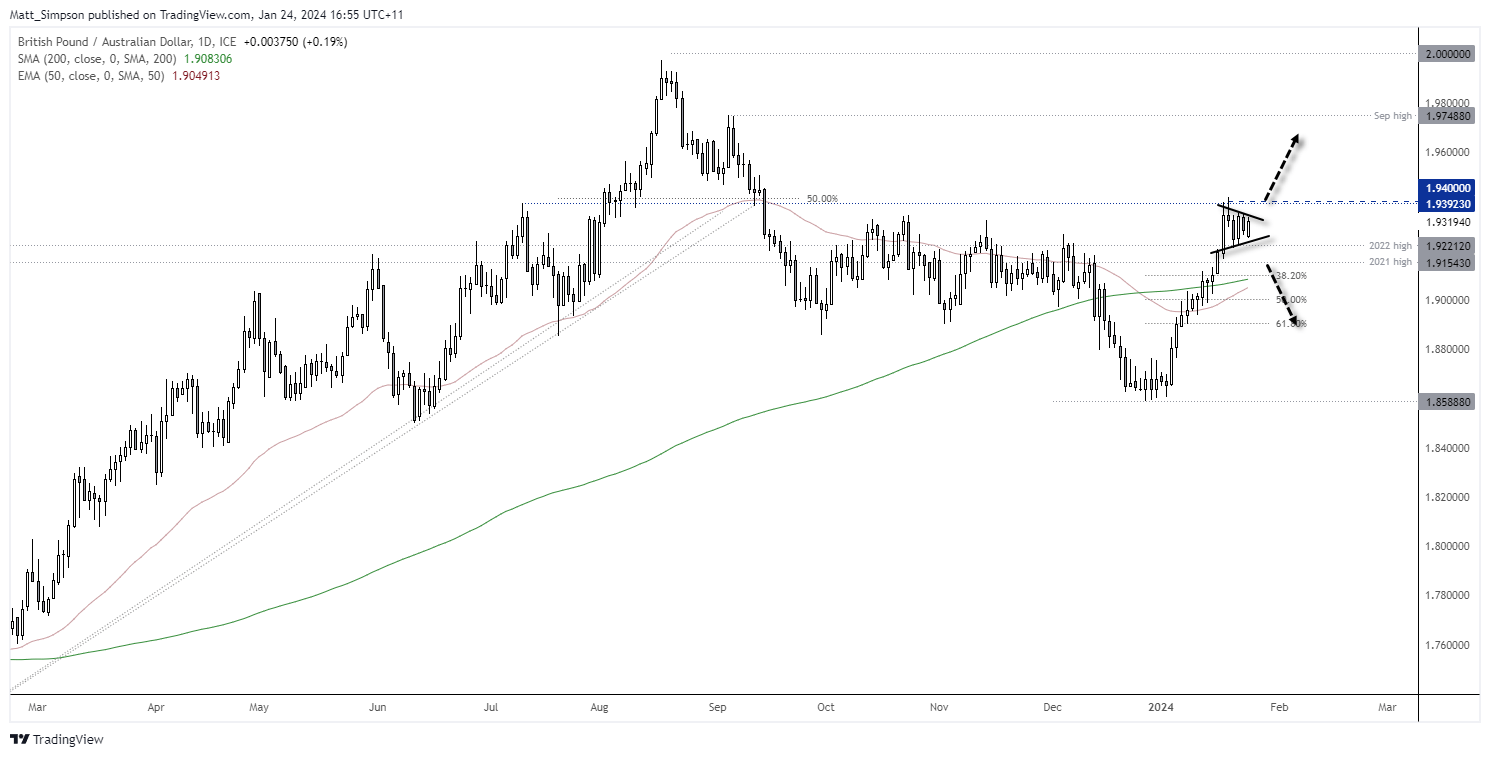

GBP/AUD technical analysis (daily chart):

Relatively hawkish expectations of the BOE over the RBA and positive interest rate differentials have helped GBP/USD rise over 4.4% this past three weeks. Price action on the weekly chart remains firmly bullish, although we’ve seen three bullish weeks in a row (and potentially on track for a fourth), so we may need a new catalyst for it to notch up another few consecutive weeks. Still, a potential bullish reversal pattern is forming on the daily chart, so I’m keeping a lookout for a break above 1.94 to signal trend continuation.

A pullback to the 2021 high could provide an area for dip buyers to consider loading up, whereas a strong break beneath it suggests a retracement is underway and invalidates the bullish bias.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade