- DAX outlook: Earnings lift the mood – for now

- Risk appetite could be limited amid geopolitical risks and interest rates outlook

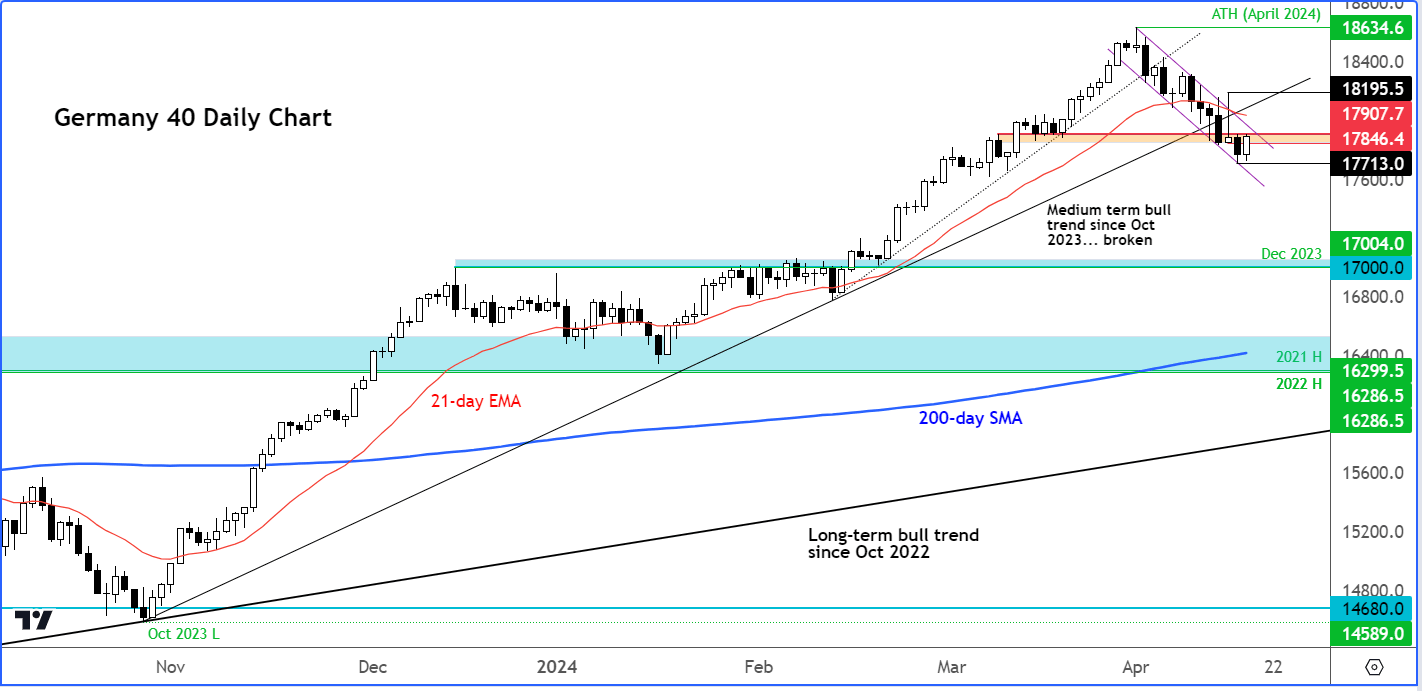

- DAX technical analysis shows German index still residing in bearish channel

DAX outlook: European and US futures rebound but don’t hold your breath

European stocks regained some ground in the first half of Wednesday’s session, as traders focused on mostly positive earnings from some of Europe’s biggest companies. However, with UK’s inflation falling less than expected, this is further fuelling fears over a more hawkish outlook for interest rates across the world, following the recent hawkish repricing of US interest rates. Let’s not forget about the geopolitical concerns in the Middle East, which remains at the forefront of investors’ minds. Therefore, company earnings, as good as they are, may only provide a temporary lift as the macro outlook has dimmed for stocks in recent weeks.

DAX outlook: Earnings lift the mood – for now

In the last couple of weeks, stocks have faced downward pressure as traders focused on the escalation of the Middle East conflict and investors adjusted their predictions regarding when and how much the Federal Reserve might cut interest rates. This meant that any potential market recovery would now have to rely heavily on corporate earnings. And that’s how it proved this morning as consumer products and services led the advance in Europe, thanks to some decent earnings results.

The DAX was supported by an 8% rise in shares of Adidas after the sportswear maker raised its revenue and profit outlook. LVMH led luxury stocks higher with a 5% rise on top of the French CAC index, thanks to reassuring results. UK’s FTSE was supported by miners, led by Anglo American and Rio Tinto. However, technology earnings missed including from chip maker ASML Holding and Just Eat Takeaway.com.

Risk appetite could be limited amid geopolitical risks and interest rates outlook

While US index futures have also recovered along with European shares, it remains to be seen whether the recovery will lead to a more significant rally or proves to be a dead cat bounce.

US and global stock indices have fallen out of favour in recent weeks. Investors have been showing reluctance to take risks, particularly after the markets achieved record-setting performance in the five months leading up to April.

The escalation of tensions in the Middle East is a primary concern for investors. The situation remains volatile, with Israel seeking retaliation for Iran's attacks on Saturday.

Additionally, investors are growing increasingly anxious about the rising yields on benchmark government bonds, as the likelihood of a June rate cut by the Fed diminishes. Initially, traders had priced in approximately six rate cuts for 2024, but now there is uncertainty about even receiving 50 basis points by December.

The mounting government debt and the increasing cost of financing it is another major concern for investors, which explains why gold has been on the ascendency despite the higher yields. The International Monetary Fund criticised US policymakers on Tuesday for adopting unsustainable fiscal policies that have contributed to the nation's recent economic success. While acknowledging the impressive performance, the IMF cautioned against excessive spending, warning of inflation and global financial instability. Such actions could elevate global funding costs, posing risks to long-term fiscal and financial health worldwide.

These macroeconomic factors, combined with profit-taking by investors, have led major indices to break down key technical levels, much to the satisfaction of bearish investors.

But thanks to a positive start to Wednesday’s session, Treasury yields retreated from their 2024 peak hit yesterday, the major indices bounced back, and the dollar index fell after a five-day rally that had lifted it to a five-month high.

Video: DAX outlook and technical insights on other major indices

DAX outlook: German index resides in bearish channel

In addition to the above-mentioned earnings results, the German DAX index has also found some support from the support trend of its bearish channel. As the index still remains inside this channel, and below the broken trend line that had been in place since October of last year, the short-term path of least resistance remains to the downside, despite today’s recovery.

At the time of writing, the DAX was back inside a broken support around 17,850 to 17,910. This area is pivotal and today’s close should give us an idea about the near-term direction of the index.

On Monday, the DAX had found good support from here, although despite staging a rally from there and momentarily breaking above the 21-day exponential moving average, it could not hold onto its gains. The index went on to close around where it had opened the day, creating a bearish inverted hammer candle, with resistance coming from the backside of the broken bearish bullish trend line.

This resulted in some further downside follow-though on Tuesday, before the index found support along with the other European markets on the back of those positive earnings results.

But for as long as that 17,850 to 17,910 area now holds as resistance on a daily closing basis, the path of least resistance will remain to the downside. A close back above this zone is required to turn the tide back in the bulls’ favour, and ideally a move above the resistance trend of the bearish channel.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade