Asian Indices:

- Australia's ASX 200 index fell by -81.6 points (-1.13%) and currently trades at 7,132.20

- Japan's Nikkei 225 index has risen by 86.98 points (0.28%) and currently trades at 30,769.66

- Hong Kong's Hang Seng index has fallen by -478.87 points (-2.51%) and currently trades at 18,637.06

- China's A50 Index has fallen by -92 points (-0.72%) and currently trades at 12,623.92

UK and Europe:

- UK's FTSE 100 futures are currently up 8 points (0.1%), the cash market is currently estimated to open at 7,635.10

- Euro STOXX 50 futures are currently up 4 points (0.09%), the cash market is currently estimated to open at 4,267.74

- Germany's DAX futures are currently up 11 points (0.07%), the cash market is currently estimated to open at 15,853.13

US Futures:

- DJI futures are currently down -89 points (-0.27%)

- S&P 500 futures are currently up 14.5 points (0.35%)

- Nasdaq 100 futures are currently up 182.5 points (1.34%)

- The US dollar retained its place at the top spot following slightly hawkish FOMC minutes, although momentum was lower with no major economic data released in the Asian session

- The minutes revealed a split between ‘some members’ who saw a case for further tightening compared to those who were leaning towards further pauses, yet ‘members agreed’ that inflation remained too high which pours cold water on cuts this year

- AUD and NZD were the weakest majors overnight, AUD/USD touched a fresh YTD low and – at the time of writing – NZD/USD is on the cusp of printing its own TRD

- EUR/USD is within striking distance of 1.0700, following weak IFO sentiment and hawkish FOMC minutes

- Ron DeSantis officially announced his run for the Whitehouse Presidency in 2024, which was un/fortunately (depending on which party you support) marred by technical glitches during the ‘historical’ Twitter Space it was supposed to be presented on

- Q1 GDP data is in focus in the US session and it is expected to fall to 1.1% q/q from 2.6%

- Whilst a lagging indicator, traders will want to see if the world’s largest economy is shrinking faster than feared and, as this captures data from the implosion of several US mid-tier banks, it may cause quite a stir if it falls below 1% and fan fears of a recession this year

Fitch place the US on a 'AAA' ratings watch

Fitch’s decision to put the US on a negative ratings watch is hitting the US when it’s already down. But that warning could be promptly removed if or when Biden is forced to concede in the final minutes of the 11th hour, and raise the debt ceiling on unfavourable terms. And as equity markets are finally beginning to price in the odds of a default, I’m not convinced the yellow card from Fitch will have a significantly larger impact than the fears already being priced in. S&P E-mini futures are holding above yesterday’s lows, so the reaction seems contained for now. But an actual default would result in an actual downgrade, and that’s when we’ll see the fireworks.

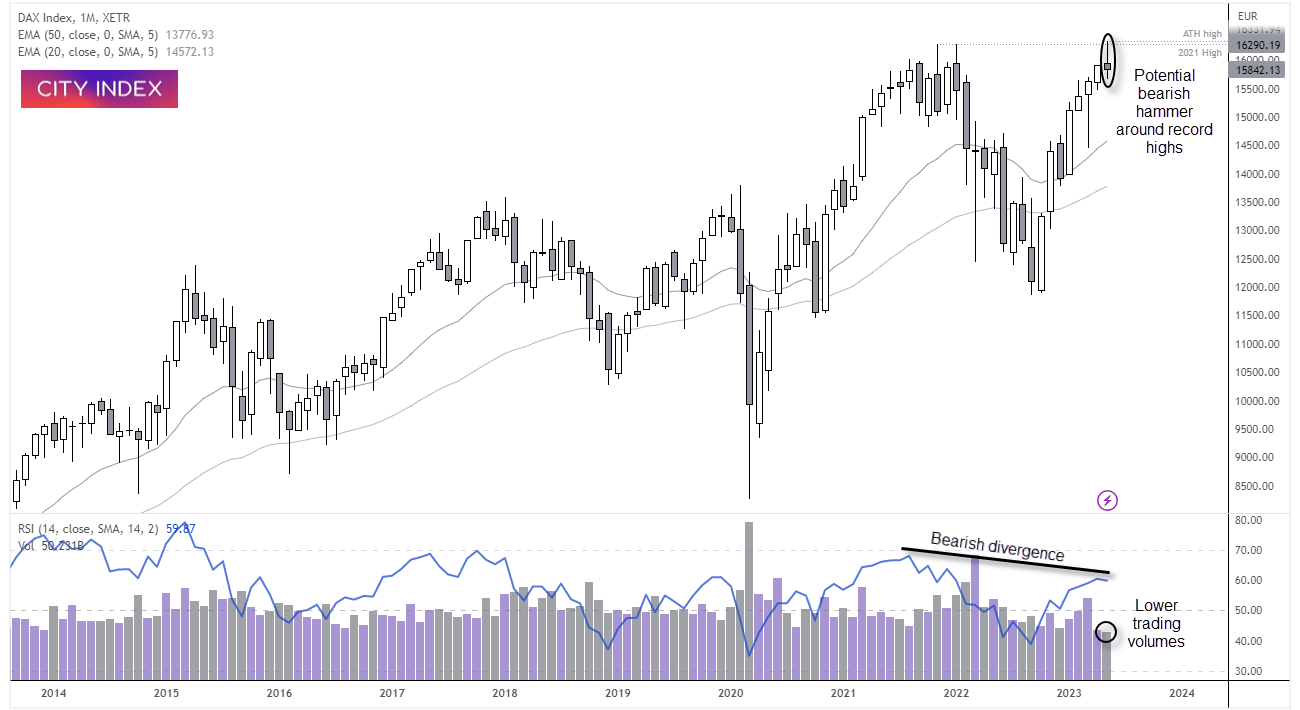

DAX monthly chart

We have four full trading days left in May, but if the DAX were to close the month around current levels it would print a monthly bearish hammer. And that could carry greater significance given it could occur near record highs on lower trading volume, alongside a bearish divergence on the RSI, as it suggests weakness of the trend which brought it to the current highs.

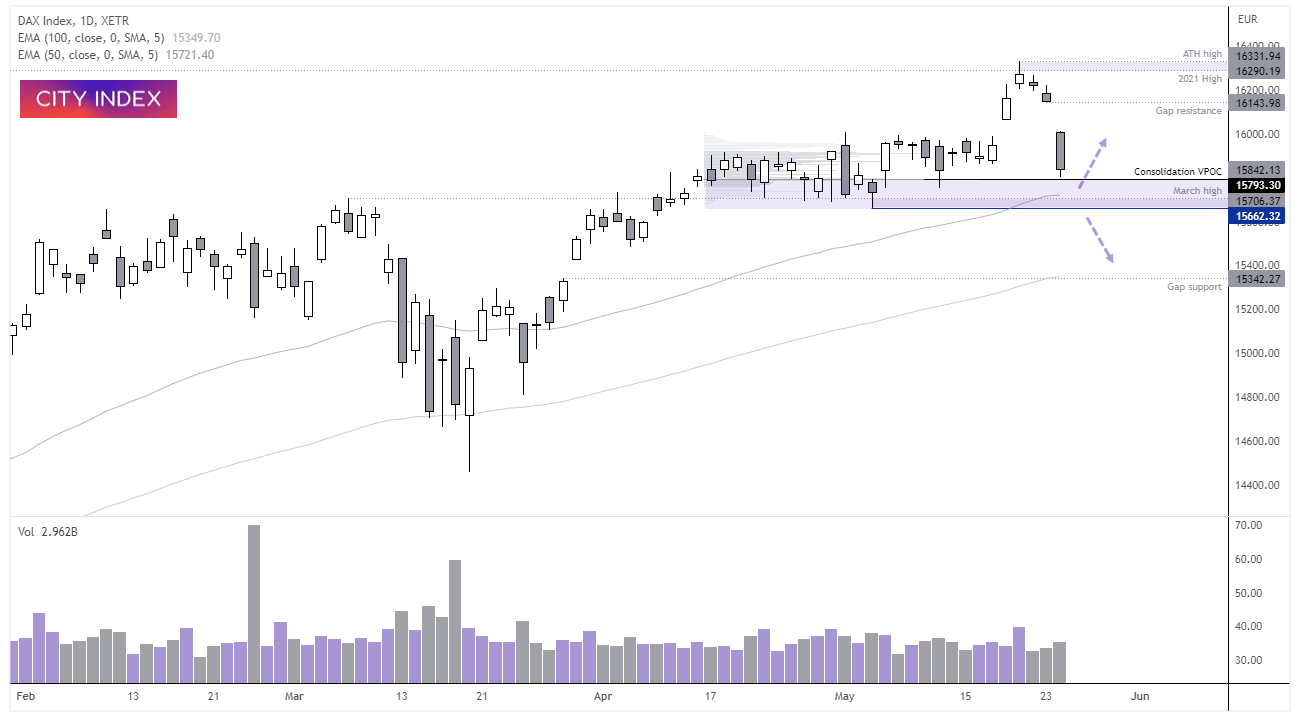

DAX daily chart

European equities have tracked Wall Street lower, and bearish momentum has increased as the threat of a US default finally begins to show itself in equity land. The DAX gapped lower yesterday, and the open marked the high of the day before falling back within range.

However, take note that yesterday’s low found support almost perfectly at the most heavily traded price within the consolidation before pulling slightly higher. Bears may want take caution around these lows on the daily chart, given its close proximity to the March high, May low and 100-day EMA on a reward to risk perspective.

And if a base forms and a deal is struck to raise the debt ceiling this week, it could provide a bullish catalyst for the DAX and appetite for risk in general, and bulls could move to close the gap.

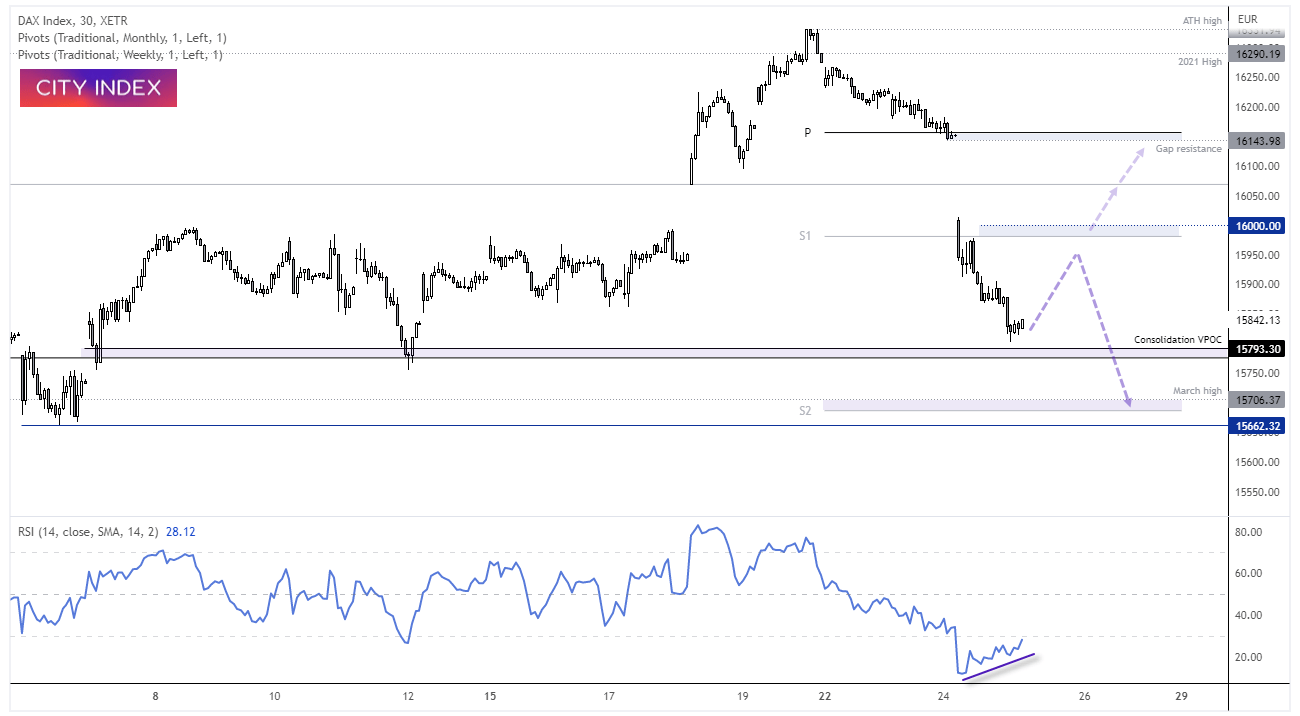

30-minute chart:

A bullish divergence is forming on the RSI 30-minute chart within the oversold level, and prices made a modest attempt to hold above the 15,790 area which includes the monthly pivot point and VPOC of the multi-week VPOC. Futures markets are a tad higher which shows another form of stability, even it’s not screaming ‘risk on’.

- The near-term bias remains bullish above 15,777 (monthly pivot)

- From here we’re looking for a technically driven rebound towards 15,900, with the potential for a move to 16,000 near the weekly S1 pivot

- A break below 17,770 brings the support zone around 15,700 into focus for bears

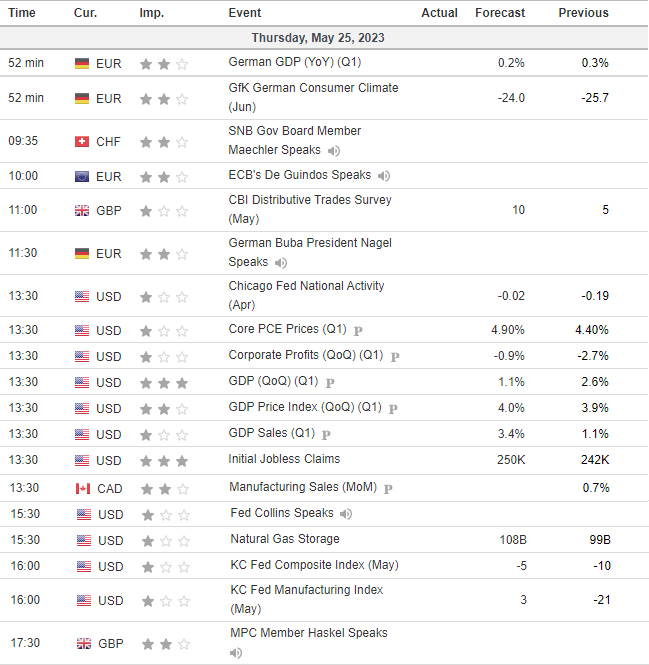

Economic events up next (Times in GMT+1)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade