When is Citigroup reporting Q4 earnings?

Citigroup will report Q4 earnings on Friday January 14th before the opening bell.

What to expect?

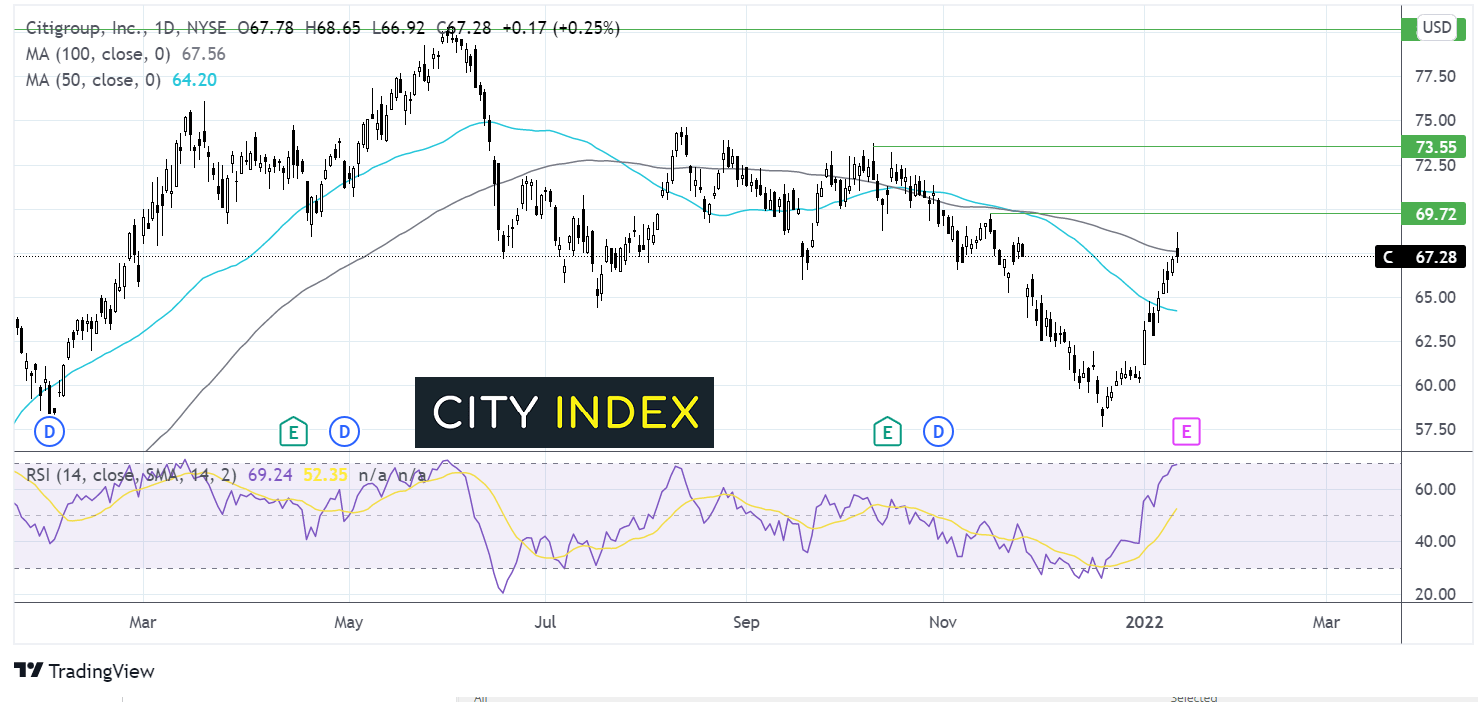

Citibank share price underperformed its banking peers in 2021. However, the share price is up 11% so far in 2022 making it one of the top performers.

To continue with this momentum earnings will need to be impressive.

Strong revenue

Strong growth in investment banking and the equity trading business boosted results in the previous quarter and are expected to drive strong revenue growth again in the fourth quarter. The Global Consumer Banking (GCB) unit is also expected to see an improvement.

Citi has exposure to both commercial and investment banking. Demand for each area is expected to be strong. Equity markets, IPO’s raising capital were all solid in 2021. Similarly house prices, mortgage demand, in addition to consumer demand were also solid.

Consensus estimates for Q4 revenue are $16.85 billion, with EPS of $1.71. Citigroup hasn’t missed a revenue estimate since Q4 2020 nor an EPS estimate since 2015.

Outlook

Looking ahead the Fed is expected to increase interest rates in 2022 which will help net interest income and margins. Meanwhile, the investment banking and equity trading business are expected to continue with their momentum for some time yet.

Share price

The outperformance of the Citi share price could be in anticipation of strong numbers. However, it could also be on the back of the new macroeconomic backdrop with more hikes anticipated from the Fed. If the latter is true, upbeat numbers could still propel the share price higher.

Where next for Citigroup share price?

Citigroup is extending the rebound from the December 2021 low of $57.70. The price has re-taken the 50 & 100 sma. However, the long upper shadow on the candle, plus the RSI tipping into overbought territory, suggests that there could be a move lower before further gains.

Disappointing results could see the price drop towards the 50 sma, negating the near-term uptrend.

Meanwhile, upbeat numbers could see the price head towards 69.72 November 15 high and $73.55 the October high.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.