Looking to get started with CFDs? Read our CFD trading for beginners guide for a handy introduction to the topic. Including how to learn CFD trading, a few strategies to get you started and more.

- What is CFD trading?

- CFD trading terms beginners need to know

- How to trade CFDs

- CFD trading tips

- CFD trading strategies

- Why trade CFDs

- How to learn CFD trading

H2: What is CFD trading?

CFD trading is a way of speculating on financial assets, like share dealing or ETF investing. However, CFD trading is a little bit different – because unlike investing in funds or stocks, you never own the underlying market.

Instead, you buy or sell a contract for difference (or CFD for short).

CFDs mirror the live prices of financial markets. When you trade one, you're getting the same exposure as you would if you had bought the asset it tracks.

But instead of investing in the market, you're buying a contract. And that contract enables you to exchange the difference in an asset's price from when you open your position to when you close it.

Let's take a look at a quick example to see how that works in practice – or for more information, look at our guide to how CFDs work.

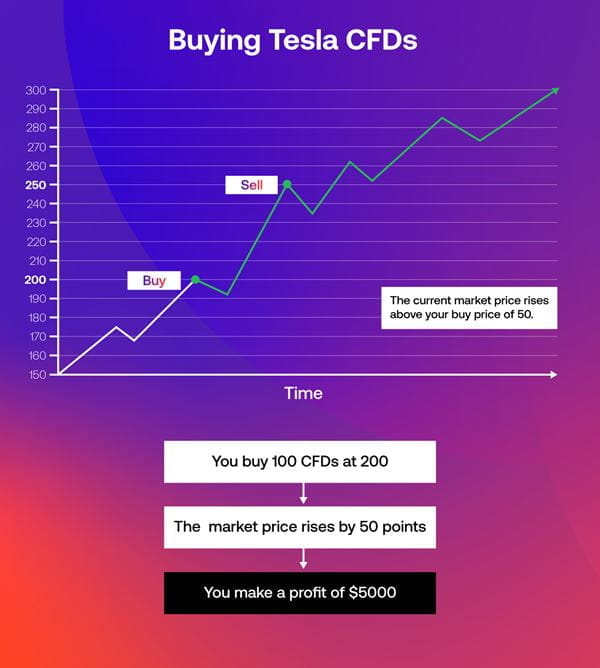

H3: CFD trading example

Tesla is trading at $200, and you want to take your position on it. You could invest in Tesla stock with share dealing, or you could buy Tesla CFDs.

Investing

You invest in Tesla by buying 100 shares at $200. Tesla climbs to $250, and you sell your stock. You're selling each share for $50 more than you paid for it, giving you a $5,000 profit.

CFD trading

You trade Tesla by buying 100 CFDs at $200, then close your position at $250. You exchange the difference in Tesla's price with your provider, earning $50 for each CFD, or $5,000.

As you can see, the result from each position was the same, but the method of getting there was a little different.

If Tesla shares had fallen to $150, then the result would be the same again.

With investing, you'd be selling your shares for $50 less than you paid for them. With CFD trading, you'd still exchange the difference in Tesla's price – but because the market has moved against you, you pay your provider $50 per share.

Learn more about CFD trading vs investing.

H2: CFD trading terms beginners need to know

That’s the basics of CFD trading, but there are a few other important concepts you’ll need to understand before you get started. Let’s examine leverage, margin, spreads, commissions and going short.

Leverage and margin

When you open a CFD position, you don't have to pay its total value. Instead, you put down a deposit that might be 5% or 10% of the position's cost. After all, you aren’t actually buying the underlying asset, you’re just speculating on its price movements.

This is called leveraged trading, and the deposit you must have in your account is known as your margin.

CFD leverage gives you more flexibility over how to allocate your capital. If you wanted to trade $50,000 of Apple CFDs, you might only have to put down $10,000, meaning you aren't tying up all your available funds in a single position.

Your profit and loss would both be based on the full $50,000, though. So while leverage can be a powerful tool, you'll want to trade carefully and keep an eye on your risk management.

The spread and commission

You'll always see two prices listed on a CFD market. The first is the sell price, and the second is the buy price. The difference between the two is called the spread.

Often, you'll find that all the costs to trade a CFD are incorporated into the spread, so you won't pay commission. On some markets, however, you'll pay via a commission instead. You'll notice that the spread is much smaller on these markets.

On long positions, you'll open at the buy price and close at the sell price. But with CFDs, you can also do the opposite – open at the sell price and close at the buy price. This is called shorting.

Shorting

As we've seen, a CFD is just a contract where your provider agrees to pay you the amount that a market has moved in your favour.

Because you aren't taking ownership of the market, you can choose whether you want to profit from upward movements (known as going long) or downward ones (known as shorting) when you open your position.

- You go long by buying CFDs. This will return a profit if the market has moved up when you close your position

- You go short by selling CFDs. Here, you'll profit if the market has fallen when you close your position

For example, say you believe that the price of oil is about to fall due to weakness in the global economy. With contracts for difference, you could profit from the bear market by selling Brent crude CFDs.

If Brent crude's price falls, you can close your position and pocket the difference in its price. However, if oil's price rises instead, you'd earn a loss.

H2: How to trade CFDs

You trade CFDs in a similar way to buying other financial markets, such as stocks. You buy or sell a set amount of your chosen asset, and how much you buy or sell dictates your profit or loss.

The main difference is what you're trading. Instead of shares, currencies or commodities, you buy and sell contracts that mimic the live prices of shares, currencies and commodities.

A Coca-Cola CFD will always track the price movements of Coca-Cola shares, for example. Buying one Coca-Cola CFD is the equivalent of buying a single share of Coca-Cola. You'll earn $1 for every dollar it moves up, and lose $1 for every dollar it moves down.

Buy 100 Coca-Cola CFDs, and you'll make or lose $100 dollars for each point that the shares move.

Read our full guide on how to trade CFDs.

H2: Start CFD trading today

If you’re new to CFD trading, then you might want to start out with a demo account. CFD demos enable you to test out trading markets with virtual currency, honing your skills before you commit real capital.

You can open a free City Index demo in seconds.

Then, once you’re ready to move up to live markets, you can follow these steps:

- Open your City Index account and add some funds

- Log in to our award-winning Web Trader platform or download our mobile trading app

- Search for your chosen market

- Choose to buy to go long, or sell to go short

H2: CFD trading tips for beginners

H3: 1. Stick with what you know

You can choose from an enormous number of CFD markets to trade, but that doesn’t mean you have to leap into obscure assets immediately.

At the outset it’s usually a better idea to pick a small number of markets that you’re already familiar with. Once you start to gain confidence, you can look to diversify a bit more.

H3: 2. Start out small

Position sizing can be hugely beneficial when trading. Essentially, the idea is to only risk a small percentage of your total capital on each trade – perhaps 1% or 2%.

Keeping your total outlays small means you can learn from your mistakes without losing too much. If you’re only risking 2% on any trade, then you could afford to get 50 trades wrong in a row before losing your balance.

H3: Always use a stop

Stops (stop-loss orders) help you control your risk on any given trade by automatically closing a position if it hits a specific level of loss. They take some of the emotion out of trading, and mean you don’t have to constantly watch each open position.

Successful traders won’t open a position without attaching a stop – no matter how experienced they are. However, standard stops don’t put an absolute cap on your risk as they can suffer from slippage. For that, you’ll need a guaranteed stop.

H2: CFD trading strategies for beginners

To trade CFDs successfully, you’ll probably want to follow a trading strategy. Your strategy dictates when you open and close positions, which markets you’ll trade and more.

Some trading strategies are very simple. You might, for example, just decide to buy stocks in economies with favourable market conditions. However, lots of CFD traders use technical analysis to build more complex strategies that work across multiple asset classes.

Let’s take a look at three popular options.

H3: 1. Trend trading

Trend trading is an easy-to-understand approach to the financial markets. Assets often move in trends, making sustained upward or downward price movements over a prolonged period of time. Trend traders attempt to earn profit by riding these trends, entering a market as close to the beginning of a trend as possible and exiting as soon as a reversal looks imminent.

One reason why trend trading is so popular is because it works across any timeframe. Short-term traders can look for trends that last hours, long-term investors can use trends that last months or even years.

The key to successful trend trading is to spot when a trend is forming, and when it is about to end. To help with this, trend traders tend to use technical indicators such as moving averages, RSI and the stochastic oscillator.

H3: 2. Breakout trading

Breakout traders use a different aspect of price action to plan their positions: support and resistance levels.

These are areas on a chart that a market has previously struggled to move beyond. Support levels are where a market has previously bounced upward, and resistance is where it has reversed downward.

Breakout trading is based on the idea that if a support or resistance level is broken, the market will then make a sustained move in that direction. So a market that breaks up through resistance will then go on a bull run, and vice versa for support.

H3: 3. Mean reversion

Mean reversion, meanwhile, is the concept that every market has an ‘average’ price that it will always revert to. So if you can identify when a market has moved away from this average price, then you can trade its reversion to the mean.

There are lots of ways to identify a market’s mean price. You could, for example, draw a long-term trendline on a chart and watch for any moves away from it. Or, you could take lots of companies in similar industries and watch their price action – if one moves away from the others, it could present an opportunity.

The flexibility of mean reversion has made it a popular strategy among algorithmic traders, who use computer programs to execute orders on their behalf.

H2: Why trade CFDs?

H3: 1. Do more with your capital

For many traders, the key benefit to trading CFDs is leverage. Leverage enables you to act like an institutional trader, providing opportunities that simply aren’t available to retail investors.

Forex pairs, for example, move in relatively small increments. A 100-pip move in EUR/USD is only equal to €0.01. So to earn realistic profits from the FX markets, you need to trade huge amounts of currency. A standard forex trade is equal to 100,000 units of the base currency.

Leverage means you don’t need to tie up massive amounts of currency on every single trade. Instead, you only need to cover your margin. However, as we’ve already noted, this will also increase your risk.

H3: 2. Range of markets

But there's another benefit to never owning the assets you're trading – you aren't limited in what you can buy or sell. If it's a financial market with a price, then you'll probably be able to go long or short on it with a CFD.

With City Index, for instance, you can access thousands of global assets. That includes thousands of stocks listed on exchanges around the world, dozens of leading indices, forex pairs, precious metals, oil, bonds and even interest rates.

As well as giving you choice, this can be useful for diversifying your exposure. By trading markets in different asset classes and regions, you can lower your overall risk.

H3: 3. Hedging

Hedging is a popular CFD risk management technique used by investors. Essentially, it involves opening a short position that offsets your exposure from an existing investment – meaning that if your investment falls in value, you earn a corresponding profit from your short trade.

If, for instance, you owned 50 Alphabet shares but were worried that the company was in for a downturn, you could short 50 Alphabet CFDs. Then, your CFDs will earn a profit if the market drops in price.

Hedging will rarely remove all the risk from a position, but it can lessen your exposure.

H2: How to learn CFD trading

To learn CFD trading, you’d be best off taking an online course. This guide has outlined all the basic concepts you need to know, but to start trading successfully you’ll want to get a deeper understanding of how CFDs work, the markets you can trade, managing your CFD risk and more.

You can access a series of free interactive lessons on the financial markets and CFD trading with the City Index Academy. Including courses on:

- The financial markets

- How to trade

- Strategies and risk

- Technical analysis

- Fundamental analysis

- Trading successfully

CFD trading FAQs

Is CFD trading risky?

Yes, as with any form of market speculation CFD trading is risky. Whenever you trade a financial market, there’s the chance that your position will earn a loss instead of a profit – and thanks to leverage, with CFD trading those profits and losses are magnified.

However, there are lots of ways you can manage your CFD trading risk: including stop losses, trading plans and more.

Which markets can I trade with CFDs?

With City Index, you can trade 1,000s of CFD markets including:

- 80+ major, minor and exotic FX pairs

- Stocks in the US, Europe, Australia and Asia

- 24-hour trading on key global indices

- Gold, silver, platinum and more

- Key commodity markets, including oil and wheat

- Options, bonds and interest rates

Open your City Index account to get started.

Are CFDs the same as options and futures?

CFDs, options and futures are three different types of financial derivative. They all enable you to speculate on the global markets, but they do so in different ways.

- Options give you the right to trade a market at a set price before the option expires

- With futures, you have to trade a market at a set price on a set date