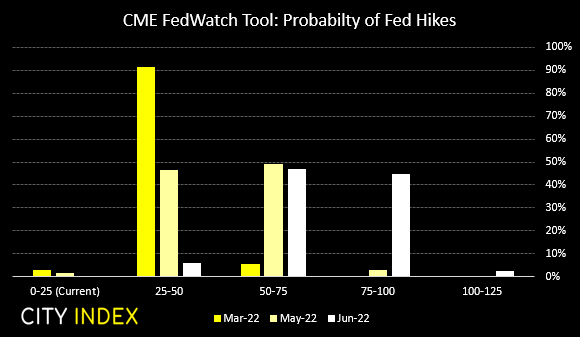

Traders are offloading bonds like hot potatoes and sending yields higher. And they’re pushing yields so high and so fast we had wondered if they’re betting on the Fed hiking by 50 bps at their March meeting. Yet market pricing says otherwise. According to Fed funds futures, there’s just over a 90% chance of a single 25 bps hike in March compared to just over a 5% chance of a 50 bps. Even by May the odds of that second hike are just below 50% hike. Yet by the June meeting there’s a 45% chance of rates sitting at the 75 – 100 target range, so there’s the potential for a couple of hikes lurking in there somewhere, even if it’s not yet fully apparent or in a single meeting.

Everything you need to know about the Federal Reserve

And whilst the rise in yields is not limited to the US, their rate of change is taking its toll on currency markets. Yield differentials matter again and that is clearly visible on EUR/USD. The spread between US and EU bond yields are pointing firmly lower and momentum on EUR/USD has clearly taken notice. We continue to suspect the corrective high was seen last week just below 1.1500, and once bears have conquered the 1.1300 handle the lows around 1.1200 will then be within their crosshairs.

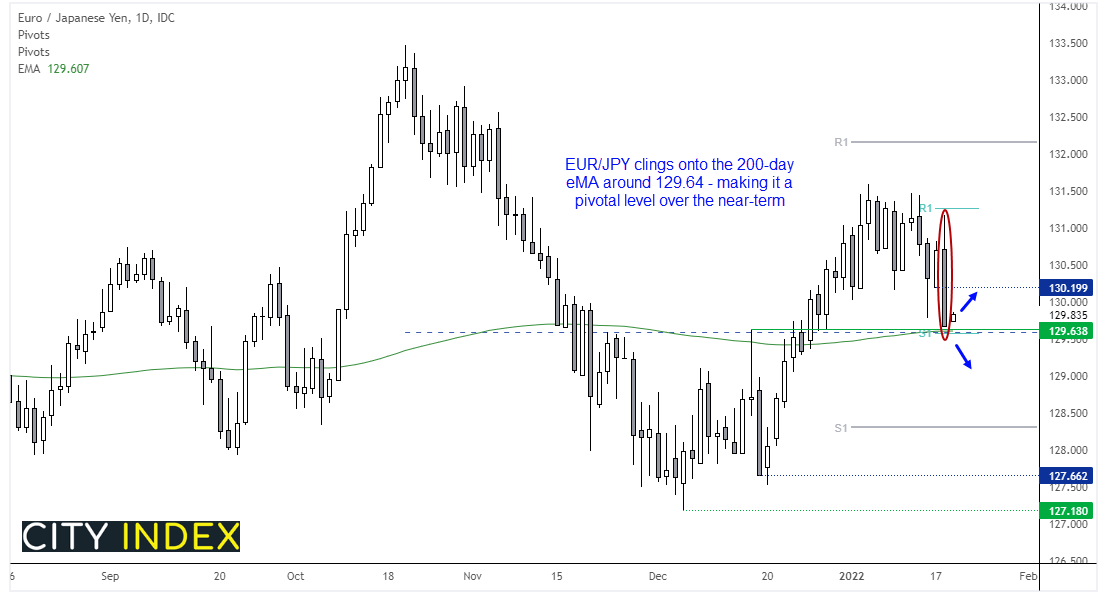

Another euro pair to keep a close eye on is EUR/JPY. It was one of the weakest performers yesterday and prices closed at the low of a very bearish day. It is clinging on to the 200-day exponential moving average in hope of support, and whilst an obligatory bounce form such a technical milestone can be customary, we do not expect it to hold above it for too much longer. Bears are likely to want to fade (sell into) minor rallies into 130.20 area, and a break below 129.50 opens the door for its next leg lower in our view.

Euro explained – a guide to the euro

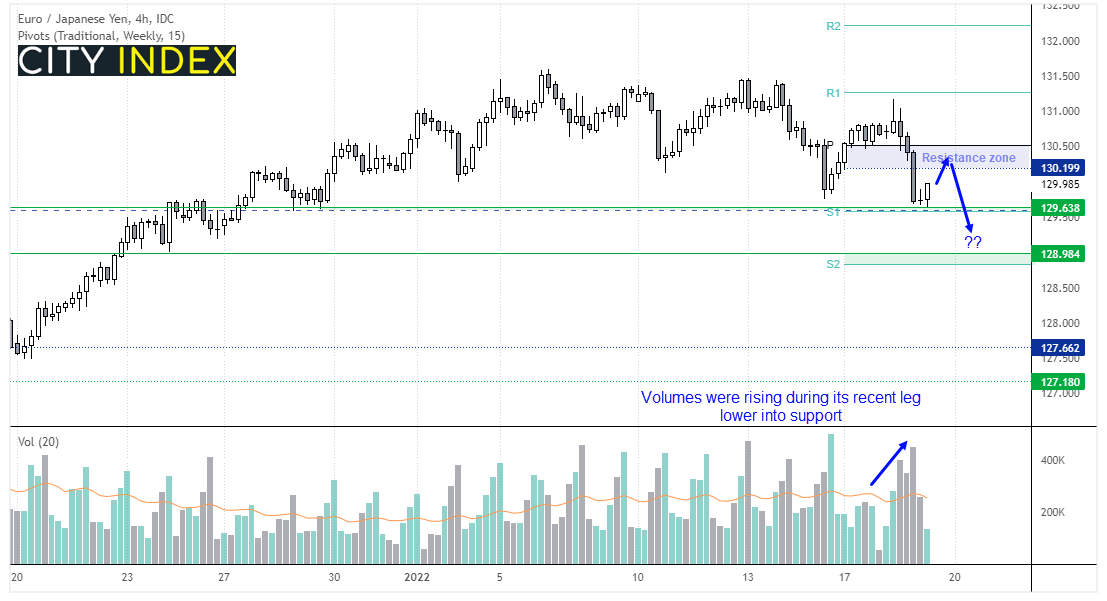

If we look at the four-hour chart it shows volumes rising as prices declined into key support. Although 129.64 (near the 200-day eMA) also coincides with the weekly S1 pivot. Prices are currently retracing but our bias remains bearish below the weekly pivot around 130.50, and for an eventual break below 129.50 to bring the support zone around 128.90 info focus.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade