After falling sharply yesterday following the news of an impeachment enquiry into U.S. President Donald Trump, USDJPY rebounded overnight in impressive fashion. In this note, we examine the catalysts for the overnight recovery and assess whether the rally in USDJPY can continue.

Boosting USDJPY was positive news on the trade front from two different sources. A bullish suggestion from President Trump that a deal with China may be reached sooner than expected coincided with news that China had agreed to make additional purchases of soybeans and pork. Elsewhere, it was confirmed that the U.S. and Japan had reached a limited trade agreement to cut tariffs on U.S. farm products including beef, pork and cheese.

Higher interest rates also proved supportive for USDJPY following comments from Chicago Fed President Evans. Evans who has earnt a reputation for being a reliable dove, told reporters that he thought after two recent rate cuts inflation would overshoot and the reason why he omitted including further cuts in his 2019 forecast.

In response, the yield on U.S. 10-year notes closed the session near 1.73%, 8bp higher than where they started the day. As outlined in this article recently, https://www.cityindex.com.au/market-analysis/usdjpy-recovery-continues/ there is a positive correlation between USDJPY and U.S. interest rates, i.e. when U.S. interests rates rise it is a positive for USDJPY and vice versa.

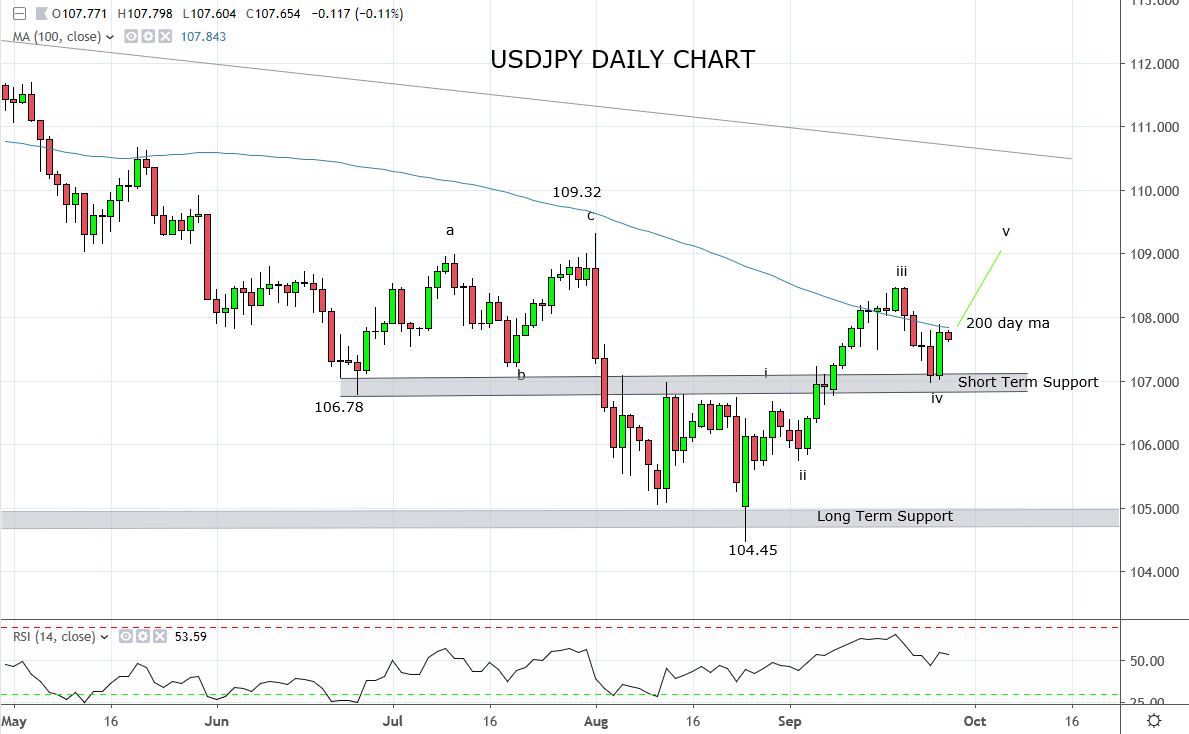

Also, from the article above, we suggested buying USDJPY on a corrective pullback to 107.50/30 with a sell stop placed below 106.30. While USDJPY did overshoot the buy zone mentioned above, the overnight rebound goes some way to suggesting a corrective Wave iv low is in place at yesterday’s 106.96 low.

Should USDJPY now break and close above the resistance provided by the 200-day moving average 107.85/90 area, it would suggest that Wave v higher has commenced, targeting a move towards 109.30/50.

In short, we continue to like USDJPY higher. However, to protect against ongoing volatility, we advise raising the stop loss on long USDJPY positions from 106.30 to 106.90.

Source Tradingview. The figures stated are as of the 26th of September 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.