Market Summary:

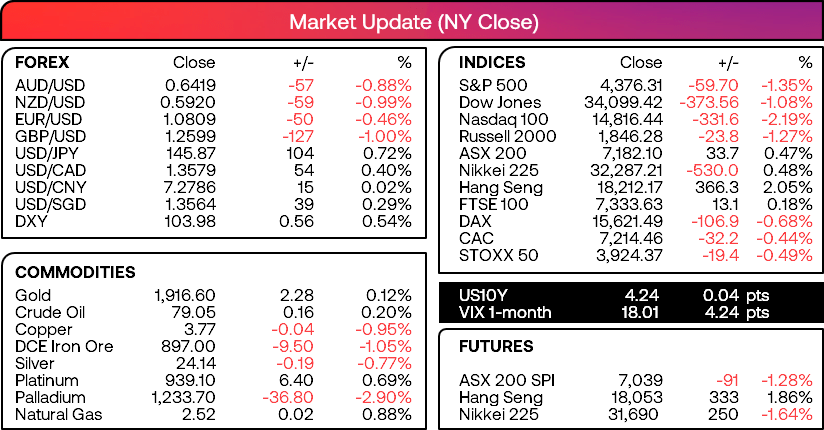

- Rising yields set the tone in the US session on Thursday on the eve of Jerome Powell's Jackson Hole speech, which saw the 2-year yields back above 5%

- The US dollar was the strongest FX major (and up against all of its peers) as it tracked surging yields to the detriment of Wall Street

- The Nasdaq 100 led the way lower from the open, falling over 2% and erasing most of the week’s gains with a bearish Marabuzo candle (enlarged engulfing candle with no upper or lower wicks)

- AUD/USD and NZD/USD were the weakest forex majors and erased Wednesday’s gains to underscore the risk-off tone.

- Gold was slightly higher as it attracted safe-haven flows, although the strength of the US dollar also saw its upside as limited as it struggled to break above 1920 and formed a small bearish pinbar

- Comments from Fed members were mixed, with Harker saying he doubts the Fed will hike again this year. Yet Collins warned that the strong US economy could warrant further hikes.

Events in focus (AEDT):

- 09:30 – Tokyo’s CPI (which can provide a decent leading indicator for next month’s nationwide CPI)

- 09:50 – Japan’s services PPI

- 16:00 – German GDP

- 18:00 – German Ifo business sentiment

- 21:00 – ECB President Lagarde speaks

- 00:05 – Fed Chair Jerome Powell speaks at Jackson Hole

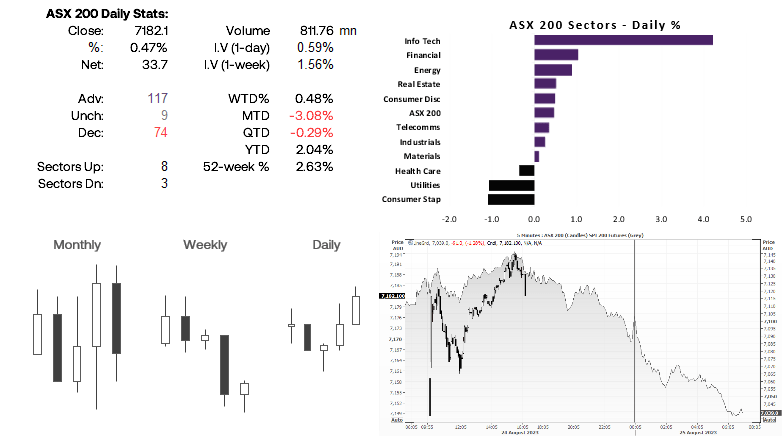

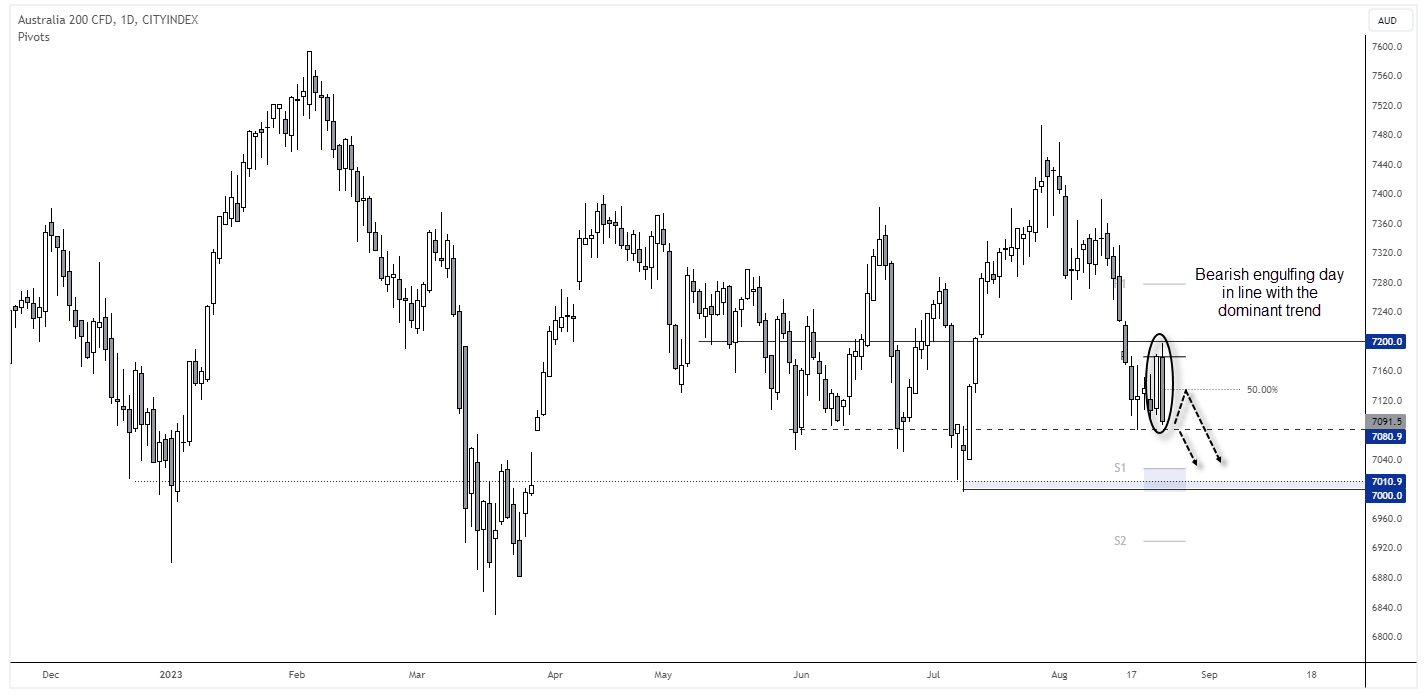

ASX 200 at a glance:

- The ASX 200 rose for a third day and reached the initial resistance zone just below 7,200

- It was also its best day in 17 with 8 of its 11 sectors rising (led by info tech and financial stocks)

- However, that all seems irrelevant with the weak lead from Wall Street and -1.28% fall on SPI futures overnight

- A bearish engulfing day formed on the local market (cash and futures market combined), which took it just beneath 7100 and near a prior support area around 7090.

- Perhaps the market can lift itself up from the lows earlier in the session, but I would be surprised if it managed to recoup 50% of yesterday’s open-close range

- Bears could consider seeking evidence of a swing high below the 50% retracement level in anticipation of a break to new lows, or simply wait fore a break to new lows

- Countertrend traders could consider dips around cycle lows, but without a bullish catalyst for sentiment its upside potential could be limited

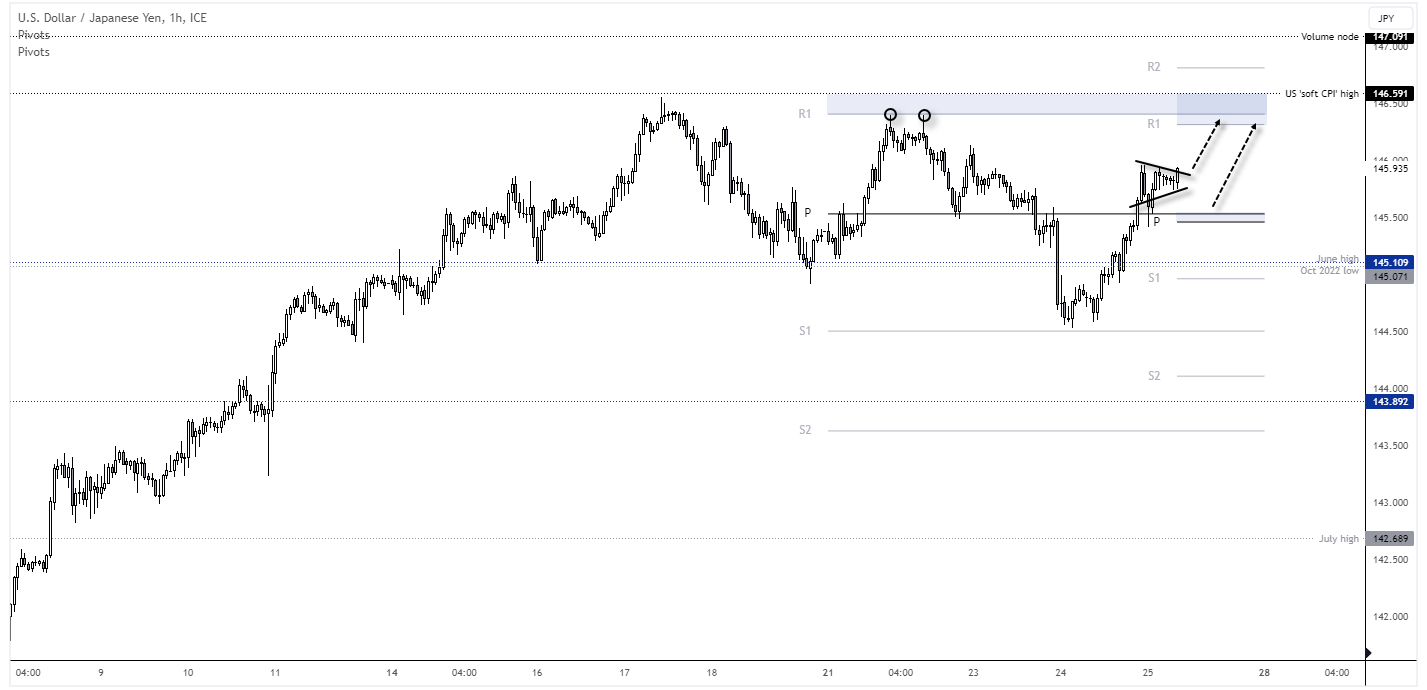

USD/JPY technical analysis (1-hour chart):

If we take a stand back and look at the 4-hour chart, it presents a strong bullish trend with a 3-wave retracement (which could be part of a bullish continuation pattern). However, we have a large risk event pending with Jerome Powell’s speech, and the assumption that if the yen weakens too much too fast, the MOG / BOJ may be inclined to verbally or actually intervene. Traders therefore may want to tread with caution, and perhaps consider breaking the sessions up into before Powell’s speech and after (or simply next week).

USD/JPY stands firm at the start of today’s Asian session, and I suspect USD may catch a bid ahead of Powell’s speech in anticipation of hawkish comments (with the potential for ‘sell the fact’ thereafter). A strong bullish trend has emerged on the 1hour chart and prices are already trying to break out of a small consolidation near cycle highs. If we see the obligatory ‘shakeout’ around the Tokyo open, bulls could consider dips above the daily and weekly pivot points around 145.50 in anticipation for a move back to cycle highs around 146.40 (and the daily and weekly R1 pivots). Given this is just below the US ‘soft-CCPI’ high – a level of historic significance – it is debatable as to whether bulls would want to hold on in hopes of a break above it ahead of Powell’s speech. And if the speech is potent enough and provides the binary outcome I suspect (bullish or bearish USD), we can always return to the tale next week.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade