- Further US dollar strength will likely require ongoing strong US economic data and/or continued geopolitical tensions

- USD/JPY continues to march higher in Asia. It will likely remain that way unless we see a major escalation in geopolitical tensions this week

- With little major US economic data, relative interest rate expectations should continue to underpin US dollar strength

USD/JPY overview

Sitting at 34-year highs and with market positioning nearing extreme levels, further USD/JPY upside is likely predicted on two factors this week: ongoing US economic exceptionalism, limiting the risk of Bank of Japan intervention or increase in Fed rate cut bets, or a dramatic escalation in Middle Eastern geopolitical tensions which could spark significant volatility and lead to an unwind in Japanese yen carry trades.

US economic strength unlikely to be questioned near-term

Regarding the first consideration – persistent strength in US economic data – the calendar is dominated by second-tier US data this week with retail sales, housing starts, building permits, industrial production and jobless claims the only releases of note. The limited news flow suggests it will be difficult for perceptions to shift definitively on the US economic trajectory.

That’s important for three reasons.

The threat of intervention from the Bank of Japan would amplify if USD/JPY continued rallying despite softer US economic data, providing ammunition to Japanese policymakers to suggest upside was being driven by speculative forces. Should the data continue to impress, it will weaken the argument for intervention.

A lack of first-tier data will also make it difficult to meaningfully reverse the unwind in Fed rate cut pricing seen since the beginning of the year, keeping yield differentials between the US and Japan sitting near 2024 highs. Similarly, while there are 15 separate Fed speakers scheduled, a lack of new information suggests there may be little deviation from the prevailing message that there’s no rush to cut rates right now.

Continued US economic resilience may reduce the risk that near record levels of speculative short positioning in the Japanese yen will be squeezed, a scenario that could potentially spark a meaningful pullback in USD/JPY if it were to take place.

Which leaves geopolitics as the biggest threat to the rally

With risks posed by a change in sentiment towards the US economy largely sidelined, it suggests geopolitical developments may play a larger role in dictating how USD/JPY fares over the coming days, especially if there’s a further escalation.

Under a scenario where tensions remain similar to where they are now or lessen, it will keep a safe haven bid in the US dollar without doing meaningful damage to US economic or rates trajectory, pointing to USD/JPY upside.

However, should the conflict escalate meaningfully, safe haven flows into the USD may be outpaced by carry trades involving the Japanese yen being unwound, leading to a rapid strengthening in the yen as seen in other period of sustained market turmoil.

Of all considerations discussed, this outcome looms s the biggest threat to the bullish USD/JPY narrative, not the risk of BOJ intervention.

USD/JPY upside favoured without major risk-off episode

It’s been over a week since USD/JPY surged to fresh 34-year highs above 152, suggesting the pair may be in the process of carving out a new higher range. The longer it stays above this key level, the more likely traders and policymakers will become comfortable with it, especially if it does not generate any adverse market or economic outcomes.

With very little on the Japanese calendar outside of Friday’s inflation report which rarely deviates too far from consensus, it’s far too soon to make any meaningful conclusion about the impact on the Japanese economy from latest weakening episode in the yen.

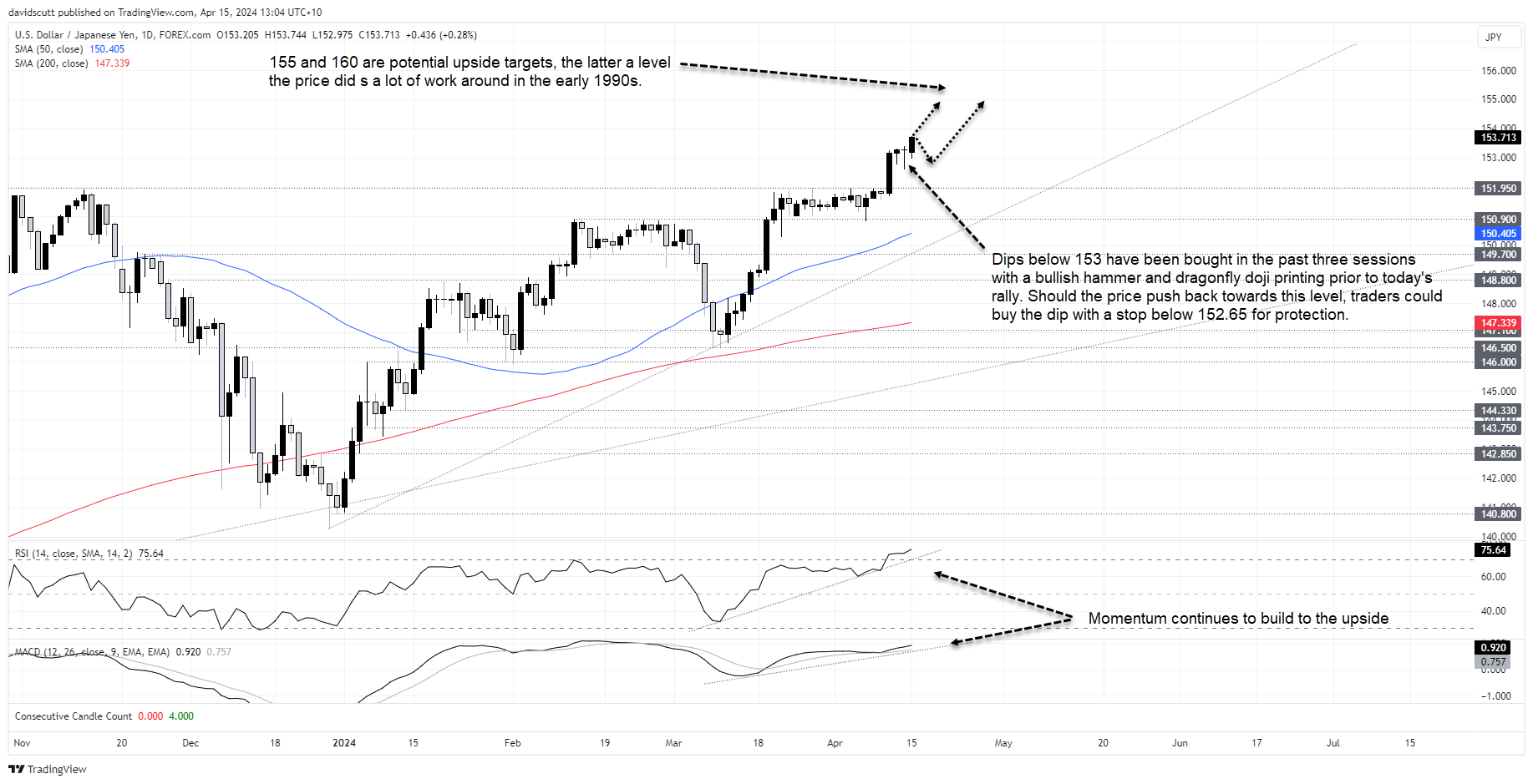

With no escalation from Israel following Iran’s attacks over the weekend and no renewed commentary from Japanese officials expressing displeasure at the yen’s level, it’s not surprising to see USD/JPY pushing higher on Monday, moving it closer towards 155, a level many have nominated as the first upside target after the break of 152. Beyond, 160 would be the next target, a level the pair did plenty of work either side of back in the early 1990s.

On the downside, USD/JPY attracted bids on dips below 153 down to 152.65, making that the first layer of support to consider. Further below, considering how long it stayed below it, 152 would offer a major test for bears should the price get there.

-- Written by David Scutt

Follow David on Twitter @scutty

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade