USD/JPY is clinging to 150 despite the weaker US dollar on Tuesday, as there seems little reason for traders to bid the yen. And unless we receive a compelling reason to buy then yen via a surprisingly hawkish BOJ or broad risk-off environment, it becomes difficult to construct an overly bearish case for USD/JPY whilst the Fed remain quiet about rate cuts.

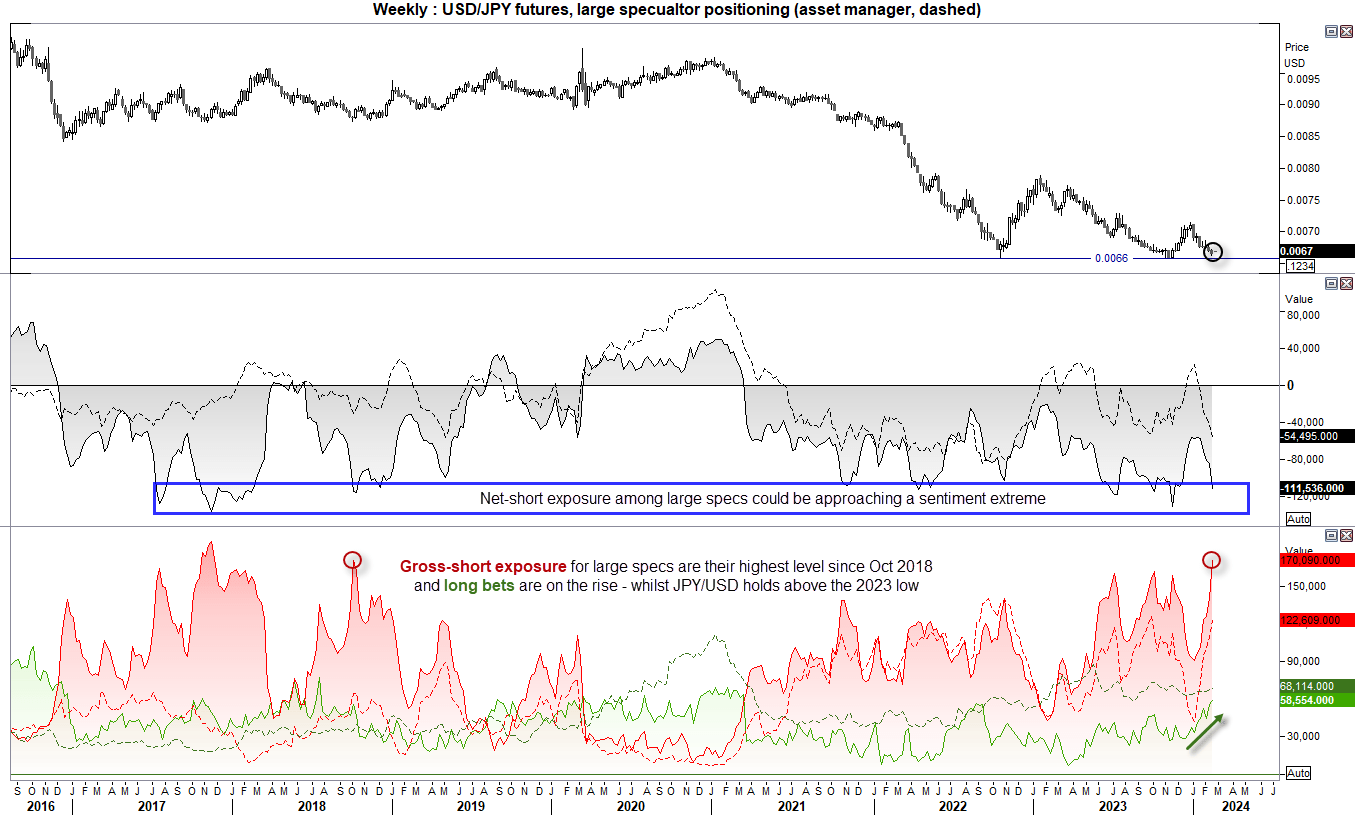

Yen futures large speculator positioning – COT report

With that said, I did outline in the weekly COT report that bearish bets against yen futures bears are near a sentiment extreme. And that does run the risk of yen futures holding above their 2023 lows, which equates to USD/JPY failing to break above its 2023 highs. Yet patience is required as this is on the weekly charts. And it doesn’t mean that USD/JPY can’t perform another leg higher towards 152 before we see a decent retracement. For now, USD/JPY remains in the ‘buy the dip’ category, given its strong trend.

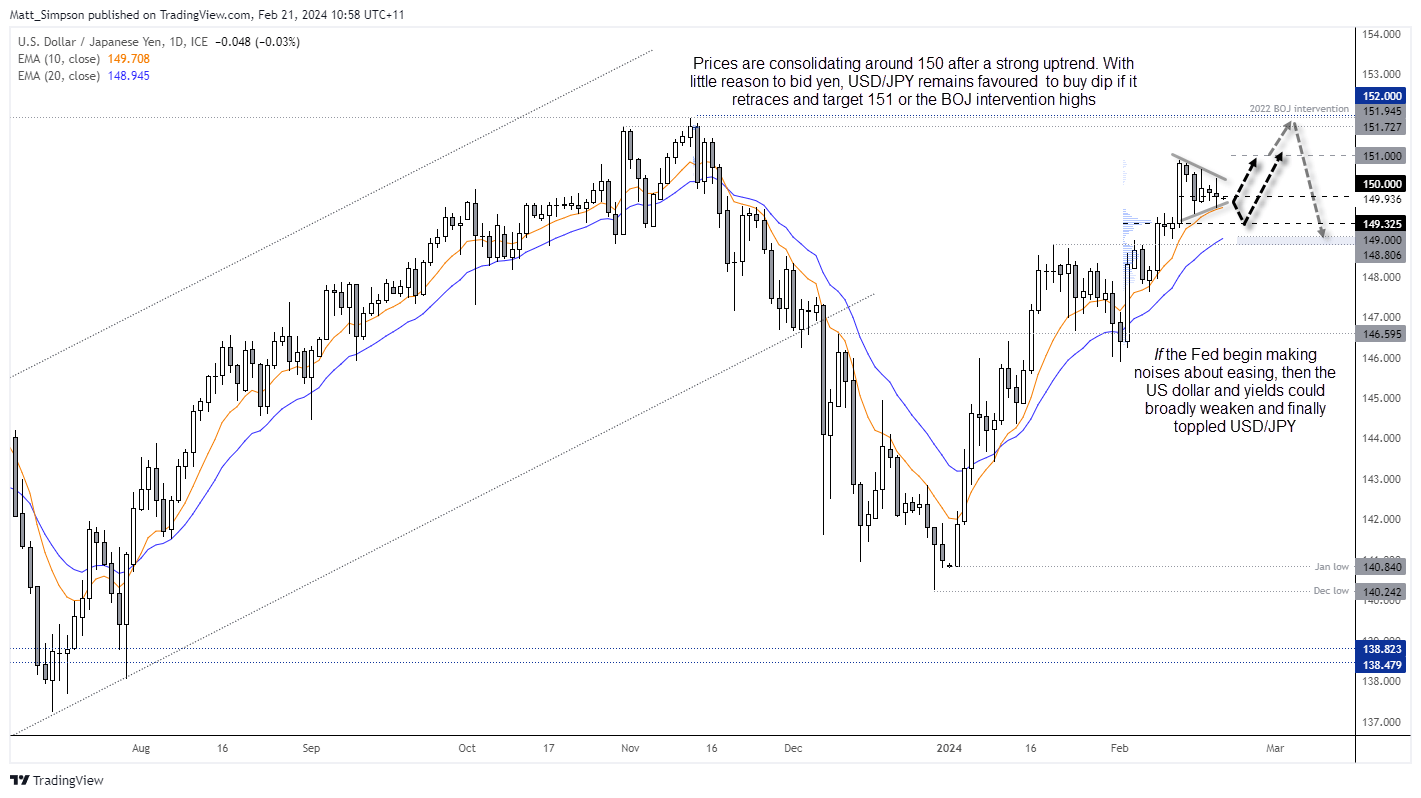

USD/JPY technical analysis (daily chart)

Technically, the USD/JPY trend remains firmly bullish on the daily chart. Prices are consolidating around 150 and holding above the 10-day EMA, and a ‘spinning top’ doji formed on Tuesday to show indecision around current levels. Traders should be on guard for spikes in either direction before the ‘real move’ unfolds. But due to its dominant bullish trend, the bias remains bullish and to seek bullish setups around support levels if prices retrace lower – as a rise to 151 at a minimum seems plausible.

Note potential support levels to seek bullish setups:

- 149.72 (10-day EMA)

- 149.30 (volume cluster)

- 148.95 – 149 (20-day EMA, round number)

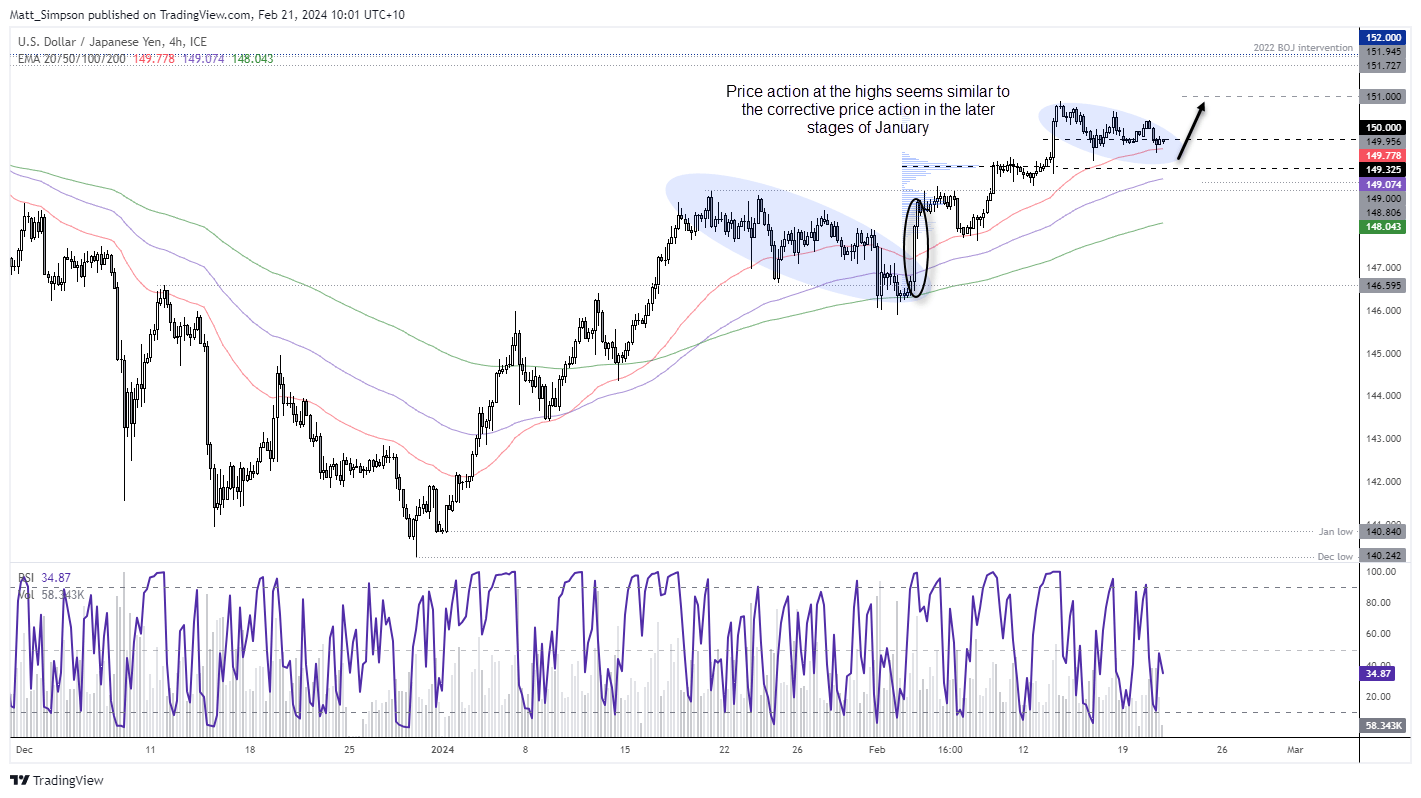

USD/JPY technical analysis (4-hour chart)

The 4-hour chart shows that USD/JPY is trading within a similar pattern to the retracement seen at the later stages of January. Note that the EMAs are fanning out in the correct bullish sequence, and retracements have been shallow during its strong bullish trend. Perhaps we'll see a dip lower at the Tokyo open, but I'd prefer to seek dips than short personally. Ultimately, USD/JPY is preferred on a 'buy the dip' basis. But the closer we get to the BOJ intervention highs / 152, the greater the odds that the market will want to naturally snap back like it did in November.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade