US futures

Dow futures +0.6 % at 34900

S&P futures +0.53% at 4560

Nasdaq futures +0.56% at 15125

In Europe

FTSE +0.1% at 7546

Dax +0.45% at 14490

Euro Stoxx +0.7% at 3931

Learn more about trading indices

Stocks jump, oil drops

Stocks are set to open higher after steep losses in the previous session and the previous quarter.

The new quarter is starting off on the front foot as peace talks resume, after stalling earlier in the week, and as the market digests the latest jobs data.

The US non-farm payroll report revealed that 431k jobs were added in March, slightly below the 490k forecast. However, the February report was upwardly revised to 750k.

The unemployment rate dropped by more than forecast to 3.6% down from 3.8% and wages grew at 5.6% YoY, up from 5.2% in February and above the 5.5%.

The data points to a tight labour market supporting expectations of a more hawkish Fed and support a 50 basis point rate hike from the Fed when they meet in May. Following the release, the USD rose, as did stocks, suggesting that the markets aren’t afraid of a more hawkish Fed.

In corporate news:

Automakers Ford and General Motors will be in focus after both firm decided to halt production in their Michigan factories owing to the global chip shortage.

GameStop will is trading 13% higher pre-market after announcing plans for a stock split late on Thursday.

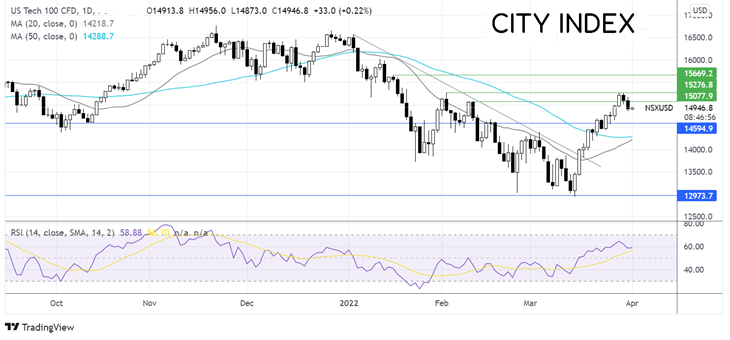

Where next for the Nasdaq?

The Nasdaq extended its rebound from the 12950 low, recapturing the 20 & 50 sma, before running into resistance at 15250. After two attempts to break this level, the prices slipped low finding support at yesterday’s low of 14850. The bullish RSI combined with the 20 mas about to cross above the 50 sma keeps buyers optimistic. Immediate resistance can be seen at 15050 high 9 February, ahead of 15275 the February high. Immediate support can be seen at 14600 a level which has offered support and resistance on several occasions across the past 6 months. A break below here exposes the 50 sma at 14280.

FX markets USD rallies, EUR trades lower.

USD is rising after the jobs data and after strong gains yesterday. US data supports a hawkish move by the Fed.

The euro trades lower despite record inflation. Eurozone inflation hit 7.5% YoY in March, up from 5.9% and ahead of forecasts of 6.6%. The data could prompt the ECB to move sooner to hike rates

GBP/USD is falling as manufacturing PMI being downwardly revised to 55.2, from 55.5, marking the slowest manufacturing activity growth in 13 months.

GBP/USD -0.2% at 1.3122

EUR/USD -0.2% at 1.1104

Oil drops 5%

Oil prices fell 7% yesterday and are extending those losses again today. Oil prices are set to drop 12% across the week after booking 8% gains in the previous week. This would mark the biggest loss in oil over 2 years.

Oil has slipped back to $100 after the US announced that it could release 1 million barrels a day into the market over the coming 6 months. The steady supply back into the market has soothed supply fears which sent oil surging at the start of the war. However, it is still short of the 3 million barrels a month from Russia which are shut out from the market.

The move comes after OPEC+ kept wit their previously agreed plan, increasing output by 430,000 per day in May.

WTI crude trades -0.6% at $98.70

Brent trades -0.3% at $103.90

Learn more about trading oil here.

Looking ahead

15:00 ISM Manufacturing PMI

18:00 Baker Hughes rig count

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.