US futures

Dow futures +1 % at 32060

S&P futures +1.4% at 3986

Nasdaq futures +2% at 12186

In Europe

FTSE +1.7% at 7364

Dax +1.5% at 13957

Euro Stoxx +1.8% at 3676

Learn more about trading indices

US stocks are rising from 18-month lows hit in the previous session. With no fresh catalyst, this is unlikely to be a reversal in risk sentiment but more a short-covering heading into the weekend at the end of a very volatile week.

Fears of rising inflation, tighter monetary policy, and slowing economic growth have plagued the markets this week after US inflation slowed by less than expected, fuelling expectation for a long road to reining in inflation. Once again, Fed Chair Powell pushed back on the prospect of a 75 basis point rate hike.

US consumer confidence is expected to show that morale dropped in May to 64, down from 65.2 in April. However, so far, deteriorating consumer sentiment hasn’t translated into a change in consumer habits. US retail sales are due next week, and the expectation is for sales to tick higher, even as inflation sits around a 40-year high.

In corporate news:

Twitter trades over 10% lower after Elon Musk said that the $44 billion deal was on hold. It’s impossible to get inside Elon Musk’s head but could the sharp drop in the Tesla share price and, more broadly, the stock market sell-off be part of the reason?

More news on the stocks to watch

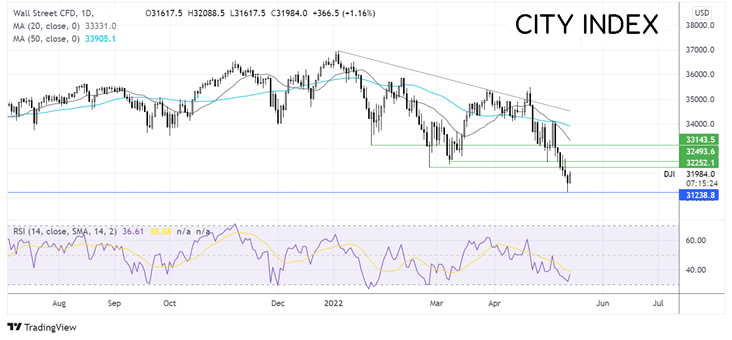

Where next for the Dow Jones?

The selloff in the Dow appears to have found a floor for now at 31250 yesterday’s low, although the price would need to rise above 32250-32500 resistance to create any hope of pushing higher. The long wick on yesterday’s candle suggests that there was little acceptance for the price at the lower levels. However, sellers could focus on 20 sma crossing below the 50 sma in a bearish signal and the bearish RSI. Sellers need a break below 31630 today’s low and yesterday’s low of 312450 to create a lower low.

FX markets USD steadies at 20 years high

USD is holding steady after rising to fresh 20-year highs in the previous session. The USD is being driven higher on a perfect cocktail of hawkish Fed bets and safe-haven flows amid the fear of what an aggressive Fed could mean for economic growth.

USD/JPY – The yen was the top-performing currency yesterday; however, dovish comments from the BoJ overnight, despite signs of higher inflation over the medium term, have dragged the currency lower today, lifting USDJPY from its two week low.

EUR/USD is holding steady below 1.04 as bears pause for breath following yesterday’s heavy selloff. Eurozone industrial production fell by less than expected in March at -1.8% MoM, down from 0.7% in February but better than the 2% forecast.

GBP/USD -0.13% at 1.2190

EUR/USD +0.01% at 1.04370

Oil rises but is set for weekly declines.

Oil is rebounding higher on Friday but is set for a weekly loss, the first in three weeks, as anxieties over the demand outlook overshadow supply-side worries.

Fears over inflation, tighter monetary policy, and its impact on global growth, plus ongoing lockdowns in China, knocked prices lower across the week. The fact that the EU is also struggling to get the ban on Russian oil approved has undoubtedly played a role in lowering oil prices. Obstacles remain to the deal, and time will tell whether they can be overcome.

COVID cases and the ongoing lockdown in China remains a key factor for the oil demand outlook. However, the one step forward and two steps back nature of treating Omicron with zero-tolerance means that there is still no natural end in sight.

WTI crude trades +1.7% at $106.78

Brent trades +1.3% at $108.74

Learn more about trading oil here.

Looking ahead

15:00 Michigan consumer confidence

18:00 Baker Hughes oil rig count

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade