US futures

Dow futures +0.8 % at 33450

S&P futures +1.42% at 4243

Nasdaq futures +1.9% at 13240

In Europe

FTSE +0.6% at 7437

Dax +1.8% at 14020

Euro Stoxx +0.24% at 3730

Learn more about trading indices

GDP contracts

US stocks are set to jump higher on the open with the Nasdaq outperforming its peers following an encouraging update from Facebook owner Meta, which is overshadowing weaker than forecast GDP data.

The US economy contracted by -1.4% Q1 on an annualized basis, this was down from the 6.9% recorded at the end of last year and below the 1.1% growth forecast. This eas the first contraction since 2020 amid a widening trade deficit and lower government spending. The markets have barely treated and that’s because the consumer side to the economy is still holding up well, with solid household demand and business investment.

In corporate news:

Meta is trading firmly higher pre-market after calming market fears and returning to user growth. The stock trades over 15% higher, despite posting its slowest revenue growth in over a decade.

Heading into earnings season the market seemed particularly nervous about how companies would hold up, and broadly speaking the numbers have been broadly speak encouraging. The market seemed to be bracing itself for some really disappointing numbers from Meta, sending the stock down some 48% from the start of the year. The relief that this appears to be more of a bump in the road rather than the start of a worrying new trend has lifted the stock 17% pre-market.

More news on the stocks to watch

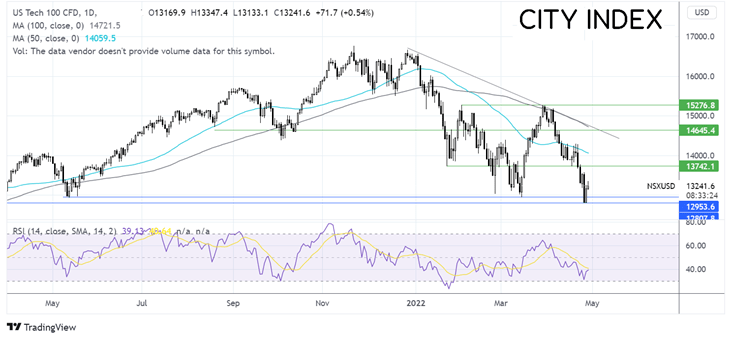

Where next for the Nasdaq?

The Nasdaq ran into resistance at the 100 sma before rebounding lower. The break below the 50 sma combined with the bearish RSI are keeping sellers optimistic of further downside. The price found support at 12800 and has since moved higher, but sellers will be looking for a move below support at 13000 ahead of 12800. A break below this level will create a lower low and could see sellers gain momentum. On the flipside, buyers will be looking for a move over 13750 to expose the 50 sma at 14050.

FX markets USD rises, and EUR falls to a five-year low.

USD is extending gains, with USD bulls showing few signs of slowing, The US Dollar index rose to a 5 year high, boosted by a combination of safe haven flows and higher interest rate expectations.

GBP/USD has fallen below 1.25 to a fresh 18 month low on US dollar strength and amid concerns over the outlook for the UK economy. Company insolvencies in the UK hit a 10 year high in Q1 as COVID support was withdrawn.

EUR/USD is extending losses for a sixth straight session amid the escalation of Russian- EU energy crisis. Higher energy prices come after Germany slashes it growth outlook, fearing the cost of living crisis could spark a recession. German inflation shows no signs of slowing, rising to a record 7.4% YoY in April.

GBP/USD -0.9% at 1.2435

EUR/USD -0.6% at 1.0493

Oil remains steady for another session

Oil prices are holding steady for a second straight session as investors continue to weigh up both supply and demand concerns. Whilst concerns over Russian supply are keeping the bulls engaged, fears over further lockdowns in China and the impact on the demand outlook mean sellers are offsetting buyers right now.

It would take a move by the EU to restrict Russian oil imports to really drive prices higher again. After the ramping up of tensions between Russia and the EU this week, that timeline could have been moved forward.

Data released yesterday revealed that crude oil stock piles rose by 692,000 barrels per week, below forecasts but inventories for jet fuel smf diesel fell to the lowest level since May 2008.

Looking ahead, OPEC meet next week. However, the group is not expected to raise output at a faster pace than that already agreed. The groups consider the shortage of oil supply to be a geopolitical issue rather than a supply issue.

WTI crude trades -0.3% at $101.20

Brent trades -0.4% at $104.52

Learn more about trading oil here.

Looking ahead

N/A

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.