US futures

Dow futures -1% at 31780

S&P futures +0.5% at 3911

Nasdaq futures -0.75% at 12650

In Europe

FTSE -1.58% at 7368

Dax -2.32% at 14858

- Bank worries return

- The market expects a rate cut in June

- EUR/USD drops almost 1% on recession fears

- Oil tumbles on delayed SPR refill

Learn more about trading indices

CS & UBS to be investigated by DoJ

US futures are falling in risk of trade amid renewed concerns over the banking sector. reports that Credit Suisse and UBS are among lenders that are being investigated by US Justice Department to see whether the banks helped Russian ugly arks evade sanctions. Deutsche Bank has also seen its share price slump by over 10% as contagion fears continue to grips the market.

Deutsche Bank said it would redeem a Tier 2 subordinated bond early, well this move is usually in order to bring confidence the sell off suggests that it has done quite the opposite.

The renewed turmoil in the sector has fueled the safe haven trade and raised bets that major central banks won't be able to tighten monetary policy much further. Demand for bonds has jumped pulling yields lower.

Earlier today the market was fully pricing in at 25 basis point rate cut by June even though fed chair Jerome Powell insisted earlier this week that rate cuts were not the base case for the Federal Reserve

Corporate news

Deutsche Bank is falling over 10% pre market after a record surge in fit it's credit default swaps meaning the cost of insuring against the risk of default surged.

block formerly known as square is falling pre market adding to 15% losses yesterday after short sellers Hindenburg research accused the firm of lax compliance and avoiding regulation.

Chevron ExxonMobil are both falling sharply as crude oil prices slumped to the lowest level in a week as the USA government said that it would take years to refill strategic reserves.

Where next for the Nasdaq ?

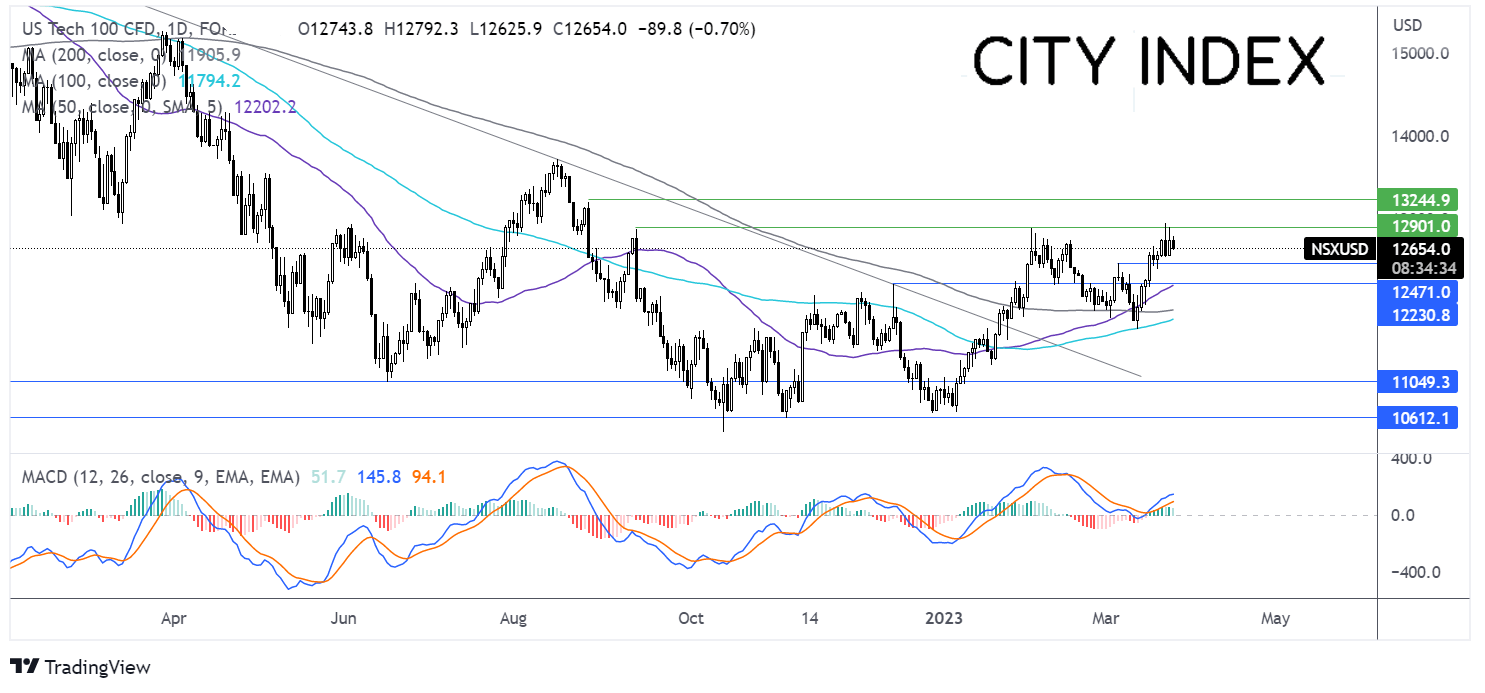

12950 proved to be a difficult level to cross this week and the NASDAQ has eased back to current levels around 12650. The rise above resistance at 12465, in addition to the bullish RSI and the golden cross signal with the 50 sma crossing above the 200 sma, keep buyers hopeful of further gains. Sellers could look for a move below 12550 yesterday’s low to test 12460 the March 6 high. A fall below here exposes the December high at 12215. Buyers need to rise above 12950 to create a higher high and bring 13200, the August 26 high, into play.

FX markets – USD falls, GBP rises

The USD is rising on safe haven flows, even as U.S. Treasury yields fall lower. ongoing banking woes and rising recession fears see investors favouring safe havens such as the USD and the JPY.

EUR/USD is falling despite upbeat PMI data from both Germany and the eurozone. instead safe haven flows are dominating market movements as concerns over another financial crisis in the eurozone ramp up. Composite PMI data for the eurozone rose to 54.1 up from 52 and ahead of forecasts of 51.9.

GBP/USD is falling in risk off trade and as investors digest stronger than expected UK retail sales but a slightly weaker composite PMI. retail sales surged 1.2%MoM in February, after an upwardly revised 0.9% in January. strong sales could be considered inflationary and will keep pressure on Bank of England to raise interest rates again. The composite PMI eased to 52.2 down from 53.1.

EUR/USD -0.9% at 1.0791

GBP/USD -0.6% at 1.2272

Oil tumbles on recession fears & demand concerns

Oil prices are tanking, dropping over 5% across the past two sessions in risk of trade as banking shares in Europe tumble and after EU S energy secretary Jennifer granholm said that replacing US strategic oil reserves could take years.

A turmoil in the banking sector continues recession fears are rising which is bad news for the oil demand outlook. furthermore the lack of crude buying for refilling spr is makes it a double whammy for the oil demand outlook.

this leaves China to do the heavy lifting, which is helping to limit losses. demand in China the world largest importer of oil is expected to continue ramping up as the country reopens.

WTI crude trades -3.5% at $67.45

Brent trades at -3.4% at $73.30

Learn more about trading oil here.

Looking ahead