USDJPY falls ahead of US GDP data

USD/JOY is falling for a third straight session, hitting a weekly low during the Asian session. While the yen continues to find support from expectations of a hawkish pivot from the BoJ in the coming months, the greenback trades under pressure as the Fed is expected to slow its pace of rate hikes in the upcoming meetings.

Prior to the Fed meeting next week, the market is focused on today’s Q4 GDP data and tomorrow’s core PCE inflation figures for clues. US GDP is expected to show that growth slowed in Q4 to 2.6%, down from 3.2% in Q3.

Slowing growth and cooling inflation tomorrow could support the Fed adopting a less hawkish stance and pull the USD lower.

Looking further ahead, Japan inflation data is due later and is expected to show that inflation rose to 4.4% YoY in January, up from 4%.

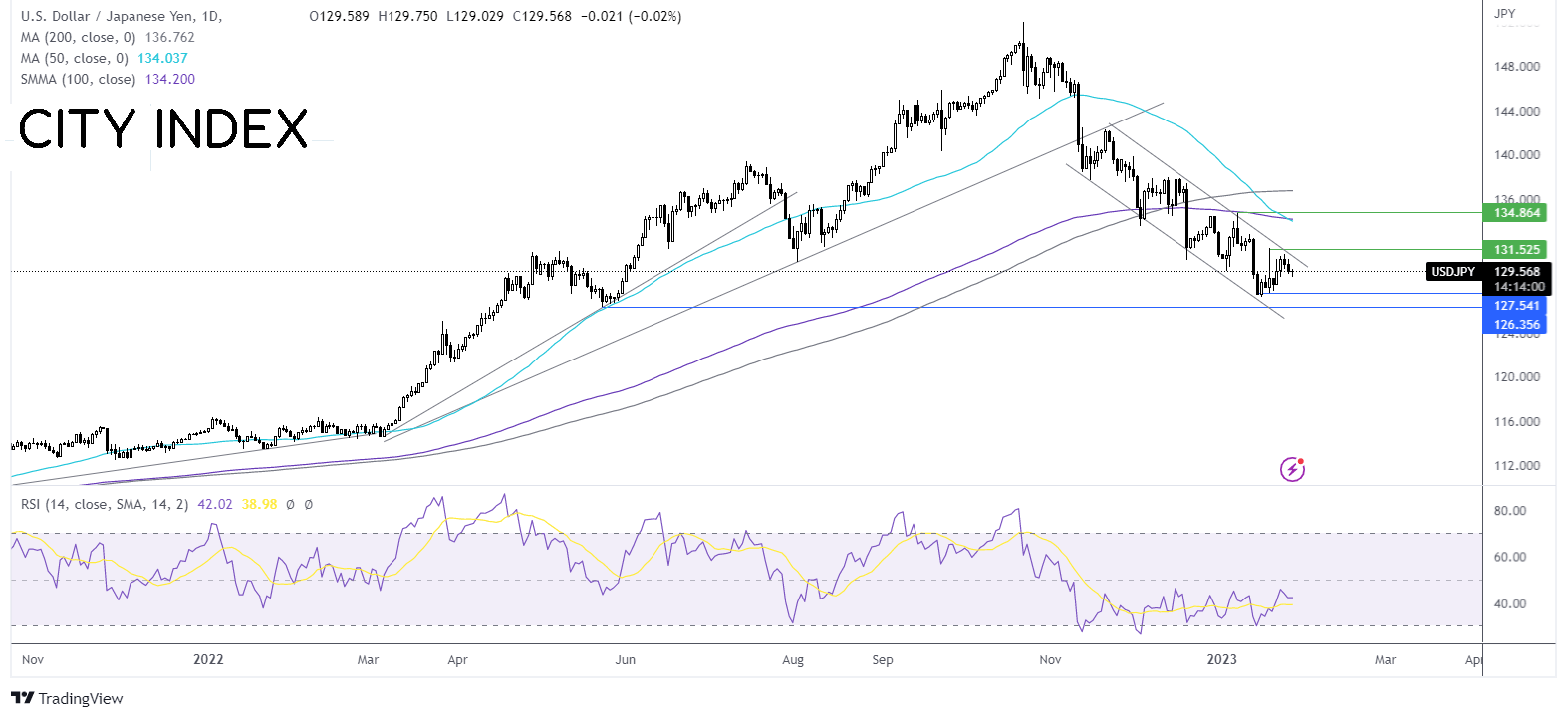

Where next for USD/JPY?

USD/JPY trades in a falling channel dating back to early November. The 50 sma has crossed below the 200 sma and is crossing below the 100 sma in a bearish signal. This, along with the RSI below 50, keeps sellers hopeful of further downside.

Sellers will look for a fall below 127.50, the 2023 low, to extend the bearish trend towards 126.35, the May low.

Meanwhile, buyers will look for a rise above 130.90, the falling trend line resistance, to extend gains towards 131.600, last week’s high. A rise above here creates a higher high.

DAX rises on hopes of a soft landing

After Asian stocks rose to a fresh 7-month high overnight, Europe is heading for a stronger open.

While European earnings are still in the early stages, results have so far suggested that the eurozone economy could hold up better than initially feared.

Recent data from Germany and, more broadly, from the bloc, such as PMIs and German IFO business sentiment, have also suggested that things are not as bad as feared.

Add into the picture China re-opening and the prospect of slower interest rate hikes in the US are adding to the upbeat mood.

With no high-impacting European data due today, attention will be on the US Q4 GDP data and of course, any response from Moscow over news that Germany and the US are sending tanks to Ukraine to help with the war efforts. Rising geopolitical tensions could keep a lid on risk sentiment.

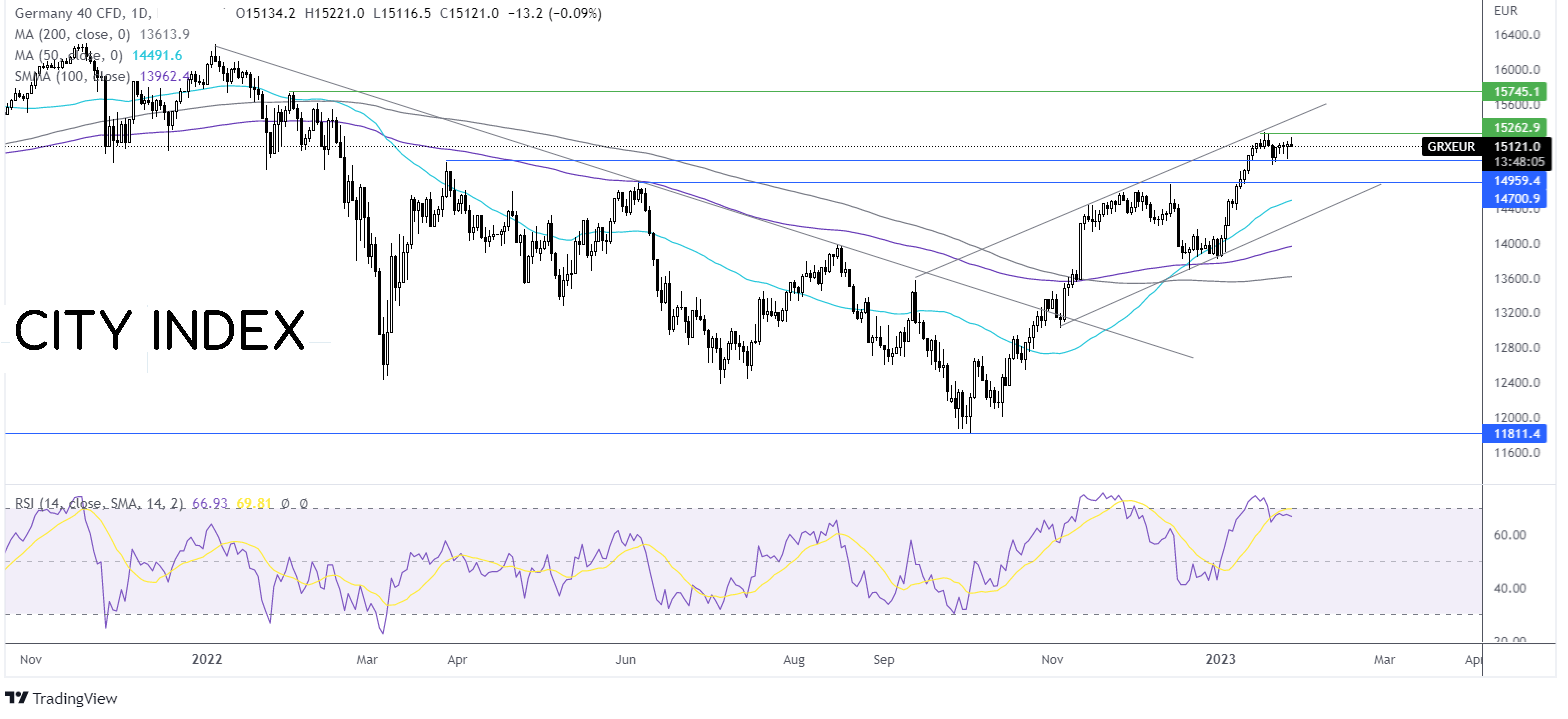

Where next for the DAX?

The DAX trades within a rising channel since early November. The index ran into resistance at 15200 and has been consolidating around this level.

The RSI supports further gains while it remains out of the overbought territory. The 50 sma has also crossed above the 100 & 200 sma in a bullish signal.

Buyers will look for a rise above 15200 to extend gains towards 15470, the upper band of the rising channel, and 15745, the February high.

On the downside, sellers could look for a move below 14930, the March high and weekly low, to bring 14480 into focus the June and December high.