FTSE looks to the Spring Statement

FTSE is set to open higher, extending gains from the previous session as banking woes ease, after encouraging data from China and as investors look ahead to the UK Budget.

A rapid response from the Fed and US regulators means that fears of contagion and a possible financial crisis in the US have faded.

Adding to the improved market mood, China retail sales rebounded strongly in February, and industrial production grew, albeit at a slower pace than forecast. Still, the data points to a broad-based recovery in the world’s second-largest economy.

Looking ahead, the Chancellor is expected to focus on growth as the UK economy’s recovery from Brexit, the pandemic, and double-digit inflation lags behind that of its peers.

The Chancellor is expected to announce measures to encourage workers into back into the workforce, higher defence spending, and the OBR growth forecasts could be upwardly revised.

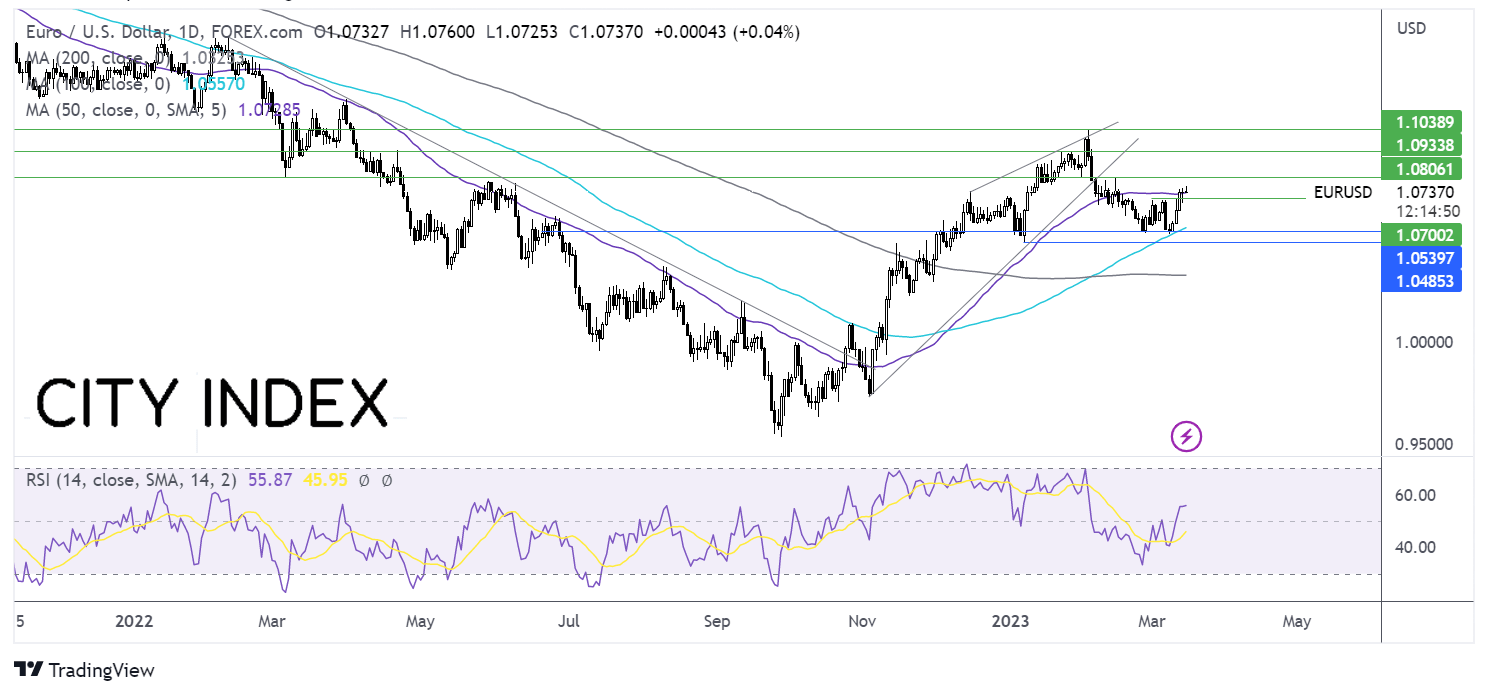

Where next for the FTSE?

After falling aggressively below the 100 & 50 sma, the FTSE found support at 7510.

The price is attempting a rebound from the 10-week low and is testing the 100 sma, which it needs to rise above in order to extend the recovery towards 7676 the April high, and 7830 the 50 sma.

Should sellers successfully defend the 100 sma, they could look to test 7510 with a break below here, creating a lower low.

EUR/USD eases from monthly high, US retail sales in focus

EUR/USD has pulled back from its monthly high of 1.0770 reached earlier in the week. After four straight days of gains, the pair is struggling for direction in early trade, with investors waiting for eurozone industrial production data and US PPI and retail sales for further clues.

The pair has broadly been supported by bets of a less hawkish Fed amid the fallout from the SVB collapse. The market is now expecting a 25 basis point hike next week, down from 50 basis points just a week ago.

Meanwhile, the ECB is expected to raise rates by 50 basis points tomorrow taking the lending rate to 3.5%.

Today investors will look to industrial production, which is expected to rise 0.4% MoM in January, after falling -1.1% in December. Upbeat data could raise hopes that the eurozone could avoid a recession.

Looking ahead to the US session, retail sales are expected to slip -0.3% MoM, after jumping 3% last month. Meanwhile, PPI is expected to cool to 5.2% YoY, down from 5.4% in January. Cooling PPI could point to a further cooling in CPI.

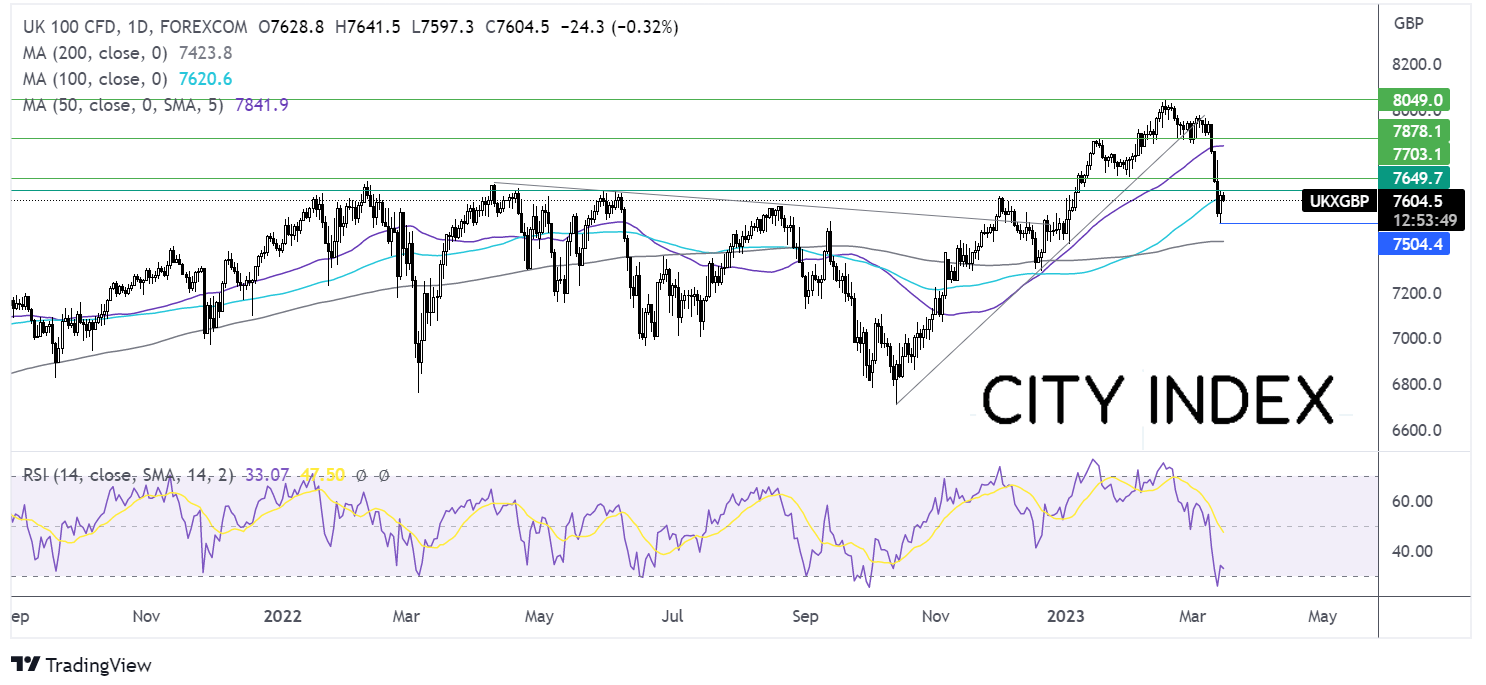

Where next for EUR/USD?

EURUS has rebounded from the 100 sma, and is testing resistance at the 50 sma at 1.0725. The RSI is keeping buyers hopeful of further upside.

A rise above the 50 sma is needed to extend the upside to 1.08 the February 14 high.

On the flipside, failure to retake the 50 sma could see the price slip back towards 1.0550, the February low. A break below here creates a lower low.