- The Santa Claus Rally describes the historical tendency of the stock market to climb during the last five trading days of the year and the first two of the new year.

- Studies have shown that the Santa Claus Rally exists across different global stock markets and geographies.

- A range of theories have been proposed to explain the Santa Claus Rally, including general optimism around the holidays, a preponderance of retail traders, and the investment of holiday bonuses.

What is the Santa Claus Rally?

The Santa Claus Rally (SCR) refers to a recurring seasonal pattern in the stock market, typically seen during the festive period at the end of December and into early January. This phenomenon, where stock prices have historically rallied more than any other time of the year, has intrigued both casual observers and seasoned analysts.

The Santa Claus Rally: Historical Track Record

Coined by Yale Hirsch in 1972 in the Stock Trader’s Almanac, the Santa Claus Rally describes the historical tendency of the stock market, particularly the S&P 500, to climb during the last five trading days of the year and the first two of the new year.

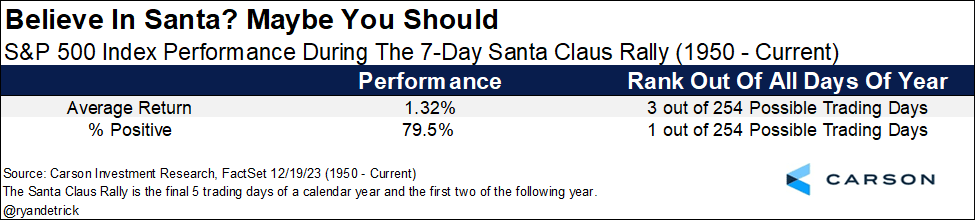

According to Ryan Detrick at Carson Research, these 7 days are more likely to be higher than any other 7 trading days of the year, with the S&P 500 up nearly 80% of the time with an average return of 1.32%, going back to 1950.

Source: Carson Research

There is also some evidence that the Santa Claus rally could have implications for the entire next year. Going back to 1950, if the S&P 500 falls during the last five days of one year and the first two days of the following year, it has historically only returned 5.0% in that next year (vs. 9.1% in all years and 10.2% when the index rallies over the Santa Claus Rally period).

Broadening out beyond just the S&P 500, a 2015 study in the Journal of Financial Planning introduced a more rigorous approach by looking at the price action in three major US indices - the Russell 2000, S&P 500, and Nasdaq Composite – and by examining returns from 15 other developed countries, including predominantly Christian and non-Christian nations alike. The study confirmed the global existence of the SCR, implying that its not just a historical fluke.

While the historical track record is impressive, it's important to acknowledge that the historical tendency for stock markets to rally around the end of the year and the start of the next year is just that: a tendency. There is no guarantee of positive or negative returns over any period, and factors beyond a single seasonal bias will impact markets moving forward.

What Drives the Santa Claus Rally? Not Reindeer!

A range of theories have been proposed to explain this end-of-year uptick.

One popular theory is that the holiday season's general optimism positively impacts investors' sentiments, leading to bullish market behavior. Another suggests that institutional investors, who typically settle their books at the end of the year, step back during this time, allowing retail investors to have a more significant influence. The infusion of holiday bonuses into the market and the slowing down of tax-loss harvesting activities are also considered contributing factors.

While we’re unlikely to ever know exactly what has driven the Santa Claus Rally, the range of plausible explanations above suggests it may be more likely to persist into the future.

The Santa Claus Rally: What You Need to Know

In conclusion, the Santa Claus Rally is more than just a quirky market anomaly; it's a window into the complex interplay of market forces, investor psychology, and seasonal trends. While it's an interesting aspect to consider, wise traders will view it as part of a broader market backdrop, ensuring that any trades align with their preferred indicators and strategy. As with all market trends, it's essential to approach the Santa Claus Rally with a balanced perspective, informed by historical data but grounded in sound trading principles.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX