S&P 500, DJIA Key Points

- Leap Day – February 29th – has various impacts on financial markets, especially when it comes to calculating bond yields and normalizing quarterly earnings for stocks.

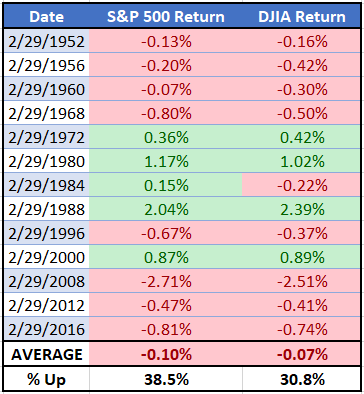

- Since 1950, the S&P 500 and DJIA have seen relatively weak performance on Leap Day, with an average decline of -0.1%.

- US stock markets have risen on roughly 35% of Leap Days, well below the long-term average.

The 2000+ Year History of Leap Day

The origins of “Leap Day” – February 29th – trace back more than 2000 years to the ancient Roman calendar reform under Julius Caesar in 45 BCE. Recognizing that a year is slightly longer than 365 days, Caesar, with the aid of astronomer Sosigenes, added an extra day every four years to align the calendar with the Earth's orbit around the Sun, marking the official inception of leap years.

However, the Julian calendar overcompensated slightly, leading to the gradual misalignment of dates with seasons. This discrepancy was rectified by the introduction of the Gregorian calendar by Pope Gregory XIII in 1582, which refined the leap year formula and established the more accurate system still in use today, where a year is a leap year if it is divisible by four, except for end-of-century years which must be divisible by 400. This adjustment ensures that the calendar remains in close synchrony with the astronomical year.

How Does Leap Day Impact Financial Markets?

Leap years can introduce subtle but noteworthy variations in financial markets, particularly within the bond market and corporate earnings. Firstly, the addition of an extra day affects the calculation of interest for bonds and fixed-income securities: in leap years, the accrual of interest incorporates this additional day, slightly altering the yield to maturity (YTM) for existing bonds. Specifically, for bonds where interest is calculated based on the actual number of days in a year, holders might observe a minor increase in interest income due to the extended period. While typically marginal, this adjustment can influence bond pricing and investor returns, especially in markets sensitive to interest rate fluctuations.

Furthermore, leap years can subtly impact corporate earnings reports, especially for the first quarter. The extra calendar day can lead to an incremental increase in quarterly earnings due to an additional day of operations, sales, or productivity. Analysts and investors often anticipate this variance; however, it can still lead to temporary market movements as the actual versus expected earnings are reconciled. Though not necessarily dramatic, traders should be aware of the ways that Leap Day can impact financial markets.

S&P 500, DJIA Analysis: How Does the Stock Market Perform on Leap Day?

To avoid burying the lede, US stock markets have tended to perform worse than usual on Leap Day.

With the obvious caveat that no two market environments are the same, especially when you’re looking at performance on just one day out of 1500, the historical returns on Leap Day have been unimpressive to say the least. As the table below shows, the average Leap Day returns for the S&P 500 and Dow Jones Industrial Average (DJIA) have been around -0.1% on average since 1950, compared to an average daily return on all days of 0.035%:

Source: TradingView, StoneX

These returns are about in the 40th percentile of all daily returns over the last 70+ years. With a sample size of only 13 occurrences since 1950, the difference in returns is not necessarily statistically significant – for statistically-minded traders, the T-stats are -0.42 and -0.33 for the S&P 500 and DJIA respectively – but it’s still worth being aware of the potential for lower than usual stock market returns on Leap Day.

Looking at the frequency of “up” days, Leap Day has only seen gains 38.5% and 30.8% of the time since 1950. For those who are more inclined to track the recent trends, US stock indices have fallen on each of the last three Leap Days, including a brutal -2.5%+ decline for both the S&P 500 and DJIA in 2008.

Acknowledging the obvious sample size limitations of this analysis, there’s at least some statistical evidence that the stock market has tended to underperform on Leap Day, so bulls may want to exercise caution, especially after US indices strong performance over the last month (and indeed last four months!).

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX