Summary the January labour force statistics report

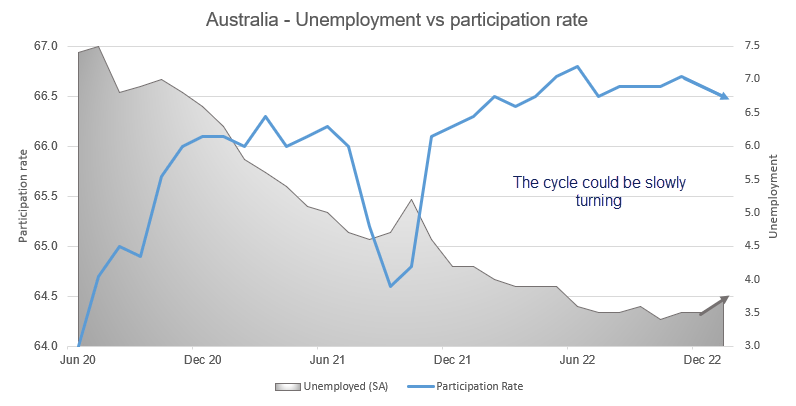

- Unemployment rose to an 8-month high of 3.7% (3.5% exp)

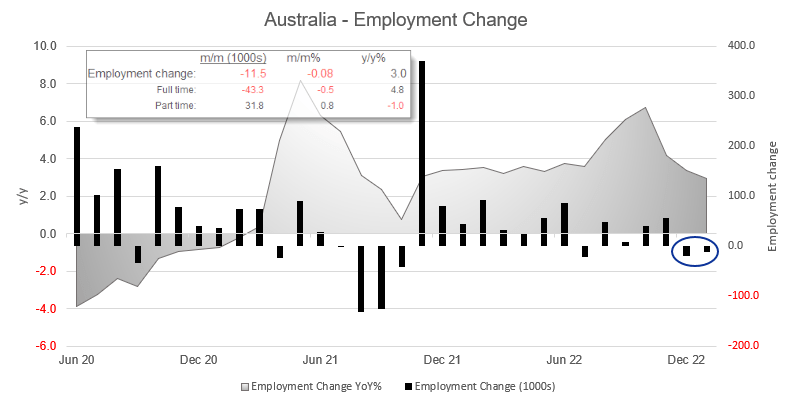

- Employment change was -11.5k m/m (second consecutive decline)

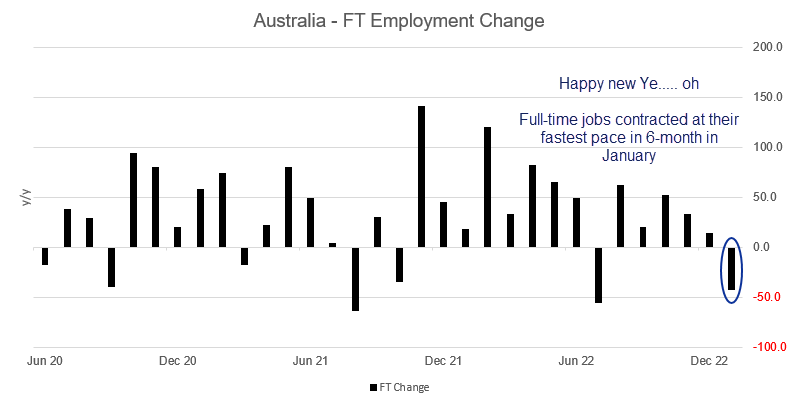

- FT employment fell -43.3k (worst month since July)

- Participation rate fell to 65.5 (6-month low)

- It shows the economy is slowly cooling, not fast enough to justify an RBA pause (yet)

December’s employment report raised a few eyebrows, as it was the first in a while to miss expectations and prompted us to question whether cracks were appearing in the economy. January’s report suggests there are.

Unemployment unexpectedly rose to 3.7% in January - its highest level since May 2022, whilst headline employment, the participation rate and employment to population all dipped. Employment fell by -11.5k m/m (and contracted for a second consecutive month), but perhaps more alarming is that full-time jobs fell by -43.3k – its worst print in 6-months.

It may be too early to call a cyclical turning point, but it seems we can no longer walk blindly into labour force statistics on the assumption all is well. And this could be a case where bad news is good, because it suggests the economy may finally be cooling after a historic run of RBA tightening. And that has been reflected in the immediate market reaction, with AUD broadly lower on hopes of a lower terminal RBA rate. The ASX seems a little undecided as it weighs up the good and the bad of a weaker employment report versus lower rates.

The Australian economy may be cooling, but RBA hikes are still likely coming

But it should be noted that these figures are far from terrible by historical standards, and that the RBA are still likely to hike rates by 25bp in March and May.

Overall, markets are finally getting the message that the RBA mean business with rates, which saw cash rate futures imply a terminal rate of 4.1% yesterday - 50bp higher than just a couple of weeks ago. But a case could be for a higher rate still, given the Fed are still providing hawkish hikes seven months after US inflation peaked whilst Australian inflation continues to soar.

Lowe defended aggressive hikes at the Senate hearing

And Lowe successfully defended his hawkish view to the Senate yesterday, which saw bets placed on a higher terminal rate. During an early question, he twice emphasised that inflation remains too high and must come down (hawkish) whilst conceding that he did not yet know how high rates had to go and the path to a soft landing was a narrow one. Ultimately, whilst he understands the consequences of higher rates on consumers now, he argues that the pain would be more severe later if they do not act aggressively sooner.

The focus now shifts to next week’s wage price index, where the RBA are hoping there’s no imminent threat of a wage spiral like seen in the UK and elsewhere. At 3.1% y/y, wages are clearly lagging inflation but the fact remains they are trending aggressively higher – so wage spiralling cannot yet be ruled out (and could be seen as a proxy for inflation, higher rates, higher Aussie dollar and lower stock market). Rest assured we’ll take a close look at that one next week.

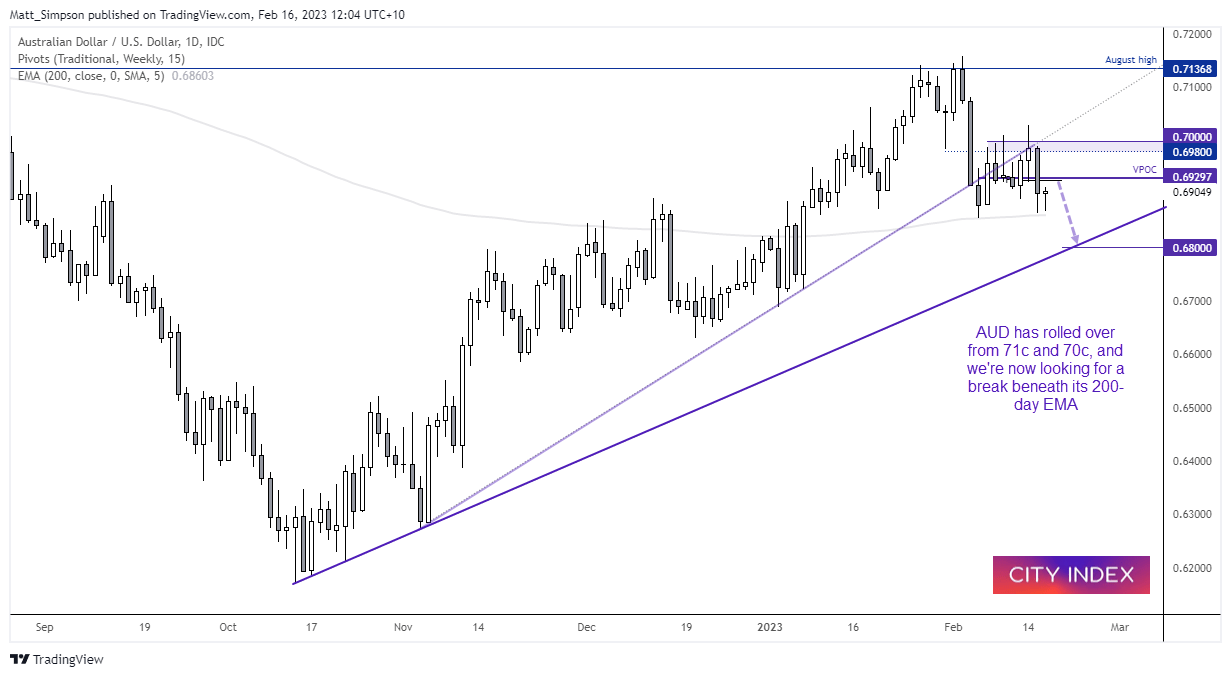

AUD/USD daily chart:

The Aussie has pulled back to its 200-day EMA which is currently providing support. But given the strong bearish momentum from its YTD high and recent ABC correction, we’re watching closely for a break beneath it and test of 0.6800.

Last week’s VPOC (volume point of control) is around 0.6930, and near the weekly pivot point. We would therefore consider fading into low-volatility retracements below 0.6960 for an anticipated move to 0.6800. The bias remains bearish below 0.7000 due to its failed attempt to break and hold above that key level.

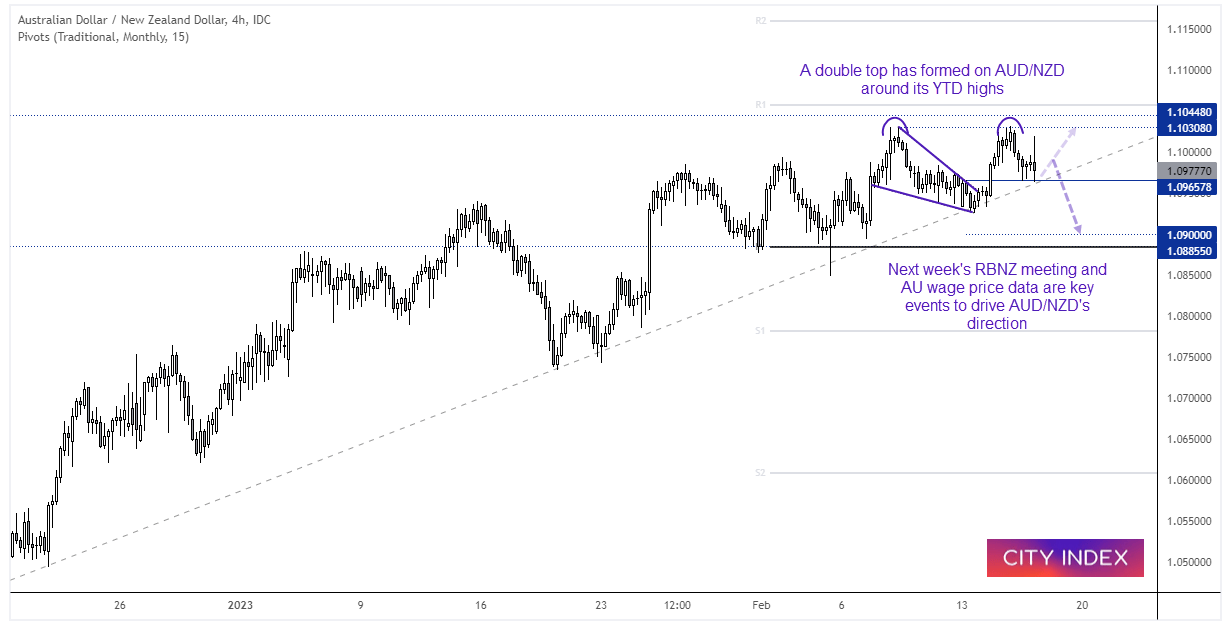

AUD/NZD daily chart

AUD/NZD reached out bullish target near the YTD highs, but now we’re questioning its potential to break lower. Prices are holding above trend support on the daily chart, but a double top has now formed and momentum has turned lower.

Next week the RBNZ announce their cash rate decision, and there are some expectations it could be a 50 or even 75bp hike. If that were to be coupled with a softer than expected AU wage report, AUD/NZD could be headed for sub-1.0900. For now, we’d take a break below 1.0965 / trend support as a sign it is headed for 1.0900.