Key takeaways

- Nasdaq 100 is currently retreating from 7-month highs

- Tesla delivered a record number of vehicles in the first quarter

- But YoY growth of 36% is behind the goal to boost deliveries by 50%

- Could encourage Tesla to cut prices further, even if it further sacrifices margins

- Tesla shares are down 2.5% in premarket trade

Nasdaq 100 retreats from 7-month highs

Nasdaq 100 futures are down 0.7% in extended hours as markets prepare to kickstart a new week, with the index retreating after closing at 7-month highs on Friday.

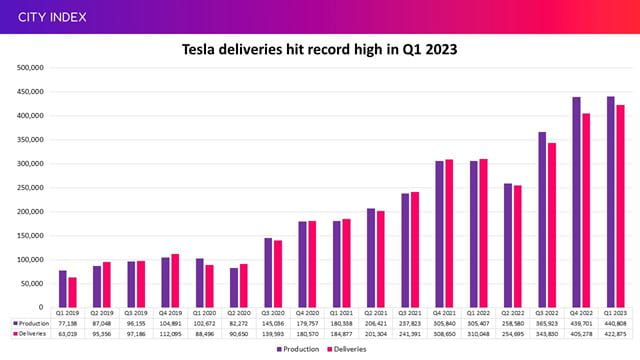

Tesla deliveries hit record high

Tesla revealed over the weekend that it produced over 440,000 vehicles and deliver 422,000 of them in the first three months of 2023. Both metrics hit a new quarterly record.

(Source: Company reports)

Notably, consensus numbers were wide-ranging for the first quarter. For example, deliveries came in ahead of the 421,164 pencilled-in on Bloomberg consensus but fell short of the 430,008 estimate from Refinitiv and the 432,000 forecast from FactSet (which in turn ranged from 410,000 to 451,000). That shows there were very different expectations across Wall Street.

The headline takeaway is that the 36% year-on-year growth in deliveries in the first quarter was behind Tesla’s ambition to grow by 50%. Plus, the progress made compared to the previous quarter has been minimal considering production was essentially flat, although news that Tesla has managed to close the gap between production and deliveries is welcome after logistical issues made it more difficult to get cars to customers. Still, the failure to hit that 50% growth target raises the pressure on Tesla to ramp things up if it is to meet that goal in 2023, having fell short of its target in recent years.

Production came in above the 432,513 estimated by analysts but will need to continue improving in the coming quarters for Tesla to achieve its ambition to produce 1.8 million 2.0 million vehicles in 2023 – which would be up in the region of 37% to 52% from the 1.3 million produced in 2022.

What does this mean for Tesla earnings?

Tesla has continued to increase output and deliveries in challenging macroeconomic conditions, but there is reason to be cautious about what the numbers mean ahead of Tesla’s earnings out later this month.

Tesla has cut prices on several occasions in the first quarter and yet we have only seen a modest improvement in sales from the previous quarter, which may raise questions about whether they are providing sufficient support to demand, especially as rivals have followed and also lowered prices.

That could encourage Tesla to cut prices further and wield its superior margin to gain ground over its rivals. CEO Elon Musk has admitted that affordability is the biggest barrier to many people pulling the trigger and purchasing an electric vehicle.

Any further cuts will hit profitability, which will come under the spotlight this year. Its margins tightened last year and this is expected to continue in 2023. Refinitiv’s consensus suggests its GAAP gross margin will come in at 22.2% in the first quarter, down from 23.8% in the fourth quarter of 2022 and from over 29% the year before.

For now, Tesla’s profitability is taking a knock from price cuts and yet there is little evidence that this strategy is leading to as big a surge in demand as markets had hoped for. The fact production continues to outpace deliveries will also continue to fuel speculation around demand this year and the first quarter figures are leaving markets worried that it will fail to hit its 50% growth target yet again in 2023.

Where next for TSLA stock?

Tesla shares are down 2.5% in premarket trade today at $202.31 as markets get their first chance to react to the production and delivery numbers today, with the stock retreating after ending last week at its highest level in over a month.

The stock could find some support around $188 considering the stock has managed to rebound from this level on multiple occasions in the past month and it is aligning with the 50-day moving average. Any drop below here opens the door to $167.50, marking the troughs we last month and last November. This is a key level that must hold to avoid bringing the lows we saw in January back into play.

On the upside, we would want to see the stock recapture the 200-day moving average in order to set a new 5-month high. This would allow it to bring the November-peak of $234 into play.

TD Cowen became one of the first brokers to adjust its target price on Tesla shares in wake of the production update, upping its view to $170 from $140. The average target price set by the 42 brokers that cover Tesla sits at $199.19, suggesting they see limited upside from current levels.

How to trade Tesla stock

You can trade Tesla shares with City Index in just four easy steps:

- Open a City Index account, or log-in if you’re already a customer.

- Search for ‘TSLA’ in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Or you can practice trading risk-free by signing up for our Demo Trading Account.