US futures

Dow futures +1.1% at 31602

S&P futures +1.18% at 3945

Nasdaq futures +0.95% at 11944

In Europe

FTSE +1.1% at 7474

Dax +1.08% at 14114

Euro Stoxx +0.6% at 3682

Learn more about trading indices

Retail earnings continue this week

Stocks are on the rise as investors look to change the tone after steep losses last week. After seven straight weeks of declines, bargain hunters are out in force, snapping up stocks after they fell to fresh 18-month lows on Friday.

Soft economic data and weak earnings, as rising input costs hit retailers’ bottom lines, raised fears of the US economy tumbling into recession. While fears of rising inflation and a hawkish Fed are nothing new, this was the first time we saw company profits taking a big hit, which spooked the market.

There is little on the economic calendar today. However, there is plenty of data due to be released across the week, which will provide further clues as to how the US economy is holding up and what the Fed is planning to do. The minutes from the latest FED meeting and US GDP data will be under the spotlight, although the key data point will be the Core PCE index, the Fed’s preferred gauge of inflation, on Friday.

For the market to stage a sustained rebound, peak inflation needs to have been priced in. A drop in PCE could help the market on an upward trajectory.

In corporate news:

More quarterly earnings from the retail sector are due this week, with the likes of Costco, Nordstrom, and Dollar General due this week. However, today the focus will be on Zoom, which will release Q1 earnings after the close.

Zoom is expected to post $0.87 a share on sales of $1.07 billion. The pandemic stay-at-home stock is now struggling to maintain the pace of growth that it saw in COVID as in-person activities resume.

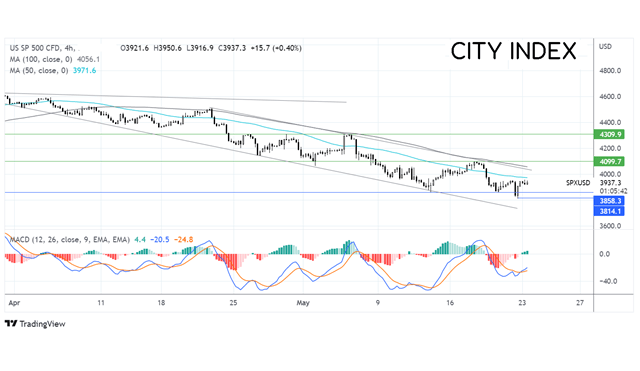

Where next for the S&P500?

The S&P has been trading within a falling channel dating back to April 21, forming a series of lower lows and lower highs. The price hit a 23-month low of 3810 on Friday and is attempting to rebound. The bullish crossover on the MACD supports further upside. However, buyers will need to break over the 50 SMA on the 4-hour chart at 3975 and the 100 sma at 4056 before attacking resistance at 4100, the mid-May high, to create a higher high. Failure to retake the 50 sma could see the price head back towards 3865, the May 19 low, ahead of 3910, the 2022 low.

FX markets – USD falls, EUR jumps.

USD is falling today, extending losses from last week. The greenback fell last week, marking the first weekly loss in 7, as doubts about the strength of the US economy emerged, prompting fears of a recession. Today the risk-on mood is pulling the USD lower as investors look to risker currencies.

GBP/USD is holding last week’s gains, trading around a two-week high on optimism surrounding Brexit and ahead of a speech by BoE’s Andrew Bailey later today. After solid jobs data, an unexpected rise in retail sales, and 9% inflation, the BoE is expected to raise interest rates further.

EUR/USD has surged higher, taking advantage of the weaker USD, and as ECB President Christine Lagarde is as good as confirmed several rate hikes across the summer. In a speech today, she said that negative interest rates would be finished by the end of Q3. Her comments came after the German IFO business climate index unexpectedly rose to 93 in May, up from 91.8.

GBP/USD +0.86% at 1.2596

EUR/USD +1.05% at 1.0680

Oil edges higher

Oil prices are edging higher, lifted by tight supply, US fuel demand, and a slightly weaker USD. However, gains are being capped by concerns over rising COVID cases in Beijing, even as Shanghai prepares to re-open.

US driving season ramps up at the end of May and usually continues until Labor Day in September. Demand is expected to be solid across this period despite surging fuel prices, with mobility data climbing in recent weeks in the US.

Gains have been limited recently by China’s ongoing zero-COVID policy and tight lockdown restrictions. These COVID restrictions have hit the economy hard and have prompted investment banks such as Goldman Sachs and JP Morgan to slash China’s GDP forecasts hurting the demand outlook.

WTI crude trades +0.8% at $110.92

Brent trades +0.89% at $111.50

Learn more about trading oil here.

Looking ahead

17:15 BoE Andrew Bailey’s speech