KEY TAKEAWAYS

- US Mexico inflation beginning to level off

- Banxico still hawkish after last meeting

- USD/MXN continues to make new lows

Mexico is one of the few countries that reports inflation twice a month. Earlier, Mexico released its Mid-month CPI for February. The headline print was 7.76% YoY vs an expectation if 7.8% YoY and a January reading of 7.94% YoY. In addition, the Core CPI was 8.38% YoY vs an expectation of 8.42% YoY and a prior reading of 8.45% YoY. Although the headline print has moved lower in four of the last five months and the Core CPI has plateaued, the prints are still too high for the Bank of Mexico. Recall that Banxico surprised the markets when it met on February 9th as it hiked rates by 50 bps, instead of the expected 25bps, to bring the benchmark rate to 11.00%. This was the first time since June that the Bank of Mexico decoupled from hiking rates the same amount as the Fed. On February 1st, the FOMC only hiked rates by 25bps.

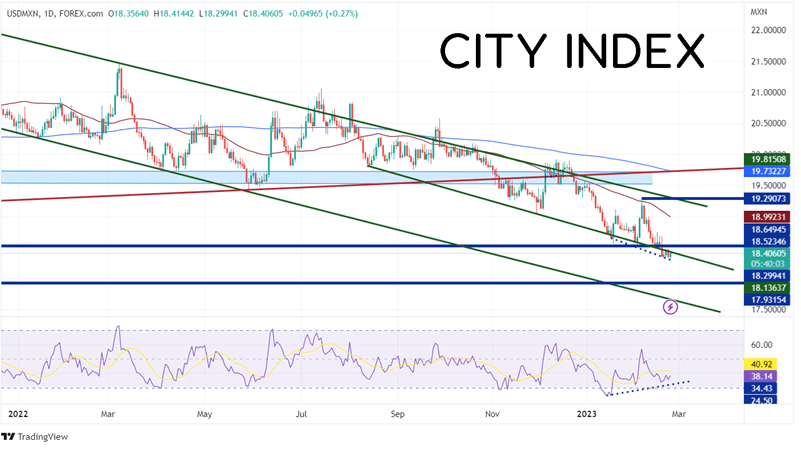

On a weekly timeframe, USD/MXN has been moving lower since the height of the pandemic in April 2020 when price reached 25.7836. The pair then pulled back and formed a base between 19.5491 and 19.7653 for the next two years, as price made lower highs. During December 2022, USD/MXN broke below an upward sloping channel dating to July 2017, and then broke the two year support range. Thus far in 2023, USD/MXN has made lower lows and lower highs, reaching its lowest level since 2018 at 18.2994.

Source: Tradingview, Stone X

Trade USD/MXN now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

On a daily timeframe, USD/MXN has formed a tighter range dating to mid-August 2022. Price was volatile within the range, but always pulled back to test the bottom trendline. In early February, USD/MXN bounced, but was held below the 50-Day Moving Average near 19.2907. Since then, price has moved aggressively lower, breaking not only the bottom trendline of the shorter-term channel, but also the lows dating back to February 2020 at 18.5235. If price is to continue lower, the next level of support isn’t until the lows from April 2018 at 17.9315 , then the bottom trendline of the larger channel near 17.6840. However, notice that the RSI is diverging with price. This indicates that price may be ready for a bounce. First resistance is at the previously mentioned February 2020 lows at 18.5235. Above there, USD/MXN can move to the 50 Day Moving Average at 18.9923, then a confluence of resistance at the February 6th highs and the top trendline of the channel near 19.2907.

Source: Tradingview, Stone X

Mexico’s mid-month CPI showed that inflation seems to be leveling off. However, the rate is still excessively high. Watch for Banixco continue to hike rates until it can bring inflation lower. The Bank of Mexico still sees inflation risks leaning towards the upside.

Learn more about forex trading opportunities.

--- Written by Joe Perry, Senior Market Strategist

Follow me on Twitter at @JoeP_FOREXcom