Looking for something specific? Jump ahead using these links.

- What is the Hang Seng Index?

- About Hang Seng Index constituents

- How often do Hang Seng Index companies change?

- How is the Hang Seng Index calculated?

- What does the Hang Seng Index price mean?

- What moves the Hang Seng Index price?

- Average annual returns of the Hang Seng Index

- Hang Seng Index market hours

- How to trade the Hang Seng Index

- How to short the Hang Seng Index

- Can you invest in the Hang Seng Index in the UK?

- Hang Seng Index companies ranked by market capitalisation

What is the Hang Seng Index?

The Hang Seng Index is the stock index currently representing around 50 of the most capitalised businesses on the Hong Kong Stock Exchange (HKSE), and is seen as a key gauge of financial market strength in Asia.

Created in 1969 with a value of 100, the Hang Seng Index is compiled, published and managed by Hang Seng Indexes Company, a subsidiary of Hang Seng Bank. The index allocates a weighting to companies by market capitalisation, similar to the UK’s FTSE 100 or the German DAX, and different from the Dow Jones, which lists companies according to its per-share price. The maximum weighting for a company on the Hang Seng Index is 10%.

In March 2021, Hang Seng Indexes announced that the index will increase the number of its constituent companies to 80 by mid-2022, and ultimately to 100 from that point.

The Hang Seng Index is not to be confused with the Hang Seng China Enterprises Index, which tracks the performance of 50 H-share Chinese mainland securities listed in Hong Kong.

About Hang Seng 50 constituents

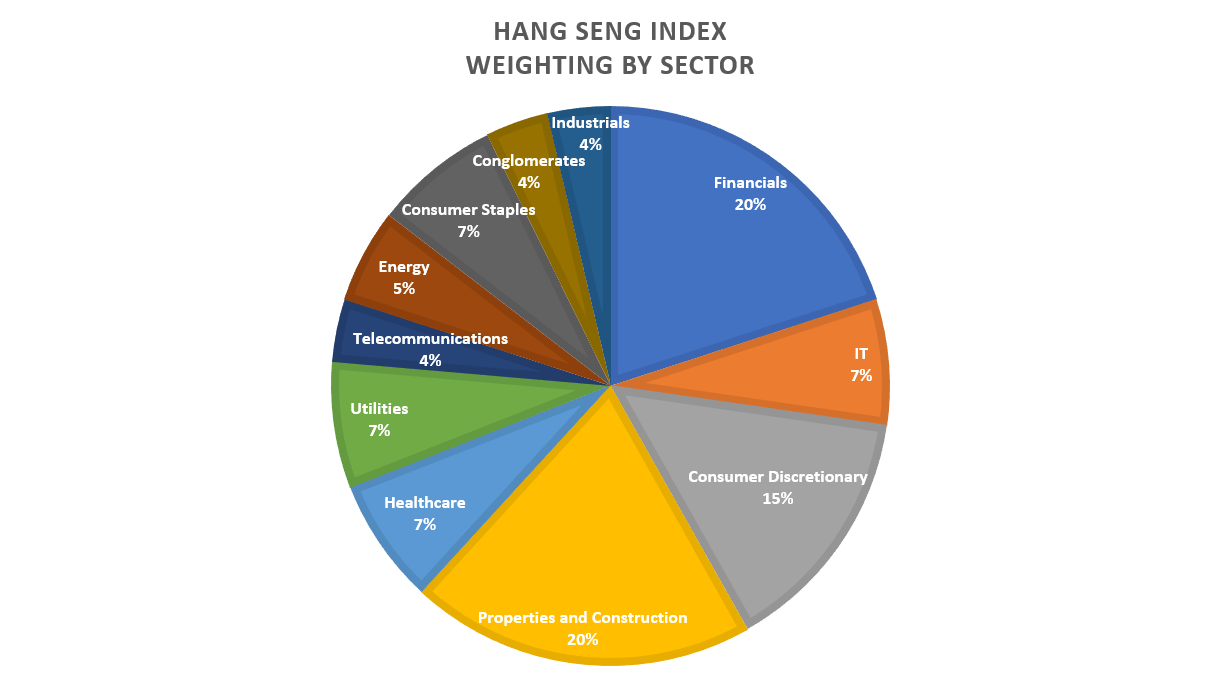

The Hang Seng Index constituents are split into the categories finance, properties, utilities and commerce and industry. The largest constituents of the index by weighting feature Chinese companies such as Tencent and Alibaba. Also among the high-profile businesses featured in the index are HSBC, which had its roots in British Hong Kong, and pan-Asian insurance giant AIA Group.

The sub-categories are divided further into a total of 12 sub-categories. Here’s how the Hang Seng Index sector composition looked as of July 6 2021, to the nearest percentage point (Source, Hang Seng Indexes). Note: the 12th category, Materials, had no representatives as of July 2021.

How often do Hang Seng Index companies change?

The Hang Seng 50 index is reviewed quarterly, and companies are admitted or omitted through analysis and external consultation. In order to be selected, a company must fit criteria based on representativeness, market capitalisation, turnover, and financial performance, and should have a listing history on the Hong Kong Stock Exchange of a minimum of three months.

How is the Hang Seng Index calculated?

The Hang Seng 50 is calculated at two-second intervals during the trading hours of the Hong Kong Stock Exchange using a free-float-adjusted equation, taking into account current prices, closing prices and issued shares. It also uses a Freefloat-adjusted Factor (FAF) and a Cap Factor (CF), which are each values between 0 and 1 and adjusted quarterly.

What does the Hang Seng Index price mean?

The price of the Hang Seng 50 indicates whether the share prices of the companies on the index are rising or falling. If the price of the Hang Seng 50 is increasing, it means that a specific company or group of companies are experiencing gains, which is reflected in the price of the overall index. Conversely, if the Hang Seng 50 price is falling, it means that companies on the index are experiencing a decline in price.

As the Hang Seng 50 ranking is based on a weighted calculation focused on market capitalisation, companies with a larger weighting will often see their share price fluctuations have a correspondingly outsized impact on the wider index.

What moves the Hang Seng Index price?

The Hang Seng price, like any stock index, is affected by a range of fundamental and technical drivers linked to the behaviour of the Hong Kong/Chinese economy, as well as international influences.

However, since the majority of the companies in the index are domiciled in mainland China, news flow and economic data from the PRC tends to influence the index more than specifically Hong Kong-based events. The US-China relationship, HK dollar strength and economic data can have a profound impact on price.

While such drivers may be expected to move the index in a certain direction, there is no guarantee that the move will play out, so traders should consider how determining factors work together rather than simply isolate any one factor. That said, here are a few of the key things to consider when trading the Hang Seng Index.

US-China relationship

The US-China relationship can be a significant driver of the Hang Seng Index. Strained US-China sentiment can exert downward pressure on the market. For example, 2018 saw a plunge in the Hang Seng Index as concerns over the US and China’s slow progress towards reaching a trade deal unsettled speculators.

Furthermore, in early 2021 Hang Seng telco stocks such as China Mobile and China Telecom were temporarily delisted from the NYSE based on perceived links with the Chinese military, sending their price down on the Hang Seng Index.

Events such as this make it worth it for traders to closely follow how the US-China relationship is unfolding on the advent of relevant news events, and how such a relationship can have a knock-on effect in commerce across regions.

HK dollar strength

The Hong Kong dollar (HKD) may be worth watching for an indication of possible Hang Seng Index moves. For example, HKD is pegged to USD in a range between 7.75 and 7.85.

In order to control banking liquidity and regulate capital inflow and outflow, Hong Kong’s central bank, the Hong Kong Monetary Authority, buys and sells the currency at either limit. Trading closer to 7.85 may hurt the Hang Seng Index due to the chance of capital outflow at that price, as seen in the Index’s losses in 2018-2019, while at 7.75 the prospect of capital inflow may buoy the index, for example like during 2014.

Socio-political events/economic data

When it comes to economic data, the Hang Seng Index traders should follow Chinese GDP figures, as well as trade balance statistics and measures of industrial production such as PMIs. In June 2021 the Hang Seng Index jumped 1.1% to 29,468 after data showed an expansion in Chinese manufacturing for the prior month, giving an insight into why such figures are worth noting.

Take a look at our economic calendar to stay up to date with all the news releases that impact your trading.

Average annual returns of the Hang Seng Index

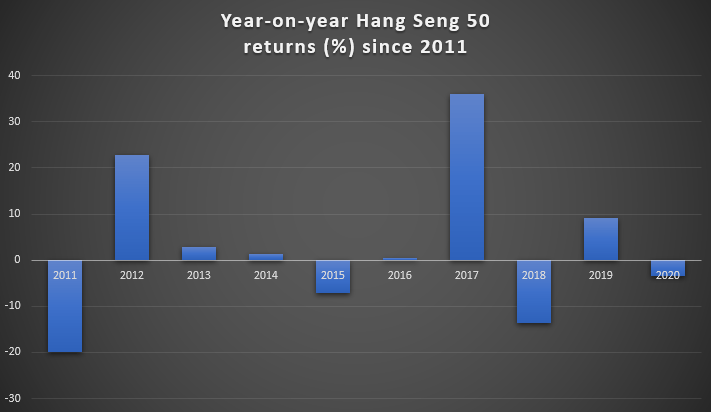

Over the last ten years, the Hang Seng Index has produced an average annual return of 2.8%. The Hang Seng’s average returns are essentially what managed funds will have earned in profit for investors over the course of a year.

You can see the yearly returns from 2011-2020 below. Remember, past returns are no guarantee of future performance. (Source: Macrotrends)

Hang Seng Index market hours

The Hang Seng 50 is open from 9:30 am to 4 pm local time on weekdays, with an hour’s lunch break at 12pm.

Read more on stock market hours.

How to trade the Hang Seng Index

There are a number of ways that you can trade the Hang Seng Index; the most common are derivatives such as CFDs, futures and options, as well as ETFs. All of these instruments enable you to get exposure to all 50 companies from a single position.

Hang Seng Index CFDs

Contracts for difference (CFDs) are derivatives that take their price from the underlying market, in this case the Hang Seng Index. As you’ll never be taking ownership of an asset, you can speculate on whether the index is going to rise or fall in value.

Learn more about CFDs.

Hang Seng Index futures

Futures contracts are agreements to exchange an asset at a set price on a set expiry date. Unlike most futures, Hang Seng contracts don’t have an underlying physical asset to exchange, as an index is nothing more than a number representing a group of stocks.

Hang Seng Index options

Hang Seng options are contracts that give you the right, but not the obligation, to buy or sell the index at a set price on a set date.

As and when the Hang Seng Index is available to trade with us via options, you’d be doing so via CFDs. Learn more about options trading with us.

Hang Seng Index stocks and ETFs

Where available, you can also trade the Hang Seng Index through ETFs, or investment instruments that hold a group of stocks – in this case, the shares of constituents on the index.

Alternatively, stocks on the Hang Seng Index can naturally be traded individually, offering an opportunity to focus on particular sectors of interest.

Find out more about share trading with us.

How to short the Hang Seng Index

Shorting the Hang Seng Index involves taking a position that the index will fall. This can be done by selling short a Hang Seng contract or shorting constituent stocks. Alternatively, traders may be interested in shorting a Hang Seng ETF, where available. For options, you can buy Put options on Hang Seng stocks if you believe them to be overvalued, or buy a Put option on a Hang Seng ETF.

Read more about shorting a market.

Can you invest in the Hang Seng Index in the UK?

You can invest in the Hang Seng Index in the UK, albeit indirectly, through a combination of ETF, mutual funds or index funds, or of course trade the security through derivatives in the methods outlined above.

Hang Seng Index companies ranked by market capitalisation

Here are the Hang Seng Index companies weighted by market cap, correct as of July 6 2021. Source: Hang Seng Indexes.

|

Rank |

Company name |

Weighting |

|

1 |

AIA Group |

9.61 |

|

2 |

Tencent |

9.37 |

|

3 |

HSBC Holdings |

8.26 |

|

4 |

China Construction Bank |

5.59 |

|

5 |

Alibaba |

5.57 |

|

6 |

Meituan |

4.75 |

|

7 |

Hong Kong Exchanges and Clearing |

4.74 |

|

8 |

Ping An |

4.07 |

|

9 |

Xiaomi |

3.88 |

|

10 |

WuXi Biologics |

3.21 |

|

11 |

Industrial and Commercial Bank of China |

3.05 |

|

12 |

China Mobile |

2.41 |

|

13 |

Bank of China |

1.87 |

|

14 |

Techtronic Industries |

1.81 |

|

15 |

Anta Sports |

1.39 |

|

16 |

Shenzhou International |

1.34 |

|

17 |

CK Hutchinson Holdings |

1.33 |

|

18 |

Sun Hung Kai Properties |

1.26 |

|

19 |

Link REIT |

1.25 |

|

20 |

China National Offshore Oil Corp |

1.22 |

|

21 |

CLP Holdings |

1.21 |

|

22 |

HK & China Gas |

1.17 |

|

23 |

Sunny Optical |

1.14 |

|

24 |

Galaxy Entertainment |

1.11 |

|

25 |

Mengniu Dairy |

1.05 |

|

26 |

Hang Seng Bank |

1 |

|

27 |

CK Asset Holdings |

1 |

|

28 |

China Life |

0.99 |

|

29 |

Geely Auto Group |

0.94 |

|

30 |

China Resources Land |

0.94 |

|

31 |

CSPC Pharmaceutical |

0.89 |

|

32 |

Bank of China Hong Kong |

0.84 |

|

33 |

Sinopec |

0.81 |

|

34 |

Sino Biopharmaceutical |

0.80 |

|

35 |

Sands China Ltd |

0.79 |

|

36 |

Longfor Group |

0.67 |

|

37 |

MTR Corp |

0.65 |

|

38 |

Ali Health |

0.63 |

|

39 |

Wharf REIC |

0.62 |

|

40 |

Country Garden |

0.61 |

|

41 |

China Overseas |

0.58 |

|

42 |

PetroChina |

0.54 |

|

43 |

Power Assets |

0.53 |

|

44 |

CITIC |

0.53 |

|

45 |

New World Development |

0.52 |

|

46 |

WH Group |

0.47 |

|

47 |

Henderson Land |

0.44 |

|

48 |

Budweiser Apac |

0.42 |

|

49 |

Haidilao |

0.38 |

|

50 |

Bank of Communications |

0.37 |