Gold and silver outlook have been supported by slumping bond yields.

Precious metals have risen for the third day thanks largely to slumping bond yields. As we have been banging on about it, gold hit a new record high above the August 2020 high of $2075 where it met supply as people took profit. However, it then started to bounce off its lows again and was hovering near $2050 at the time of writing, ahead of US jobs report. Silver, meanwhile, has broken to its highest point since mid-April, closing in on the $26 handle. With silver being about 50% away from its record high that was hit in 2011, it remains significantly overvalued relative to gold on a historical basis. Will we see a stronger showing from the grey metal moving forward?

Fed probably done, but ECB has more tightening to come

Precious metals have risen following the conclusion of two major central bank meetings. The Fed has signalled that it may have hiked rates for the last time in this cycle, while ECB President Christine Lagarde said "it's very clear that the ECB isn't pausing” its rate hikes, adding that “we have more ground to cover” in a journey which they had not arrived at the destination yet.

The dollar should remain under pressure against the euro, as the disparity between Eurozone and US monetary policies grow larger. This should keep the US dollar index undermined, and metal prices underpinned.

Like the ECB, the Fed hiked rates by 25 basis points on Wednesday as had been highly anticipated. But by removing a key line from the statement that “some additional policy firming may be appropriate,” the market has interpreted that decision as a dovish move by the central bank. While the Fed didn’t rule out further rate increases on Wednesday, Chairman Powell said interest rate cuts are not on the table because of still-high inflation. Yet, the market again challenged his views, sending the dollar and bond yields lower in the immediate reaction to the FOMC’s rate decision and press conference.

Recession concerns boosting gold outlook

Tumbling regional bank stocks and a sharp slide in crude oil prices in recent days, are both highlighting financial stability and recession risks. They are among the reasons why the market thinks there will be no more rate hikes from the Fed, and that monetary policy will be loosened later in the year, underscoring our bullish gold outlook.

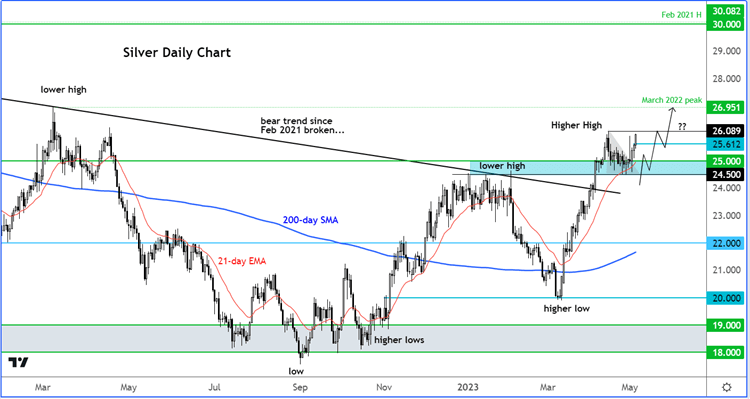

Silver outlook: Technical analysis

Silver’s bullish consolidation in recent weeks above old resistance circa $24.50 to $25.00 area, and now some follow-up buying pressure, means it has potentially cleared the way for the next leg of its rally. The April high comes in at $26.09 and the March 2022 high is at 26.95. Areas above these highs will likely be target by the bulls next, as the sellers’ stop orders will undoubtedly be resting above those peaks.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade